Trump's Crypto Advisors May Reshape the Global Crypto Landscape

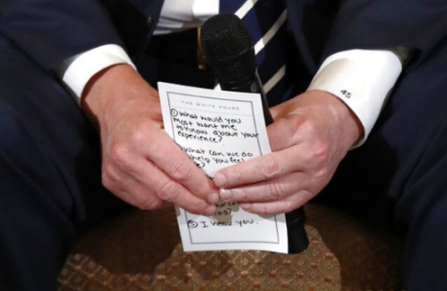

In the past few days, an internal White House memo has been quietly circulating within Washington's financial circles.

One name in particular has caused a huge stir—

Trump's crypto advisor is none other than Binance founder CZ (Changpeng Zhao).

❶ From “Regulatory Fugitive” to “White House Advisor”?

In the history of global crypto, CZ’s name has stood at the center of both the “decentralization revolution” and the “regulatory storm.”

He has been investigated by the US Department of Justice, sued by the SEC, and regarded as an “outlier in the crypto world.”

But now, his name appears in a draft document for the Trump administration’s “Crypto Council,”

listed as a potential policy advisor.

On the surface, it seems absurd, but on closer inspection, it makes sense.

❷ Trump’s Ultimate Ambition: Make the US the “Global Crypto Capital”

Since taking office, Trump has repeatedly emphasized “Bring Capital Home”—bringing capital back to the US.

And the world’s most active, most free, and most capital-attractive asset market is crypto.

To regain discourse power in this field,

he needs someone who understands liquidity, global compliance, and how to win traders’ trust.

CZ happens to possess all of these qualities.

❸ The Blueprint Revealed by the Leaked Document

In the leaked “Crypto Council Brief,” Binance representatives are listed as “policy participants.”

This is not by chance, but a strategic probe:

Washington wants to leverage CZ’s global network to bring decentralized capital back under the US regulatory system.

What does this mean?

The US is no longer simply cracking down on crypto, but planning to integrate the power of the crypto ecosystem,

formally merging Wall Street with Web3.

❹ CZ’s Value: He Brings More Than Market Experience

CZ possesses three things Washington dreams of:

Global trader trust;

Liquidity and market connectivity;

Deep control over the global crypto ecosystem.

No traditional financial executive can replace these resources.

What Trump wants is a bridge figure who can help the US dollar regain dominance in the crypto space, and CZ is that bridge.

❺ The Impact Will Be Structural: Chain Reactions from DeFi to BNB

If this plan goes public,

Washington’s regulatory stance will shift from “suppression” to “integration.”

This means:

Regulatory relaxation: crypto companies may obtain formal operating licenses;

DeFi revival: funds will legally flow into the decentralized ecosystem;

Institutional participation: ETFs, sovereign funds, and banking systems will fully engage.

Who will be the direct beneficiaries in the market?

BNB and Binance ecosystem projects.

Once the news is confirmed, these assets could become the “core targets of policy premium” in the next cycle.

❻ The Fusion of Power and Crypto: A New Era Signal

This is no longer just a rumor or political gimmick.

It represents a deeper transformation—

the first formal combination of power structures and crypto capital.

If CZ really steps into the White House,

it will not only be a personal comeback story,

but also the first time the crypto world truly enters the political center.

Conclusion:

From a besieged exchange founder to a possible White House advisor,

CZ’s transformation not only symbolizes a reversal of personal fate,

but also represents a fundamental restructuring of the global crypto landscape.

Trump knows that if the US wants to regain financial hegemony,

it must embrace crypto—instead of rejecting it.

The moment CZ walks into the White House,

crypto will no longer be a “marginal asset,”

but the new core of the global financial system.

The future of finance is not on Wall Street, nor in Silicon Valley,

but on-chain—and it may start from the White House.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Prepares for Volatility Storm as CPI Data and Fed Meeting Loom

Societe Generale: A mild recession in the US could weaken the dollar

Chainlink Eyes $100 After S&P Global Collaboration Boosts Investor Optimism