Wintermute founder: The crash was caused by multiple factors, with excessive market leverage being a key issue

ChainCatcher news, Wintermute founder Evgeny Gaevoy stated in The Block's podcast that, "I believe the crash was the result of multiple factors combined. On one hand, there is indeed more leverage in the system; on the other hand, the market now has more types of tokens, more perpetual contract products, and more large platforms trading these perpetual contracts. Looking back three or four years ago, we simply didn't have so many perpetual contract products with huge open interest and enormous crash risks. In terms of market maturity, although the overall system is indeed more complete and sophisticated than before, this development has also brought about many problems. It is still unclear who exactly was 'liquidated' and who suffered the most losses, but I suspect that many institutions with heavy losses were actually running long-short hedging strategies. For example, they might have shorted bitcoin and gone long on some altcoins, thinking this would hedge their risks, but in the end, they were 'slapped in the face' by the ADL mechanism."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Whale liquidates ETH and HYPE long positions within three hours, reducing holdings by $18.8 million

xBrokers trading section officially launched, first stock "聚 (0XXXX.HK)" opens with a gain of over 462%

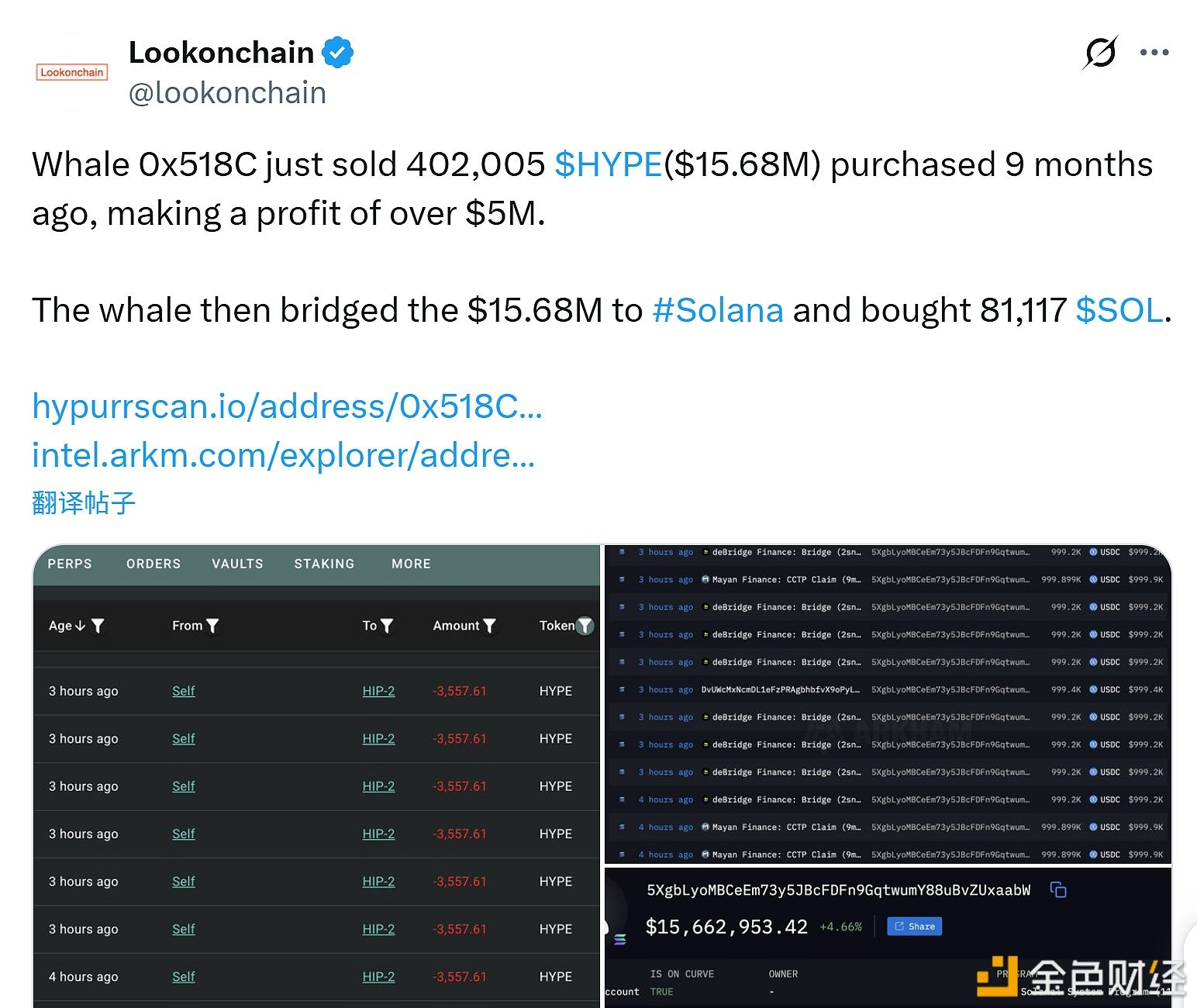

A whale wallet sold 402,005 HYPE and bought 81,117 SOL.

A whale swapped HYPE for SOL, worth $15.68 million.