Tokenomics is the study of the economic models that drive cryptocurrency projects. It explains how tokens are created, distributed, and utilized within a blockchain network. Understanding tokenomics is crucial for anyone involved in crypto, as it reveals what makes a token valuable and how it functions in the market. This article breaks down the key aspects of tokenomics, including token supply, distribution, utility, and mechanisms that impact value.

Supply and Distribution of Tokens

The supply and distribution model is a core component of tokenomics. Total supply refers to the maximum number of tokens that will ever exist. Some projects cap the total supply, creating scarcity, which can increase the token’s value over time. Other projects have no supply cap, leading to inflationary pressures that could decrease the token’s value if not properly managed.

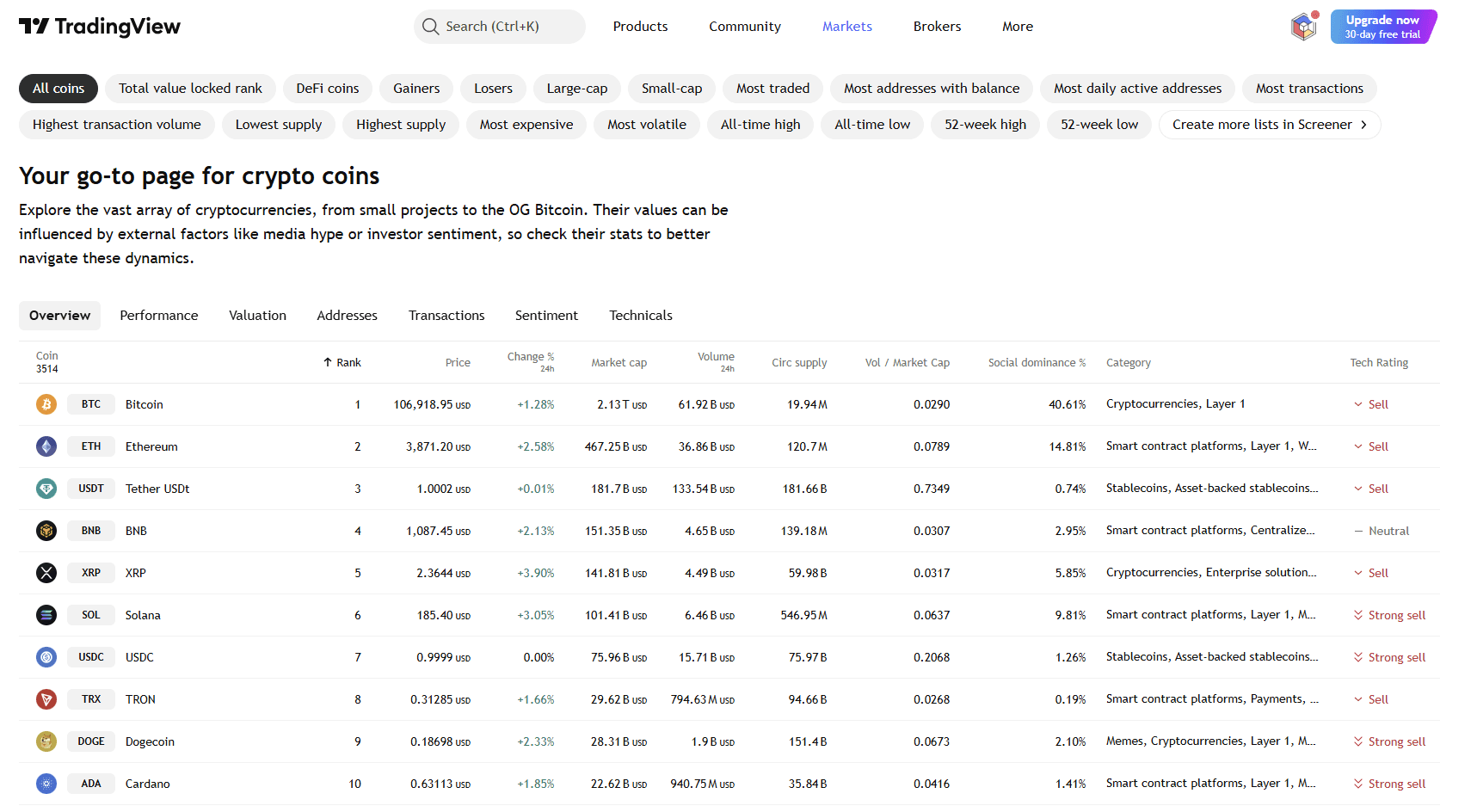

The circulating supply is the number of tokens currently available for use in the market. This number is crucial because it influences token liquidity. A high circulating supply with low demand can lead to falling prices, while a limited supply with high demand could drive prices up. Token allocation determines how tokens are distributed among various groups, including developers, investors, and the general public.

A balanced allocation is crucial for preventing centralization, where one group controls the majority of the token supply. This ensures fairness and trust within the community. Many projects also use a vesting schedule, which releases tokens gradually to the team and investors over time. This prevents sudden sell-offs, which could destabilize the market by flooding it with tokens, leading to a price drop.

Token Utility and Its Role in Value

The utility of a token is another important factor that contributes to its value. Tokens with real-world applications within their ecosystem are more likely to maintain value. One key use of tokens is governance. Many projects grant token holders the right to vote on decisions that affect the network’s future. This sense of ownership can make tokens more valuable because holders have a say in the project’s direction.

Tokens can also be used for accessing services within decentralized applications (dApps). In DeFi projects, for example, tokens can pay for services like lending, borrowing, or staking. Tokens used for in-game purchases or rewards in blockchain-based games also have clear utility, contributing to their demand and value.

Economic Mechanisms and Incentives

To maintain or increase the token’s value, many projects implement economic mechanisms. Staking is one common strategy where users lock up tokens to support the network’s security or provide liquidity. In return, users earn rewards, incentivizing them to hold tokens and reducing market volatility.

Token burns are another mechanism used to reduce supply. By permanently removing tokens from circulation, a project can create scarcity, which could drive up the token’s price. Many projects also utilize transaction fees to fund operations. Some of these fees are burned, which further reduces the circulating supply and adds a deflationary pressure on the token, potentially increasing its value.

Nexchain AI Tokenomics: The Foundation of Its Blockchain Ecosystem

One of the best examples of a robust tokenomics structure for study is the current market model exemplified by Nexchain AI. Nexchain’s tokenomics model is at the heart of its blockchain’s scalability and long-term viability. At the core of its economy is the NEX token, which serves various purposes within the ecosystem, including transaction fees, staking rewards, and governance.

The initial supply of NEX tokens is capped at 2.15 billion, with a significant portion allocated to early investors, liquidity pools, ecosystem development, and staking rewards. The distribution strategy is designed to ensure that the token’s value is sustained as the platform grows.

One of the unique features of Nexchain’s tokenomics is its hybrid Proof-of-Stake (PoS) model, integrated with AI-driven optimizations. This allows for adaptive transaction validation, enhancing both scalability and security. The NEX token plays a critical role in the PoS mechanism by incentivizing network participants to stake their tokens and secure the platform. In return, stakers are rewarded with additional NEX tokens, creating a steady cycle of reward distribution that supports ecosystem growth.

Testnet 2.0: Enhancing Tokenomics with AI-Driven Features

Nexchain’s upcoming Testnet 2.0, launching in November, promises to introduce crucial improvements that will enhance both the platform’s usability and tokenomics. One of the key features of Testnet 2.0 is the integration of AI Events during transaction confirmations. This feature introduces an AI Risk Score data system, allowing users to see potential risks before approving transactions. This addition enhances security and adds transparency to the platform, making Nexchain more appealing to investors concerned with fraud prevention and network integrity.

Additionally, the Testnet 2.0 will allow participants to engage with the platform and receive rewards. Using the promo code TESTNET2.0, users can earn a 100% bonus on their transactions, further increasing demand for the NEX token. This bonus structure not only incentivizes early adoption but also drives token liquidity, which is essential for a thriving ecosystem.

As Testnet 2.0 is rolled out, Nexchain’s tokenomics will continue to evolve, with new features that optimize both the platform’s efficiency and its financial structure. The combination of AI-powered enhancements and token incentives positions Nexchain as a forward-thinking blockchain that can address critical challenges in the market, such as scalability, security, and token value sustainability.

Evaluating a Project’s Tokenomics

When assessing the tokenomics of a cryptocurrency project, consider the total supply, token allocation, and the utility of the token within its ecosystem. Is the token used for governance, payments, or rewards? Does the project have mechanisms like staking or token burning to support its value? These factors determine the long-term potential of a cryptocurrency and its sustainability in the market. By understanding these key elements, investors can better evaluate a cryptocurrency’s value proposition and assess its future prospects in the competitive crypto space.