From SDK to "Zero-Code" DEX Building: Orderly's Three-Year Masterpiece

Orderly ONE proves that sticking to one thing and doing it to the extreme is the right approach.

Orderly ONE proves that sticking to one thing and doing it to the extreme is the right way.

Written by: Eric, Foresight News

On September 23, Orderly launched Orderly ONE, a tool that allows users to build a perpetual contract DEX within minutes without writing any code. This tool integrates liquidity from over 17 major blockchains, including Solana, Arbitrum, Base, BNB Chain, and Abstract. Building a DEX with Orderly ONE is free for users, but to charge trading fees, a broker code must be purchased for $1,000 (with a 25% discount if paid in ORDER tokens).

Orderly, which has been relentlessly focused on on-chain order book models and liquidity sharing, initially launched 2B services via SDK, helping clients build DEXs based on Orderly’s infrastructure one-on-one in two to three weeks. With technical and process optimizations, this time was reduced to two or three days, and now, users can launch their own DEX in just a few minutes through simple operations on the website. This marks a qualitative leap from quantitative changes.

Building a World of Self-Operated "Crypto Brokerages"

From Kronos Research to WOO and then to Orderly, when I interviewed Ran about three years ago, my biggest impression was that this team had a unique understanding and insight into trading. Choosing to build Orderly Network was a way to put years of knowledge and experience into practice.

Orderly aims to solve the problem of fragmented liquidity. If liquidity is centralized, every new DEX can leverage existing high-quality liquidity infrastructure and focus on operations and other aspects, forming an effective "industry division of labor" without reinventing the wheel in an already mature industry. On the other hand, with Orderly’s focus on the order book model, the more users trade on the same underlying order book, the deeper the liquidity becomes, further optimizing the trading experience. Conversely, if every DEX starts from scratch, it is a sign of inefficiency in the industry.

Orderly ONE is essentially a collection of Orderly’s previous products and services, with the underlying technical architecture roughly consisting of a liquidity layer, a trade matching layer, and a settlement layer.

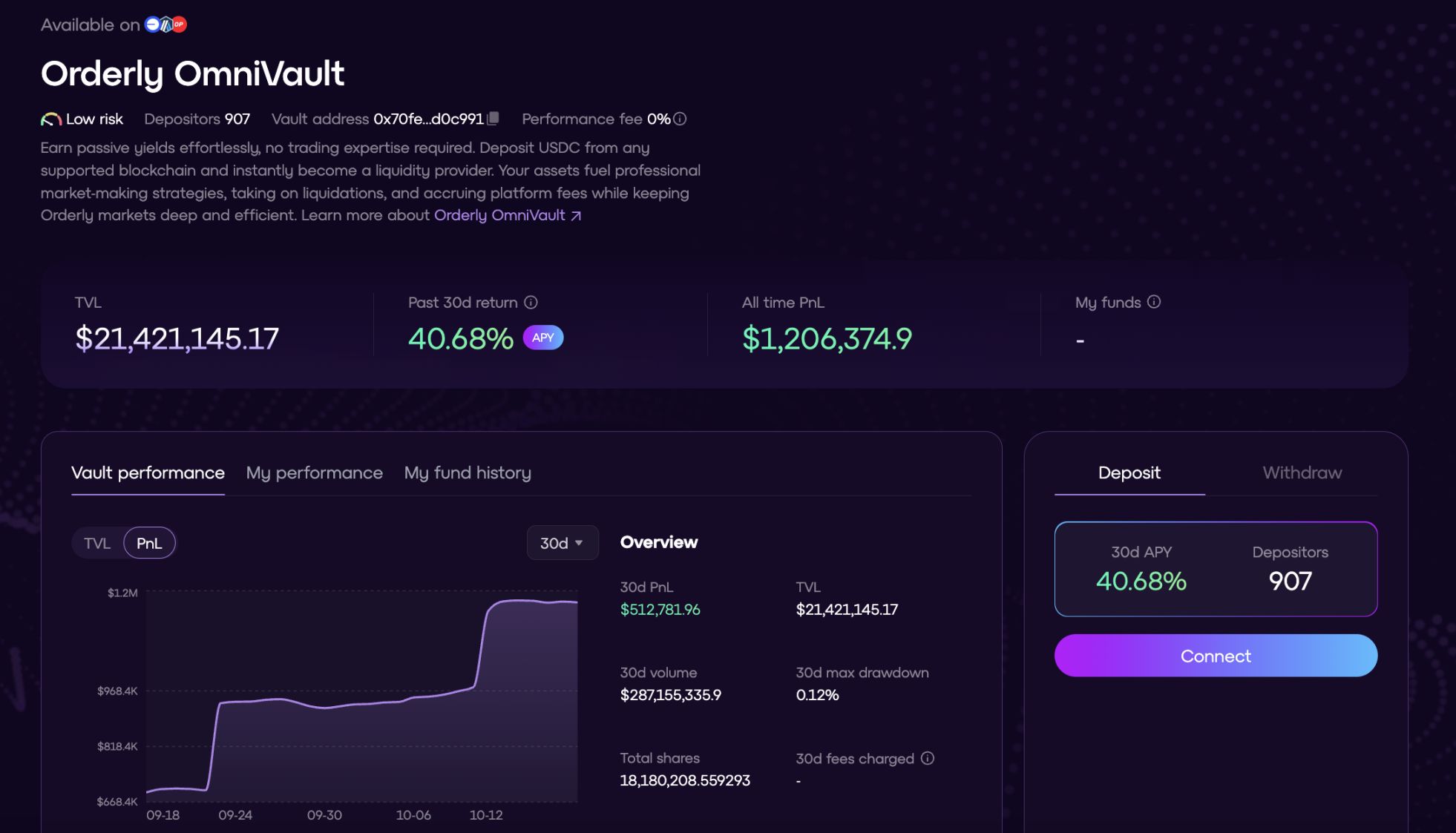

The liquidity layer is a unified multi-chain order book established by Orderly, with LayerZero responsible for cross-chain state synchronization, ensuring that orders on any chain can be matched globally. The initial liquidity was provided by market makers including Kronos Research. In April this year, Orderly launched OmniVault, allowing users to deposit USDC and earn returns through market-making strategies managed by trusted institutions. OmniVault further enriched the sources of underlying liquidity.

The trade matching layer is an off-chain matching engine developed by the Orderly team, enabling a trading experience indistinguishable from CEXs, with threshold signatures and state commitments periodically uploaded on-chain. The Orderly team developed Orderly Chain based on OP Stack to execute final trade settlements and adopted Celestia’s data availability infrastructure to minimize costs and improve efficiency.

With this infrastructure, Orderly has successfully helped build 67 DEXs that are in real operation, with daily trading volumes exceeding $1 billion. In less than a month since the launch of Orderly ONE, more than 1,300 DEXs have been built on Orderly ONE, fully demonstrating the popularity of such products.

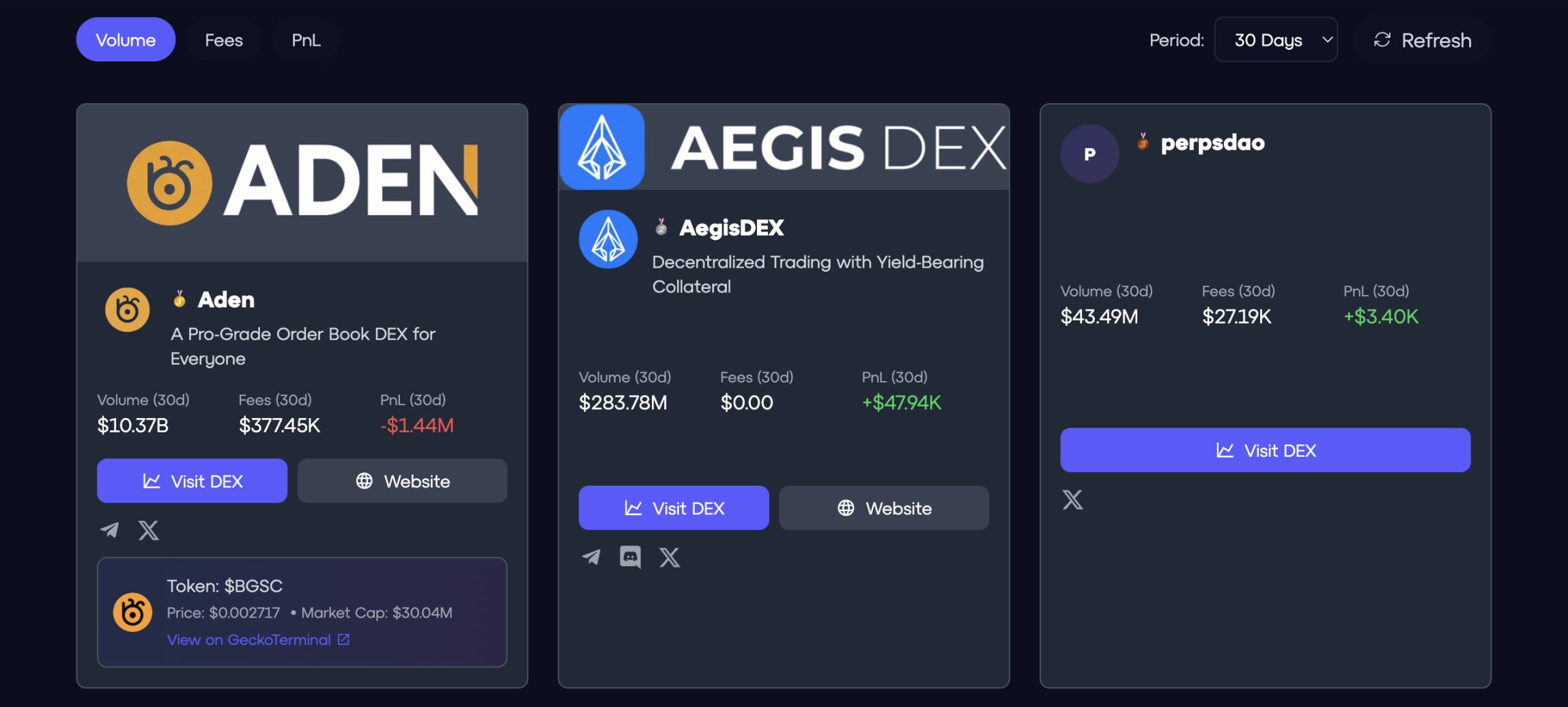

As early as three years ago, when I interviewed Ran, he told me that some small CEXs’ contract functions were actually supported by Orderly in the background. This was the first time I realized that blockchain-based settlement systems are gradually playing a role in finance, especially in trading. One of Orderly’s largest clients is Aden, a perp DEX incubated by BugsCoin, a project initiated by Korea’s top trading YouTuber Inbum. According to Orderly’s official website, as of this writing, Aden’s trading volume in the past 30 days has reached an astonishing $10.37 billion.

Orderly team members told me that Orderly had already planned to develop a no-code product as early as last year. DEXs such as Aden, launched in July, were also built on the same framework. After refining the experience with over 50 DEX launches, the newly released Orderly ONE is now a relatively mature product. This fully aligns with Orderly’s style: starting from WOO’s frontend, then launching the SDK and gradually optimizing and accumulating liquidity. Once liquidity reached a certain level and enough client needs were understood through one-on-one communication, the no-code product was launched, progressing step by step.

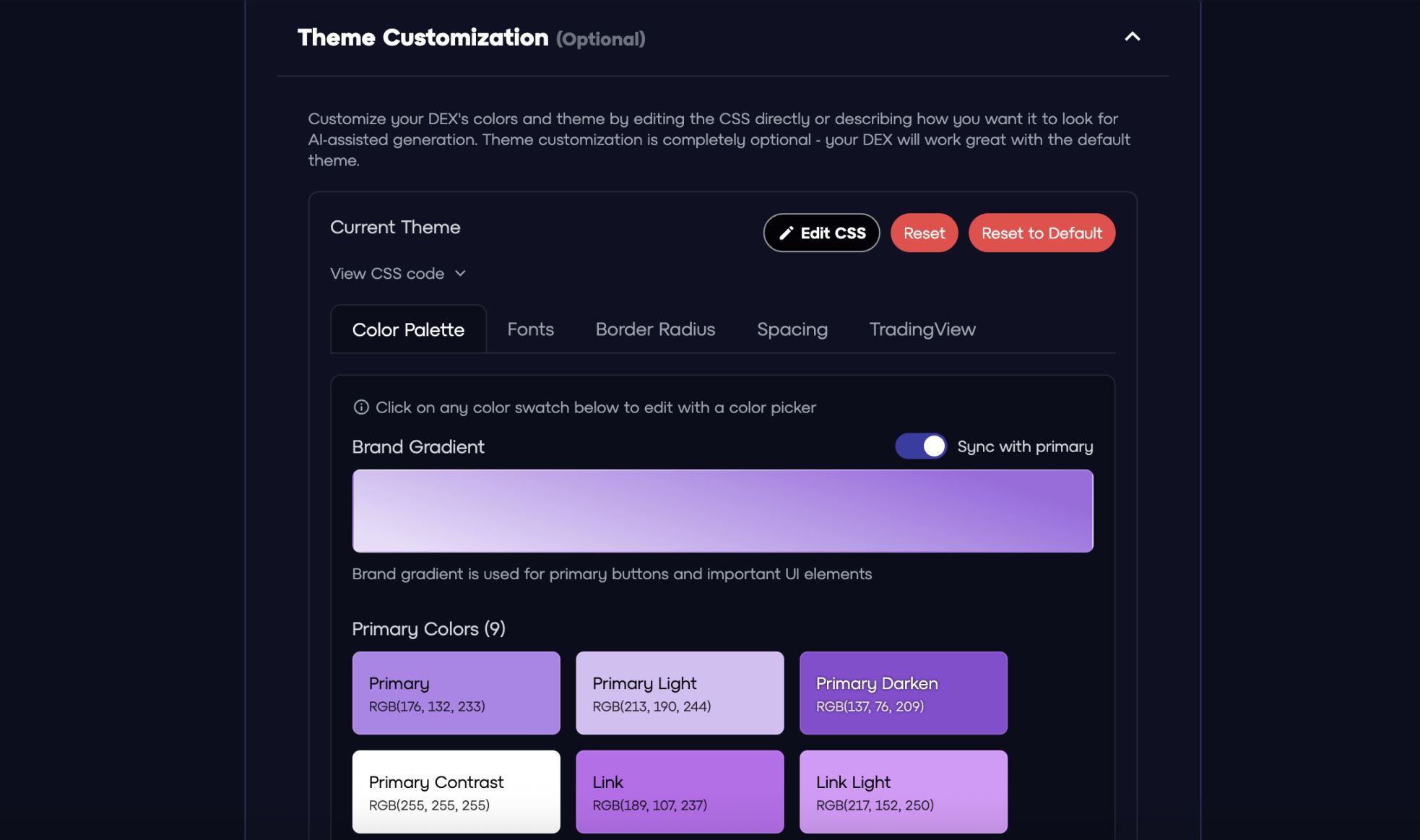

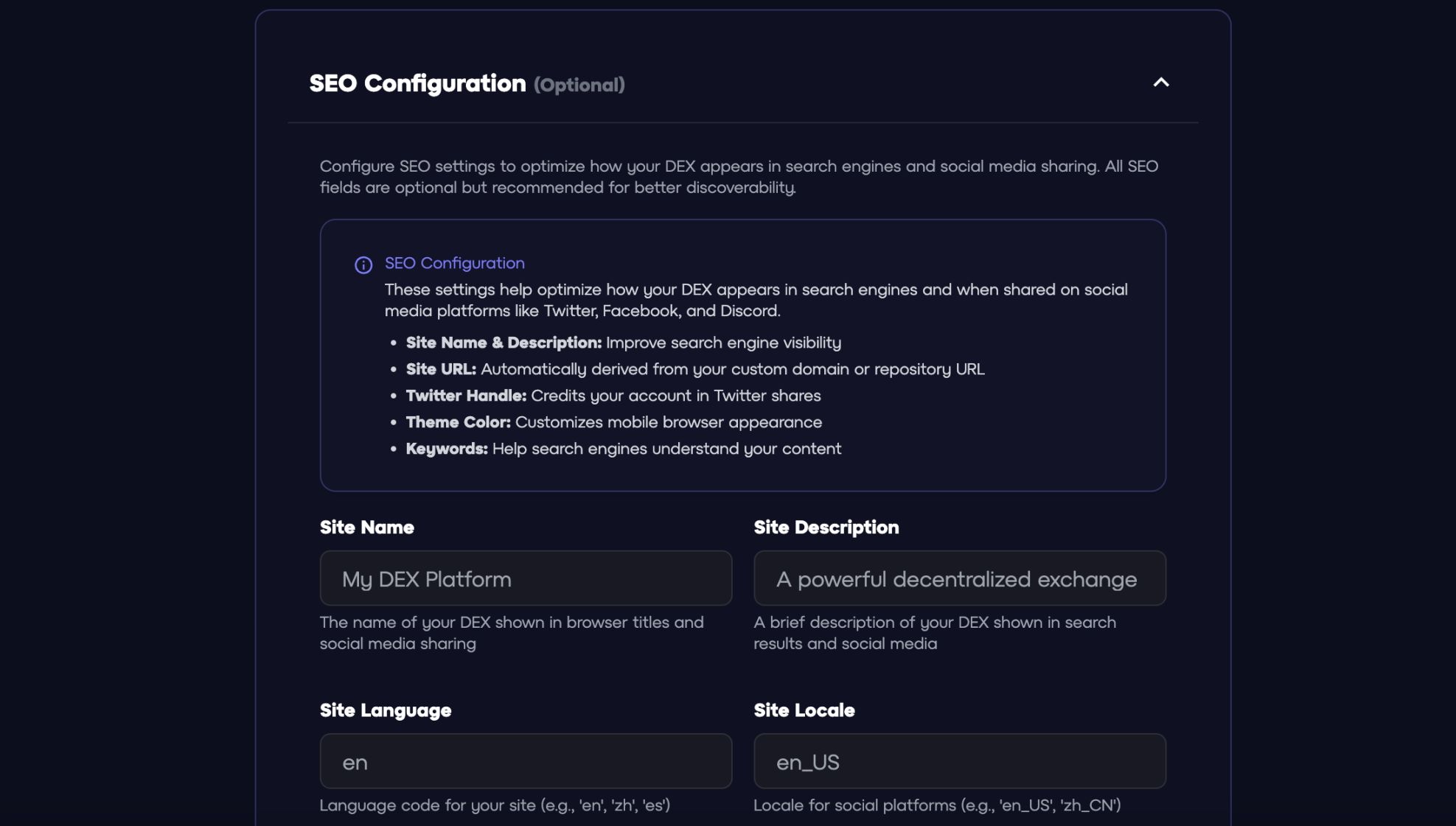

Orderly ONE offers a wide range of customizable modules, including logo, theme color, domain name, trading pairs, and fee tiers, down to details like colors and SEO. The frontend of Orderly ONE’s "Configuration Center" uses a modular Remix template, automatically fetching user configurations and generating static sites that can be hosted on IPFS or custom domains. The backend provides APIs for market data, depth, K-line, accounts, rebates, etc., facilitating secondary development for advanced users. Readers can try setting up a DEX themselves to experience the product’s design ingenuity.

Orderly ONE’s potential customer base is very diverse, including DEXs built by trading KOLs or communities like Aden, in-game trading platforms for gaming projects, or, as mentioned earlier, some newly established CEXs—all can use this product to build their own trading platforms.

In this way, Orderly is like a "stock exchange," and the trading platforms built through Orderly are like brokerages. Unlike the complex licensing and permit systems in traditional finance, in the Web3 world, as long as there are users, anyone can establish and operate their own "crypto brokerage" without permission.

Steadfast Execution is "the Only Right Way"

The debate over whether AMM or order book models are better in the DEX field has never ceased. In the business market, there is never an absolute good or bad; often, simply sticking to one direction can turn the ordinary into the extraordinary.

Back in the Web3 space, there is no absolute good or bad between AMM and order book models; each has its own advantages and disadvantages. The key is for the project team to pave a broad road where no one has gone before. Now, it seems that the Orderly team has found the right path for themselves. The launch of Orderly ONE has made new DEXs far more efficient than the period when one-on-one guidance was needed, and the establishment of a large number of new DEXs has also improved Orderly’s revenue capacity.

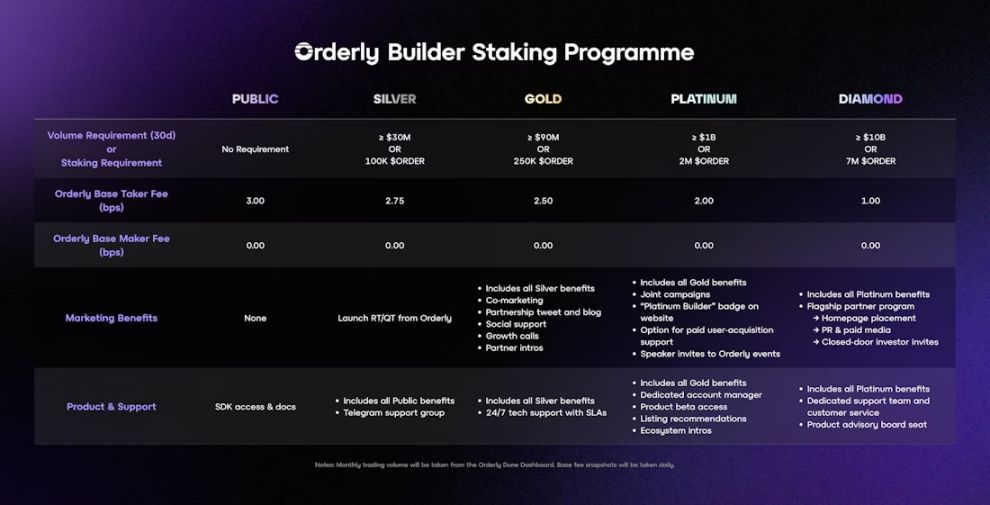

Orderly’s documentation shows that for DEXs developed based on its infrastructure, fees are determined by trading volume or the value of staked ORDER. Maker fees are completely free, and taker fees are as low as 0.01%. The more DEXs use Orderly as their underlying infrastructure, the greater the value Orderly captures and the stronger the purchasing power of ORDER.

In early September, the Orderly community passed a governance proposal to use 60% of Orderly protocol’s net profits to buy back ORDER tokens. Of the repurchased tokens, 50% will be distributed to ORDER stakers in the form of esORDER, released linearly over three months; the remaining 50% will be retained in the DAO wallet as ORDER tokens. The expansion of Orderly’s product services has increased revenue capacity, while also providing stable buying support for the token and offering additional returns or discretionary funds for stakers and the community.

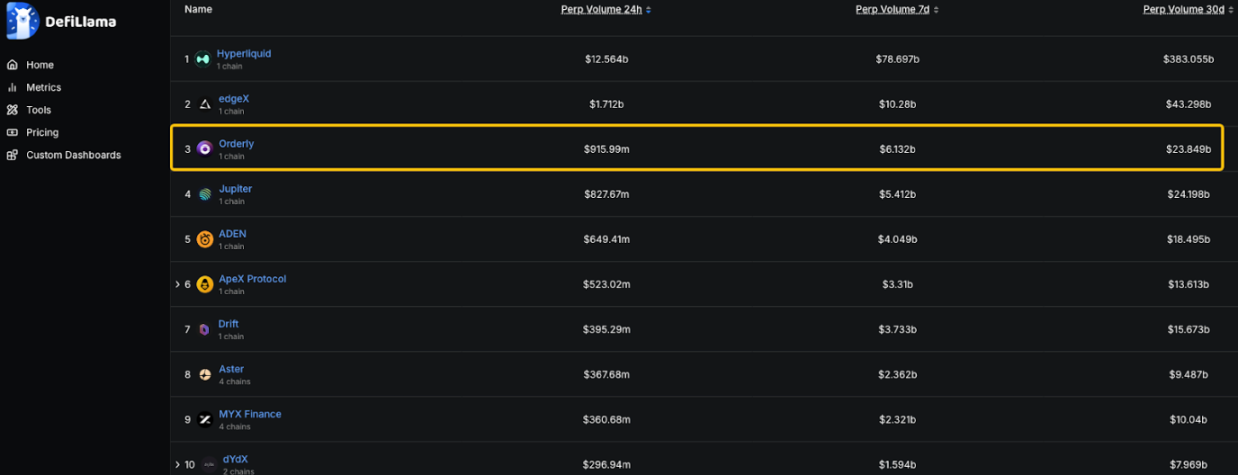

Over the past three years, Orderly has always advanced at its own pace, taking steady steps and executing appropriate strategies at the right time in terms of products, liquidity, and tokens. To date, the cumulative settled trading volume has exceeded $110 billion. According to DefiLlama data, if the trading volumes of DEXs built on Orderly are combined, Orderly can easily rank among the top five in the entire network. Such focus and pursuit of excellence are rare in the Web3 space.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Could Be on the Verge of a Major Breakout, Analyst Says

Nivex SeaSpark Yacht Gala: Embracing the Future Wave of Socializing and Finance

Nivex held the SeaSpark VIP yacht event in Singapore, partnering with multiple Web3 companies to create a high-end maritime social experience and explore future connections between technology and finance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Dive into Abraxas Capital’s Bold Portfolio Moves

In Brief Abraxas Capital strategically closed parts of its short positions for profit in recent market shifts. The fund’s portfolio strategies show different risk profiles, focusing on maximizing gains. Recent transactions demonstrate effective risk distribution strategies, maintaining the fund's profitability.

Bank of England to Lift Stablecoin Limits Once Economic Risks Subside