Analyst: Bitcoin trend reversal requires simultaneous growth in price and open interest, or significant capital inflows

BlockBeats News, October 18, CryptoQuant analyst Axel Adler Jr stated in a post that after a large-scale leverage wipeout, the market is still in a correction phase; the risk of cascading liquidations has dropped below peak levels. A short-term rebound is possible, but for a sustainable reversal to occur, either prices and open interest need to grow in sync, or there must be a significant inflow of spot funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Andrew Kang turns bearish, opens 25x short position with over 10,000 ETH

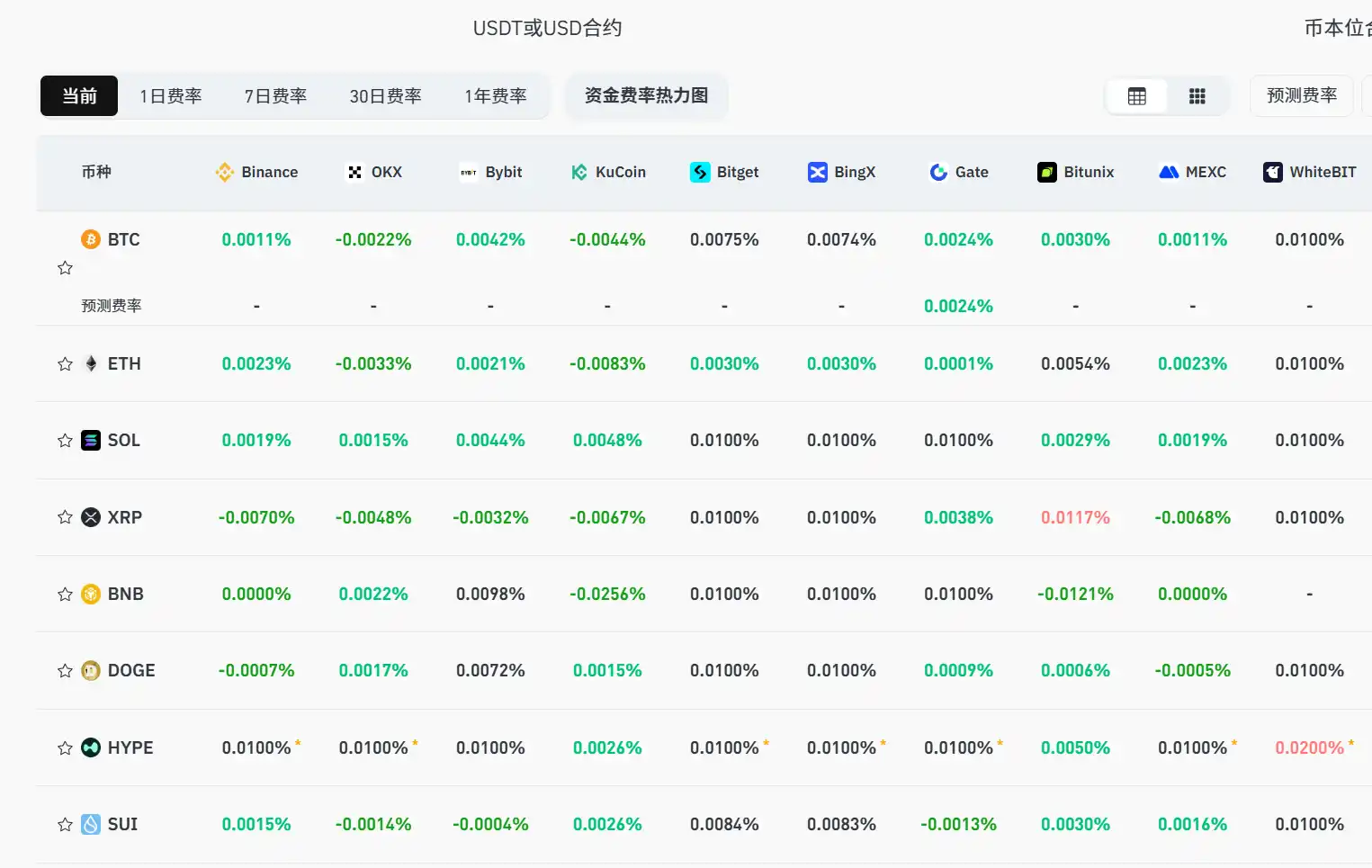

Current mainstream CEX and DEX funding rates indicate the market remains bearish.

Crypto market sentiment moves out of the "extreme fear" zone, Fear & Greed Index currently at 29