People quietly making a fortune through arbitrage on Polymarket

After receiving a $2 billion investment, Polymarket's valuation has reached $9 billion, making it one of the highest-funded projects in the crypto sector. The article reveals arbitrage strategies on the platform, including sweeping the closing market, multi-option market arbitrage, and market-making opportunities, while also pointing out black swan risks and the phenomenon of large players manipulating the market. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

After receiving a $2 billion investment, Polymarket is now valued at $9 billion, making it one of the highest-funded projects in the crypto space in recent years.

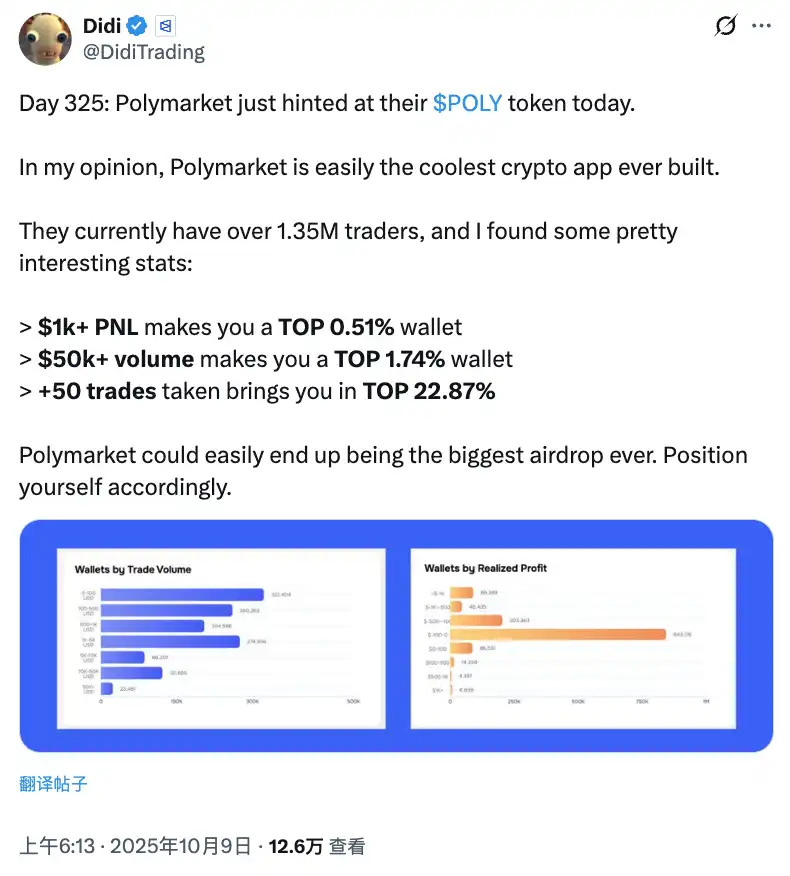

Amidst growing rumors of IPOs, IDOs, and airdrops, let’s first look at some interesting data: If your PNL exceeds $1,000, you’re in the top 0.51% of wallets; if your trading volume exceeds $50,000, you’re among the top 1.74% of whales; if you’ve completed more than 50 trades, you’ve outperformed 77% of users.

This data also means that, in this fertile ground of Polymarket, there actually haven’t been that many people who have consistently cultivated and reaped rewards over the years.

With ICE’s strategic investment, Polymarket’s liquidity, user base, and market depth are all growing rapidly. More capital inflow means more trading opportunities; more retail participation means more market imbalances; more market types mean more arbitrage opportunities.

For those who know how to truly make money on Polymarket, this is a golden era. Most people treat Polymarket as a casino, while smart money sees it as an arbitrage tool. In the following long article, Odaily BlockBeats interviewed three seasoned Polymarket players to break down their money-making strategies.

Endgame Sweep as a New Financial Tool

“On Polymarket, about 90% of large orders over $10,000 are executed at prices above 0.95,” veteran player fish said bluntly.

In this prediction market, a strategy called “endgame sweep” is very popular.

The method is simple: when the outcome of an event is basically settled and the market price soars above 0.95, even approaching 0.99, you buy in at that price and patiently wait for the event to officially settle, pocketing those last few points of certain profit.

The core logic of endgame sweep is just four words: trading time for certainty.

When an event has already occurred—say, an election has a clear result or a sports event has ended—but the market hasn’t officially settled, the price often hovers close to but not quite at 1. At this point, entering the market theoretically guarantees you those last few points of profit once settlement occurs.

“Many retail investors can’t wait for settlement,” fish explained to Odaily BlockBeats. “They’re eager to cash out and move on to the next bet, so they sell directly at prices between 0.997 and 0.999, leaving arbitrage space for the whales. Although each trade only earns about 0.1% profit, with enough capital and frequency, small gains add up to considerable income.”

But just like all investments carry risk, endgame sweep is not a risk-free “no-brainer” financial tool.

“The biggest enemy of this strategy,” fish continued, “is not market volatility, but black swan events and whale manipulation.”

Black swan risk is something endgame sweep players must always be wary of. What is a black swan? It’s when something that seems certain suddenly reverses unexpectedly. For example, a match appears to be over, but is later ruled invalid by referees; a political event seems settled, but a sudden scandal overturns the result. If these low-probability events occur, your chips bought at 0.99 instantly become worthless.

“So-called black swan events that can reverse are basically all manipulated by whales,” fish further explained. “Here’s how whales play: when the price nears 0.99, they suddenly dump large orders to push the price down to 0.9, creating panic; they stir up sentiment in the comments and on social media, spreading rumors of a possible reversal to amplify retail panic; after retail panic-sells, they scoop up chips at low prices; once the event settles, these whales not only pocket the 0.9 to 1.00 spread, but also take the profits that should have gone to retail.”

This is the complete closed loop of whale manipulation.

Another veteran player, Luke (@DeFiGuyLuke), added an interesting detail to this loop: “The readability of Polymarket’s comment section is particularly high. I think this is quite unique; you rarely see it in other products.”

People write lots of evidence to support their views, and many know you can align with the crowd. So manipulating public opinion becomes easy on Polymarket.

This also became Luke’s entrepreneurial opportunity: “When I used Polymarket, I noticed something interesting—no one wants to read content on Twitter, right? It’s all nonsense and not real. Most people don’t talk much. But the Polymarket comment section is fun—even if someone only bets tens or a hundred dollars, they’ll write long essays.”

“You’ll find this content especially interesting. So I felt the readability of Polymarket’s comment section was really high.” Based on this observation, Luke started a product called Buzzing: anyone can create a market on any topic. After betting, everyone can comment, and these comments form a feed, distributing content to the market.

So, since endgame sweep carries the risk of manipulated black swans, does that mean you shouldn’t play?

“Not necessarily. The key is risk control and position management. For example, I never put more than 1/10 of my position in any single market,” fish added. “Don’t put all your funds in one market, even if it looks 99.9% certain to win. Prioritize markets that are about to settle (within a few hours) and have prices above 0.997, so the black swan window is shorter.”

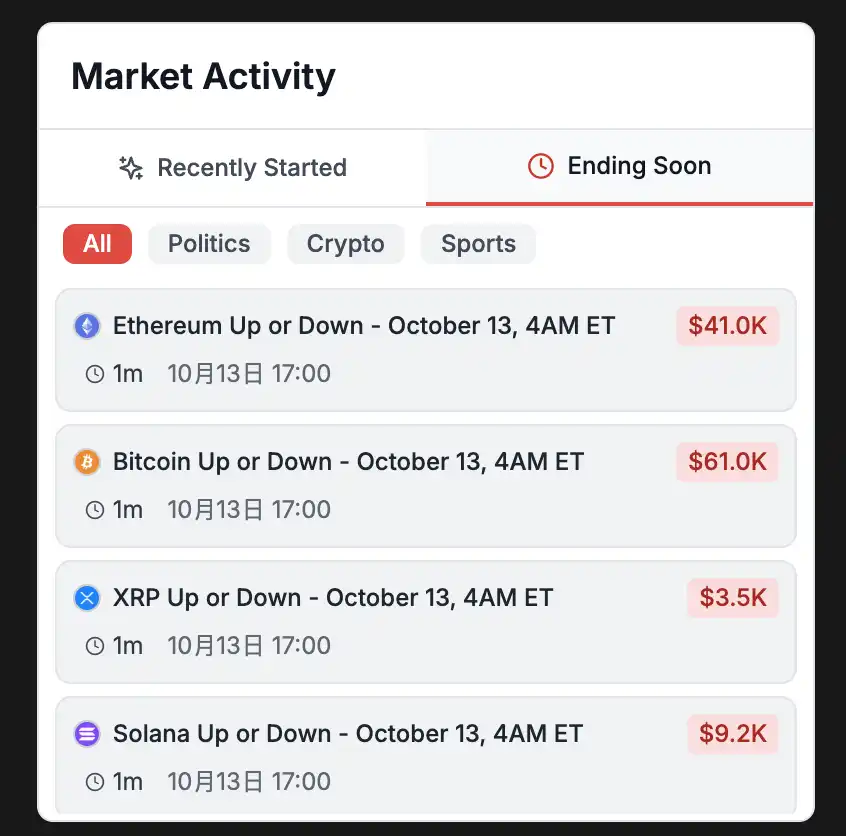

Markets about to end as shown on polymarketanalytics

Arbitrage Opportunities Where the Sum Is Less Than 100%

There’s an address on Polymarket that turned $10,000 into $100,000 in six months, participating in over 10,000 markets.

It wasn’t by gambling or insider info, but by using a seemingly simple yet technically demanding arbitrage strategy—capturing “sum less than 100%” opportunities in multi-option markets.

The core logic of this strategy is elegantly simple: in a multi-option market where only one option can win (Only 1 Winner), if the sum of all option prices is less than $1, you buy one of each option. After settlement, one will win, and you’ll get $1. The difference between cost and payout is your risk-free profit.

This may sound a bit abstract. Let’s use a concrete example. Suppose there’s a market about “Will the Fed cut rates in July?” with four options:

Cut by more than 50 basis points: price $0.001 (0.1%);

Cut by more than 25 basis points: price $0.008 (0.8%);

No change: price $0.985 (98.5%);

Raise by more than 25 basis points: price $0.001 (0.1%)

Add these four prices: 0.001 + 0.008 + 0.985 + 0.001 = $0.995. What does this mean? You spend $0.995 to buy one of each option; after settlement, one will win and you’ll get $1. The profit is $0.005, a 0.5% return.

“Don’t underestimate this 0.5%. If you invest $10,000, you earn $50 per trade. Do dozens of trades a day, and the annual return is amazing. Plus, this is risk-free arbitrage—as long as the market settles normally, you’re guaranteed to profit,” said Fish.

Why do such arbitrage opportunities exist?

In multi-option markets, each option’s order book is independent. This leads to an interesting phenomenon:

Most of the time, the sum of all option probabilities is greater than or equal to 1 (the normal state, as market makers profit from the spread). However, when retail trades a single option, only that option’s price changes; the others don’t adjust in sync. This creates a brief market imbalance—the sum of all probabilities is less than 1.

This window may last only a few seconds, or even less. But for arbitrageurs running monitoring scripts, it’s a golden opportunity.

“Our bot listens to all multi-option market order books 24/7,” fish explained. “Once it detects the sum is less than 1, it immediately buys all options programmatically to lock in profit. Once the bot system is set up, you can monitor thousands of markets at once.”

“This is a bit like MEV (Miner Extractable Value) atomic arbitrage in crypto,” fish continued. “Both exploit brief market imbalances, using speed and tech to arbitrage ahead of others, then let the market rebalance.”

Unfortunately, this strategy now seems monopolized by a few bots, making it hard for ordinary people to make big money from it. In theory, risk-free arbitrage is open to all, but in practice, it’s become a war between a few professional bots.

“Competition will only get fiercer,” fish said. “It depends on whose server is closer to the Polygon node, whose code is more efficient, who can detect price changes faster, and who can submit and confirm transactions on-chain more quickly.”

Essentially, This Is Also Market Making

At this point, many may have realized that the arbitrage strategies discussed above are essentially playing the role of market makers.

The job of a market maker is simply: deposit USDC into a specific market’s pool, which is equivalent to placing both Yes and No orders, providing counterparties for all buyers and sellers. The deposited USDC is split into corresponding contract shares based on the current Yes/No ratio. For example, at a 50:50 price, depositing 100 USDC gives you 50 Yes and 50 No shares. As the market fluctuates, your Yes/No inventory ratio deviates from optimal (e.g., 50:50). Good market makers actively trade or adjust funds to constantly rebalance positions and lock in arbitrage space.

So from this perspective, these arbitrage bots are actually acting as market makers—they continuously rebalance the market through arbitrage, making prices more reasonable and liquidity better. This benefits the entire Polymarket ecosystem. Therefore, Polymarket not only charges no fees but also rewards makers (order placers).

“From this angle, Polymarket is actually very friendly to market makers,” Fish said.

“From the data, market makers on Polymarket should have earned at least $20 million in the past year,” Luke told Odaily BlockBeats two months ago. “We haven’t updated the stats since, but it’s definitely more now.”

“As for the profit model, based on market experience, a relatively stable expectation is: 0.2% of trading volume.” Luke continued.

Suppose you provide liquidity in a market with a monthly trading volume of $1 million (including both buy and sell orders you fill), your expected profit is: $1 million × 0.2% = $2,000

This return may not seem high, but the key is that it’s relatively stable, unlike speculative trading with wild swings; and if you scale up, 10 markets is $20,000, 100 markets is $200,000. If you add platform LP rewards and annualized holdings, actual returns are higher. “But the main income is still from market making spreads and Polymarket’s rewards.”

Interestingly, compared to other arbitrage strategies that are dominated by bots, Luke believes that competition among market makers is not yet very intense.

“Token trading is definitely highly competitive now, down to hardware. But Polymarket’s market competition isn’t that fierce. So the competition is still about strategy, not speed.”

This means that for players with some technical ability and capital, market making may be an undervalued opportunity. As Polymarket reaches a $9 billion valuation and liquidity keeps growing, the profit space for market makers will only increase. Entering now may not be too late.

2028 Election Arbitrage

In conversations with Odaily BlockBeats, both Luke and Tim mentioned the potential of market making arbitrage, especially in Polymarket’s 2028 US election market, which offers a 4% yield.

There are still three years until the 2028 election, but Polymarket has already started laying the groundwork, offering a 4% annualized yield to attract early liquidity and capture the market.

“Many people may think that at first glance, a 4% annualized return is low in crypto; platforms like AAVE offer higher APYs.”

“But I think Polymarket is doing this to compete with Kalshi,” Luke explained. “Kalshi has long offered US Treasury yields on account balances, which is common in traditional finance. For example, Interactive Brokers gives you a yield even if you don’t actively buy bonds or stocks. These are standard features in traditional finance.”

“Kalshi is a Web2 product, so it’s easy for them. But Polymarket hasn’t done this because all the money is in the protocol, making it harder to implement. So in this financial feature, Polymarket was previously a bit behind Kalshi.”

This shortcoming is even more obvious in long-term markets like the 2028 election. “Think about it, you put money in now and have to wait three years for settlement, so your money just sits there—it’s a bit frustrating, right? So they launched this annualized reward to close the gap with competitors, and it’s probably subsidized by them,” Luke said.

“But I think market makers aren’t aiming for just the 4% annualized yield; that’s mainly for regular users.” With this subsidy, users’ trading costs are somewhat reduced, which is great for those who trade frequently and in high volume on Polymarket, as studios are very sensitive to cost and return calculations.

Tim has also studied this mechanism in depth: “If you look closely at the details, you’ll find there’s much more arbitrage space for market makers than just the 4%.”

“Polymarket’s rewards are a detail many overlook—each option gets an extra $300 daily LP reward,” Tim continued. Besides the 4% annualized holding yield, Polymarket gives market makers extra rewards. If you provide liquidity—i.e., place both buy and sell orders to help maintain market depth—you share in this $300 daily LP reward pool per option.

Tim did a quick calculation. Suppose the “Who will be president in 2028?” market has 10 popular options, each with a $300 daily LP reward, making the total LP reward pool $3,000 per day. If you hold 10% of the liquidity, you get $300 per day, or $109,500 per year.

“And that’s just the LP reward. Add in market making spread profits and the 4% annualized compounding, and triple returns can easily exceed 10%, even 20% or more.”

“If you ask me whether it’s worth market making for the 2028 election, my answer is: if you have the tech, capital, and patience, it’s a seriously undervalued opportunity. But honestly, this strategy isn’t for everyone.”

Tim said: “It’s suitable for steady players with some capital (at least several tens of thousands of dollars); for techies who can build automated market making systems; for long-termists willing to trade time for stable returns; and for those with some understanding of US politics who can judge market trends.

But it’s not suitable for those with too little capital (a few thousand dollars); for short-term speculators who can’t wait four years; for complete newbies who don’t understand US politics or market rationality; or for those who need liquidity and may need to use their funds at any time.”

News Trading on Polymarket

While digging into Polymarket’s market data, Luke and his team discovered a phenomenon that overturns conventional wisdom.

“Everyone used to say Polymarket users are smart and prescient, right? That before an event is resolved, the market has already predicted the outcome,” Luke said. “But actually, it’s the opposite.”

“Most Polymarket users are actually dumb money, pretty bad,” Luke laughed. “Most of the time, people misjudge the event. Only after the event is resolved or news breaks do many rush in to arbitrage, pushing the price to the expected level, toward Yes or No. But before the news breaks, people often get it wrong.”

“From the data,” Luke continued, “the entire Polymarket market’s user bets and price feedback lag behind real events. Often, the real event has already happened, but everyone’s bets are wrong, leading to big reversals.”

Luke gave a vivid example: “Take the papal election. The first pope elected was an American. Before the Vatican announced it, the probability of the American candidate winning was still just a fraction of a percent, extremely low. But as soon as the Vatican announced it, boom, the price skyrocketed.”

“So you can see, users often bet incorrectly in these markets,” Luke concluded. “If you have the right news sources and can react first, there’s money to be made. I think this is still doable.”

But this path still has a high barrier to entry.

“I think this requires strong development skills,” Luke admitted. “You need to access news sources in real time, a bit like MEV. You need to reliably scrape news, add several layers, do natural language processing, and trade quickly. But there’s definitely opportunity.”

On this $9 billion battlefield of Polymarket, we’ve seen all kinds of money-making strategies, but regardless of the method, it seems many low-key players making money on Polymarket treat it more as an arbitrage machine than a casino.

From our interviews, it’s clear that Polymarket’s arbitrage ecosystem is maturing rapidly, and the space for newcomers is shrinking. But that doesn’t mean ordinary players have no chance.

Returning to the data at the start: a PNL over $1,000 puts you in the top 0.51%, trading volume over $50,000 puts you in the top 1.74%, and completing 50 trades beats 77% of users.

So even if you start trading frequently now, by the time of the airdrop, as the largest-funded crypto project in recent years, Polymarket might still give ordinary players a big surprise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

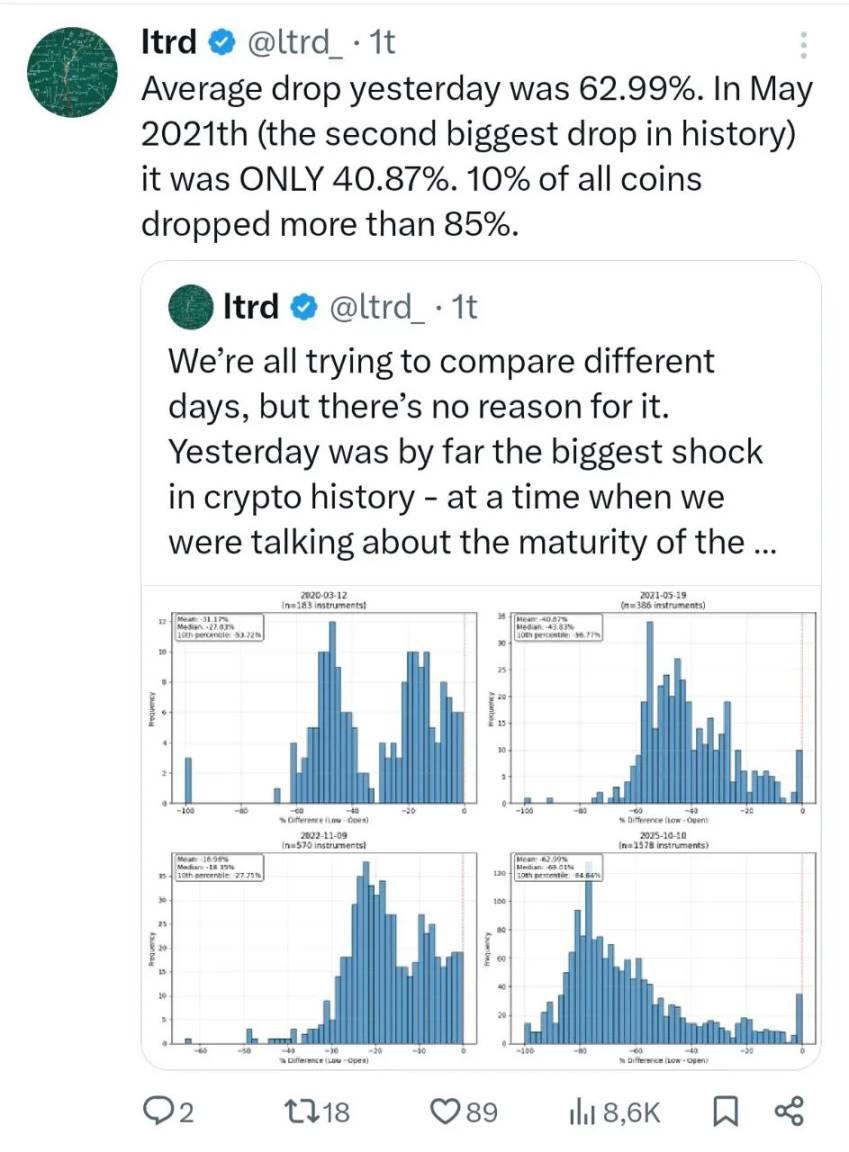

"10.11" Review and Survival Guide for the Survivors

In the post-crash era, where should cryptocurrency investment go from here?

From JPEG to AI Infrastructure, How Does AINFT Achieve a New Ecological Reconstruction?

AINFT aims to build a decentralized AI application aggregation ecosystem, allowing users to freely explore and utilize various AI Agent digital assistants just like using an "App Store."