Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21]

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 0](https://img.bgstatic.com/multiLang/web/95cd4ab7a1787c928d52e3a3866256ae.jpg)

Market highlights

1.BTC's short-term rebound has reignited market optimism. SoSoValue data reveals AI agents and Hyperliquid ecosystems as the current market trending topics. $HYPE has reached another all-time high, with impressive gains from $AIXBT, $SHOGGOTH, and $VIRTUAL, driving bullish sentiment in this sector.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 1](https://img.bgstatic.com/multiLang/web/f7dab276332a7520764241f8a3a34132.png)

2. December NFT sales have reached $636.8 million, the highest since April 2024. The OpenSea Foundation is now active, posting its first tweet: "ocean enters the chat." Its official NFT, Gemesis, has a floor price of 0.07 ETH. Prediction markets place the likelihood of OpenSea launching a token this year" at 55%.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 2](https://img.bgstatic.com/multiLang/web/f17c8a5ad10a2fd27bd9cb793fd4aecf.png)

3. A co-leader of the U.S. Department of Government Efficiency (DOGE) is reportedly hacked, with a post about a DOGE-$USUAL partnership quickly deleted. $USUAL experiences a brief surge before declining. The Trump family project WLFI acquires an additional 759 ETH. Binance Alpha announces its fourth batch of projects, including $BANANA, $KOGE, $BOB, $MGP, $PSTAKE, $GNON, $Shoggoth, $LUCE, and $ODOS.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 3](https://img.bgstatic.com/multiLang/web/5a3852459a26337f185123817e2105d2.png)

4. SOL-based "satirical token" $UFD skyrockets to 291 million in two days before pulling back. Fartcoin's market cap exceeds $1 billion, with speculation that Sigil Fund might be an early backer. Frontier Lab's report suggests a growing focus on DeFi and AI agents sectors amid market uncertainty.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 4](https://img.bgstatic.com/multiLang/web/53a76a614432a0c074f474491eb36c53.png)

Market overview

1. BTC rebounds after briefly touching the $92,000 level, driving a broader market recovery. The AI agent token $AIBXT emerges as a market focal point.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 5](https://img.bgstatic.com/multiLang/web/4f30a835665136a02f66cec3f0562f17.png)

2. The Dow Jones rises by about 500 points following U.S. PCE inflation data. Nvidia climbs over 3%, Apple gains 2.5% this week, while Tesla drops approximately 3.5%.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 6](https://img.bgstatic.com/multiLang/web/492c359afde698b5fbb60653898ae4d5.png)

3. Currently at 97,653 USDT, Bitcoin is approaching a potential liquidation zone. A 1000-point drop to around 96,653 USDT could trigger over $60 million in cumulative long-position liquidations. Conversely, a rise to 98,653 USDT could lead to more than $950 million in cumulative short-position liquidations. With short liquidation volumes far surpassing long positions, it's advisable to manage leverage carefully to avoid large-scale liquidations.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 7](https://img.bgstatic.com/multiLang/web/aea51fe91cf209cbbc9dfadc2d609afb.png)

4. Over the past 24 hours, the BTC spot market recorded $7 billion in inflows and $7.6 billion in outflows, resulting in a net outflow of $600 million.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 8](https://img.bgstatic.com/multiLang/web/29057dd92990059003c8b8ddd129c677.png)

5. In the last 24 hours, $BTC, $ETH, $SOL, $DOGE, and $XRP led in net outflows in futures trading, signaling potential trading opportunities.

![Bitget Daily Digest | OpenSea signals token launch, AI agents take center stage [December 21] image 9](https://img.bgstatic.com/multiLang/web/b65cee42b287ee9bf9f2b2a08720e03e.png)

Highlights on X

1. @加密韋馱: Gambling and staking: strategies for navigating market chaos

Market volatility and sentiment shifts are a constant reality. Adopting a "permanent bear market" mindset, @加密韋馱 treats bull markets as brief intermissions, maintaining over 70% of holdings in USDT-M positions. In ecosystems like Sui and Solana, @加密韋馱 employs a dual strategy:

Betting on projects: Focus on core assets like $SOL, $SUI, and $HYPE, gradually increasing positions until liquidity wanes. Even if trapped, @加密韋馱 will place sell orders or leverage experience to pivot to a DCA strategy to manage risks.

Betting on events: Allocate small positions to capitalize on sentiment-driven, short-term opportunities, exiting before volatility subsides. For example, @加密韋馱 bought $COW at $0.385 and exited quickly at $0.65.

By treating narratives and fundamentals as noise and focusing on "game rules," @加密韋馱 prioritizes risk control over outsized gains, aiming for steady progress with reduced downside risks.

X post: https://x.com/thecryptoskanda/status/1870047087540547765

2. @憨厚的麦总: The logic of asset correlation, from BTC to broader market dynamics

Bitcoin's price fluctuations often trigger reactions in altcoins and even the U.S. stocks market, rooted in the logic of risk aversion. When BTC experiences a significant drop, investors, fearing further market downturns, tend to sell off altcoins, reinforcing the market consensus that "when BTC falls, altcoins suffer more." This consensus drives traders and automated strategies to further amplify price volatility. Similarly, as a high-risk asset, BTC often declines before the U.S. stock market, as institutions tend to sell high-risk holdings first during the onset of pessimism to adjust portfolio structures, eventually impacting broader markets. Understanding this correlation logic helps optimize strategies during market swings. In downturns, avoid assets with the weakest market consensus; during rebounds, focus on those with the strongest consensus. Embrace the principle that strong assets tend to stay strong and prioritize leading assets, unless there are significant changes in underlying logic, such as shifts in capital flow causing sector rotation. Clarifying these dynamics allows for more effective navigation of market risks and opportunities.

X post: https://x.com/Michael_Liu93/status/1870038372087148802

3. @雨中狂睡: Virtuals vs. AI16Z – Competition and flywheel effects

The crypto AI agent sector can be broadly categorized into two factions: the Virtuals faction and the AI16Z faction. AI16Z’s influence extends from Solana across the entire blockchain ecosystem, encompassing tokens like $HEU on Base. The Virtuals faction, on the other hand, is also expanding externally. Tokens like $SERAPH and $TAOCAT are products of collaborations with the TAO ecosystem.

X post: https://x.com/0xSleepinRain/status/1869999090911850915

4. @Doctor Profit: BTC strategy and future investment layout

BTC is currently consolidating within the $90,000 – $110,000 range, but once this consolidation phase ends, it is likely to see a strong rally with targets in the $125,000 – $135,000 zone. Based on this outlook, the $90,000 – $92,000 range presents a key opportunity for building significant long-term positions. Establishing long positions in this zone could maximize returns from the subsequent major market rally.

X post: https://x.com/DrProfitCrypto/status/1870070869692743872

Institutional insights

1.CryptoQuant: The current market is not a traditional "alt season" but rather isolated token-specific rallies.

X post: https://x.com/ki_young_ju/status/1870003401351934412

2.Spartan Group: Historically, altcoins outperform BTC in the year following a U.S. presidential election.

Original link: https://www.spartangroup.io/insights/republican-victory-ushers-in-a-new-era-for-crypto

News updates

1. The Russian Central Bank has no plans to invest in cryptocurrency.

2. The initial estimate for the U.S. December one-year inflation rate is 2.8%, compared to the anticipated and previous value of 2.9%.

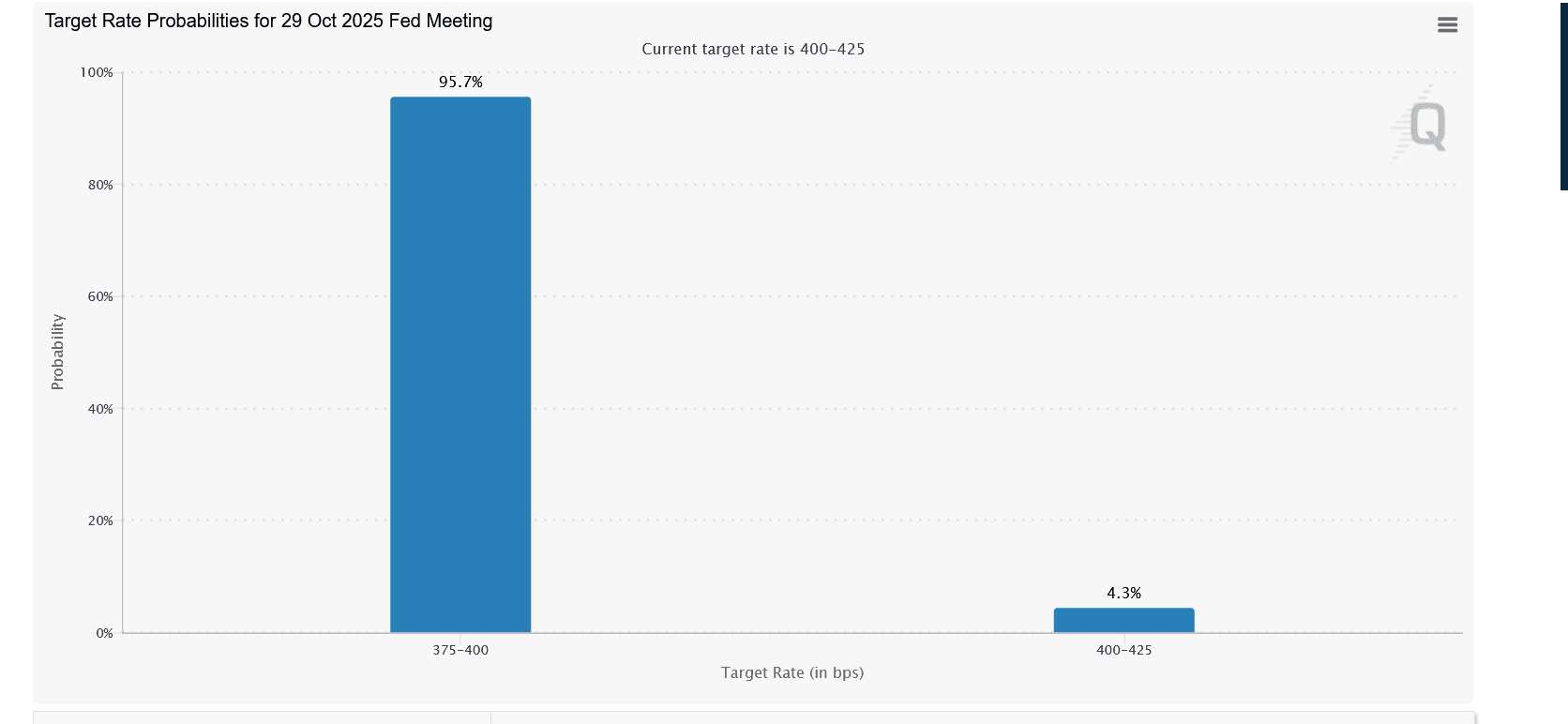

3. Fed's Daly states that a 100-basis-point rate cut this year was appropriate, with fewer cuts expected next year.

4. The U.S. PCE and core PCE data come in below expectations.

Project updates

1. Injective partners with SVM Sonic to launch the cross-chain AI platform Smart Agent Hub.

2. IOST tokenomics update: 97% of new tokens allocated to community.

3. The AAVE community submits a Temp Check proposal to deploy Aave V3 on the Mantle Network.

4. BIO Protocol: Voting open on the new proposal of enabling BIO token transferability.

5. EigenLayer launches slashing functionality on the testnet.

6. Turbos Finance: Exceeds $4 billion in cumulative trading volume with almost 1.5 million active addresses.

7. IoTeX launches BinoAI, its first AI agent in the DePIN sector.

8. In the latest Ethereum ACDE meeting, developers focus on the Pectra specification updates affecting proposals including EIP-7742.

9. LayerZero starts the proposal vote for "whether to activate the LayerZero protocol fee switch".

10. Jupiter introduces its new swap mechanism, JupiterZ.

Recommended reads

Ethereum ETFs surge in December, reaching $1.66 billion in inflows, dominated by BlackRock's ETHA

Ethereum ETF inflows accelerated in December, with $1.66 billion in new investments, accounting for 74% of the total $2.24 billion since their launch.

Read the full article here: https://www.bitgetapps.com/zh-CN/news/detail/12560604438645

History proves that alt season is coming, and the 12 months after the election remain crypto's golden bull run period

In the 12 months since the last two elections, altcoins have seen returns about three times that of Bitcoin.

Read the full article here: https://www.bitgetapp.com/zh-CN/news/detail/12560604437381

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is Cardano (ADA) About to Rebound as the Fed Turns Dovish?

Sorare CEO still bullish on Ethereum despite ‘upgrading’ to Solana

Base co-founder discusses token issuance again—what does Zora’s launch of live streaming at this moment signify?

The current $850 million FDV still has reasonable room for growth considering Zora's ecosystem status and growth potential.

The last mile of blockchain, the first mile of Megaeth: Taking over global assets

1. The blockchain project Megaeth has recently reached a critical milestone with its public sale, marking the official start of the project. Its goal is to build the world's fastest public chain to solve the "last mile" problem of blockchain's management of global assets. 2. Industry observations indicate that the crypto punk spirit has been weakening year by year, and the industry's focus is shifting towards high-performance infrastructure. Against this backdrop, Megaeth is advancing the implementation of its project, emphasizing that the blockchain industry has moved past the early exploratory phase, and high performance has become key to supporting the next stage of application scenarios. 3. Industry insiders believe that all infrastructure has a "late-mover advantage," and blockchain also needs to go through a process of performance upgrades to drive scenario expansion. High performance is seen as the key to unlocking larger-scale applications. 4. With multiple chains exploring performance pathways, Megaeth positions itself as aiming to be the "fastest public chain," attempting to solve the challenge of "trillions of transactions on-chain." The team believes that addressing real-world problems is the most effective path, regardless of whether it is Layer1 or Layer2. 5. Megaeth's public sale is seen as the beginning of its "first mile" journey. Although it may face technical challenges, the potential brought by its differentiated underlying architecture is highly regarded and is expected to give rise to new industry paradigms.