Is the soon-to-TGE DEX Lithos actually a public goods fund?

On the surface, it is a DEX, but in reality, 40% of the initial supply will be used to fund public goods.

On the surface, it's a DEX, but in reality, 40% of the initial supply will be used to fund public goods.

Written by: Eric, Foresight News

After the official launch of the Plasma token, its ecosystem projects have also started to follow in its footsteps. Lithos, a DEX positioned as the liquidity market within the Plasma ecosystem, after two consecutive delays, is finally scheduled to launch its TGE tonight at 20:00 (UTC+8). Although it's now too late to claim the airdrop, this "public goods foundation disguised as a DEX" still presents early opportunities for excess returns.

"Mechanism Frankenstein" DEX

Lithos' design mechanism basically draws on the experience of many mature DEX protocols and incorporates the strengths of various models. Its core products, in addition to the DEX, also include the yet-to-be-launched Foundry Launchpad, which is intended to support new projects on Plasma to directly establish initial liquidity based on Lithos' infrastructure, and to guide deeper liquidity and price discovery through mechanisms such as "bribes" described below.

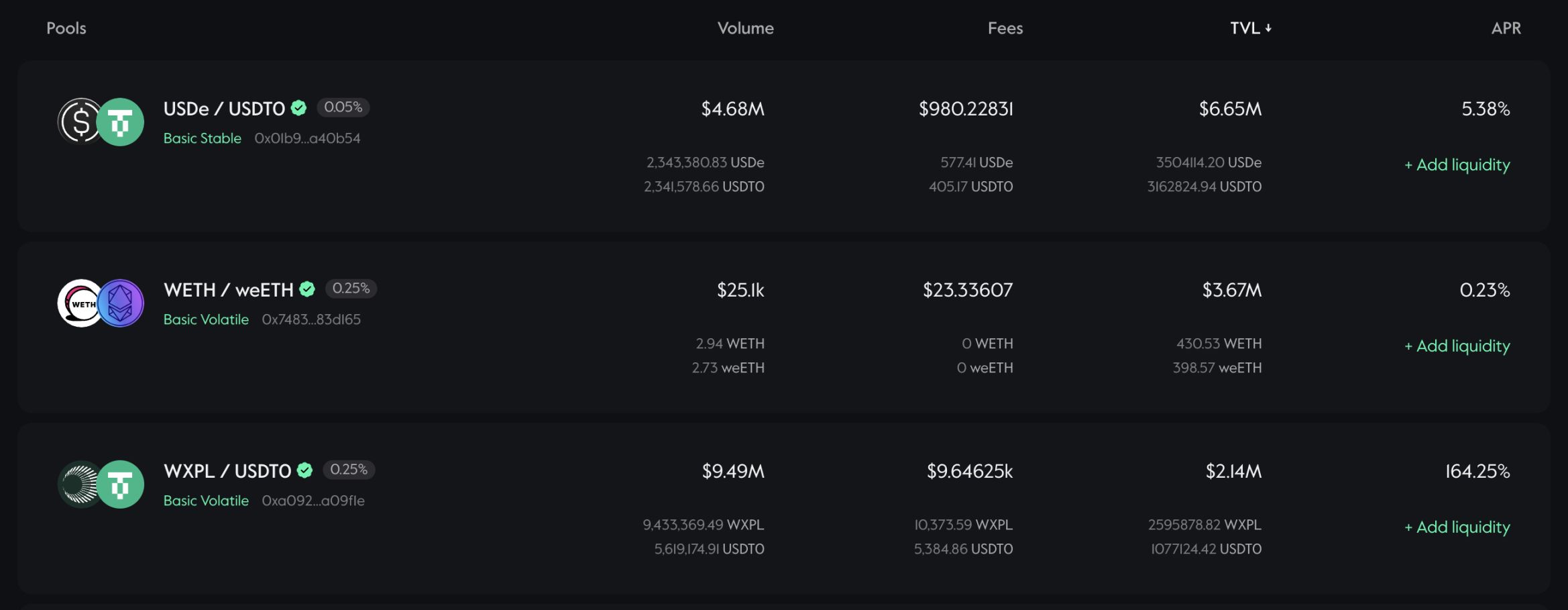

On the DEX, Lithos divides liquidity into stable asset liquidity pools (such as USDC/USDT or WETH/weETH), volatile asset liquidity pools, and pools that allow liquidity provision within a specific range. Fees can also be designed according to the attributes of different pools.

In terms of mechanism, Lithos adopts the ve(3,3) model. Explaining ve(3,3) in detail can be quite complex, so readers can look up more information themselves. Simply put, ve(3,3) combines Curve's ve model with OlympusDAO's (3,3) game theory. Through mechanism design, both liquidity providers (LPs) and token holders are incentivized not to sell tokens, but to lock tokens and participate in voting to earn fees, token emissions, and "bribes," achieving a win-win situation.

Users holding Lithos' token LITH can choose to lock their tokens to mint veLITH, with the amount and duration of the lock determining their voting power (number of votes). Users with voting power can vote to decide which liquidity pools will receive newly unlocked LITH tokens as incentives for the upcoming week (the weekly cycle starts at 0:00 UTC every Thursday), and to allocate the amount each pool can receive.

In addition to LITH token rewards, voters can also receive a portion of the trading fees from the liquidity pools that receive LITH incentives through voting, as well as "bribes." So-called "bribes" are essentially project tokens provided by project teams to incentivize liquidity in their own protocol token pools. The more token incentives a project provides, the more motivated users are to vote for that pool. More LITH rewards from voting attract more liquidity providers, thereby increasing trading depth and promoting price discovery for new project tokens.

Finally, Lithos also ensures that core trading pairs always have sufficient liquidity and reduces reliance on speculative LPs through Protocol Owned Liquidity (POL). This liquidity comes from protocol revenue and will be permanently locked as LP shares.

Liquidity pool classification, dynamic fees, and ve(3,3) are all mechanisms designed by DEX predecessors and recognized by the market. Lithos combines the mechanisms it deems effective. Although it may not seem innovative, by integrating with aggregators Jumper and Kyber Network, Lithos has managed to generate nearly $15 million in trading volume with a TVL slightly over 14 million tokens, which is a barely passing grade.

Tokenomics Design

The initial supply of LITH is 50 million tokens, of which 2% will be used to create initial liquidity; 5% for liquidity incentives; 5% allocated to market makers and CEX; 10% to the ecosystem growth fund; 5% for airdrops; 19% allocated to the foundation for operations and as a strategic reserve; and 14% to the team, with this portion of tokens vesting over two years after a one-year lockup. However, what stands out is that 40% of the initial supply will be permanently locked (Lithos likely means locked as veLITH) to fund Plasma-based projects, research initiatives, and community programs that benefit the broader ecosystem.

LITH has no maximum supply. According to the ve(3,3) model, new tokens are distributed every week. Lithos' current design references Thena, with 2.6 million tokens minted in the first week, then decreasing by 1% each week until the weekly issuance drops to 0.2% of the circulating supply, after which the token issuance will stabilize to "achieve long-term incentives." Of the tokens minted each week, 67.5% will be allocated to LPs, 30% as anti-dilution redistribution, and 2.5% to the developer wallet to support certain protocol operations.

In addition, Lithos has designed a regular buyback and distribution program called "Ignition," aimed at supporting long-term LITH holders with additional rewards. This program runs every four weeks, with a portion of the repurchased tokens distributed as extra rewards to veLITH holders. Lithos' own LP shares and the revenue obtained from holding veLITH will not all be distributed to veLITH holders; a portion will be retained by the foundation to increase voting weight or injected into the protocol to boost liquidity (POL).

Lithos has not disclosed the members of its project team. Judging from the overall project design, Lithos is more like a non-profit Plasma public goods fund, with its core revenue source being its self-built DEX. The project's revenue and a significant portion of its tokens will ultimately be used to support other public goods within the Plasma ecosystem. Such highly community-driven designs have become quite rare in recent years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Investment Inflows Hit $3.17 Billion Despite Market Volatility

Spot Bitcoin ETFs Record $1 Billion Volume in 10 Minutes

Bitcoin metric shows ‘euphoria’ as $112.5K BTC price squeezes new buyers

XRP price shows promise at $2.50: Is 57% rally still possible?