Date: Thu, Oct 16, 2025 | 08:30 AM GMT

The cryptocurrency market is still struggling to stage a meaningful V-shaped recovery following the October 10 crash, which triggered more than $19 billion in liquidations . The sharp decline dragged several altcoins lower by 20–30%, pushing many back to price levels not seen in months.

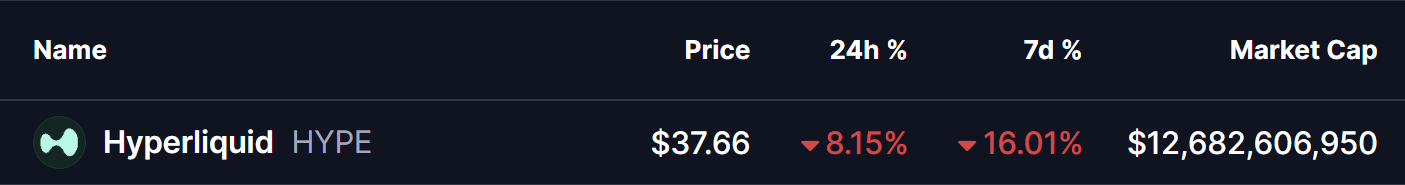

Among those hit is Hyperliquid (HYPE), which continues to trade in the red this week with a 16% weekly decline. But beyond the short-term price action, the technical structure is now flashing potential warning signs that could hint at a deeper correction ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at Downside

A recent fractal comparison suggests that HYPE’s current market structure mirrors the 2019 cycle of Binance Coin (BNB) — a pattern that ended with a sharp correction.

In the case of BNB, the token rallied over 800% before facing heavy resistance near the 1.618–2.0 Fibonacci extension zone. Once it lost momentum and broke below the 100-day and 200-day moving averages, the price plunged over 73%, confirming a major trend reversal.

BNB and HYPE Fractal Chart/Coinsprobe (Source: Tradingview)

BNB and HYPE Fractal Chart/Coinsprobe (Source: Tradingview)

Fast-forward to 2025, HYPE appears to be tracing a similar path. After a strong 500% rally, the token began to correct from the same 1.618–2.0 Fibonacci extension area, suggesting an overextended move.

Currently, HYPE has already lost its 100-day moving average, which sits around $45.58, and is now trading near $37.88 — just above the 200-day moving average at $36.61, a level that served as the last line of defense in BNB’s prior fractal before its sharp decline.

What to Watch for HYPE?

If this bearish fractal continues to unfold, a breakdown below the 200-day MA could confirm the next leg down, potentially initiating a broader correction phase similar to what BNB experienced in 2019.

However, if HYPE manages to reclaim the 100-day MA at $45.58, it could invalidate the bearish setup and reintroduce bullish momentum. Such a move would signal renewed buying interest and suggest that the current pullback might be a consolidation rather than the start of a larger downtrend.

Traders should also remember that fractal patterns are not guaranteed — they merely provide a visual framework for potential price behavior based on historical similarities.