The U.S. Securities and Exchange Commission ( SEC ) announced the first Project Crypto directive on August 5, 2025. This directive clarifies that specific liquid staking applications are exempt from securities laws. It specifies that liquid altcoins, given through administrative or technical processes without requiring entrepreneurial effort, will not be considered securities. This decision is seen as a pivotal moment that may encourage institutional investors, who have been hesitant due to regulatory uncertainty, to venture into the sector.

New Opportunities for Institutional Capital in Crypto

ZIGChain co-founder Abdul Rafay Gadit believes the SEC’s announcement opens doors to previously impossible strategies for corporate treasuries. Gadit states that pension funds and asset managers can now secure annual returns of 5-15% from staking rewards while maintaining immediate access to their capital through liquid altcoins. This flexibility removes the incompatibility with traditional accounting and liquidity requirements posed by long-term lock-up issues.

Institutional investors can utilize staking coins as collateral, in trading, or within portfolio management strategies, all while sustaining their staking income. Gadit emphasizes that this development will trigger broader acceptance, encouraging institutional participation to meet the scale and security needs of Blockchain networks.

Regulatory Clarity Accelerating Ecosystem Growth

Marcin Kazmierczak, co-founder of the Oracle protocol RedStone, describes the SEC’s stance as a milestone for the cryptocurrency market, highlighting an anticipated increase in demand for Ethereum $3,832 -based liquid staking protocols.

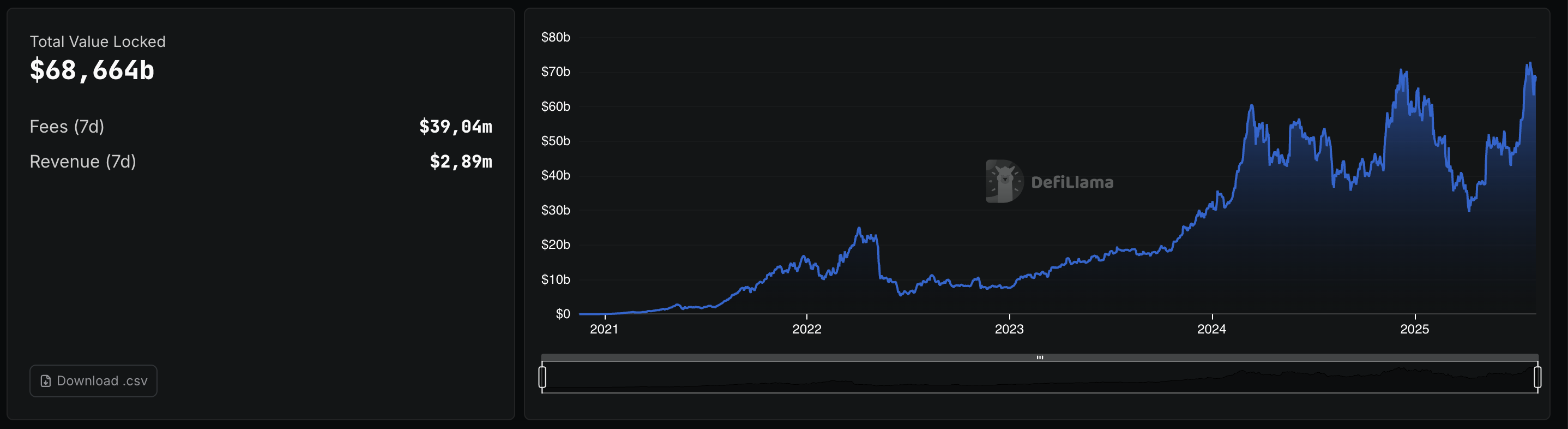

According to Defillama’s data, the total value locked (TVL) in liquid staking soared from $31.14 billion to $71.16 billion in 2024, reaching $68.66 billion as of August 5. Following the SEC’s approval, the TVL is expected to climb rapidly, potentially reaching new record levels.

Kazmierczak points out that the new framework promotes systems functioning at the protocol level, reducing the need for human intervention. “This approach aligns with Blockchain’s core principles by minimizing single points of failure,” he explains. With 33.8 million ETH staked on Ethereum (28% of the supply) and the overall staking market exceeding $60 billion in size, the removal of regulatory uncertainty could pave the way for the ecosystem’s next growth phase.