The Reality of Korean Retail Investors: 14 Million "Ants" Flock to Cryptocurrency and Leverage

A brutal "Squid Game".

A brutal "Squid Game."

Written by: Sangmi Cha, Haram Lim

Translated by: Luffy, Foresight News

Tony Kim, a manager at a textile company in Seoul, goes all-in on a stock whenever he feels bullish about it.

34-year-old Tony Kim has never held more than one stock at a time in his 140 million won (about $98,500) investment portfolio. The father of two said, "Koreans, myself included, are obsessed with that dopamine rush—it feels like it's in our genes."

Tony Kim

For many retail investors, this approach may seem reckless or require extraordinary stress tolerance. But among Korea's approximately 14 million retail investors, known as the "ant army," this is just a glimpse of their intense desire for returns and ever-increasing risk appetite.

This desire is driving funds into investment accounts at near-record speeds. Over the past five years, Korean retail investors have doubled the scale of margin loans by leveraging up; they've poured into highly speculative leveraged and inverse exchange-traded funds (ETFs), accounting for 40% of the total assets of some leveraged ETFs registered in the U.S. Meanwhile, trading volumes of high-risk cryptocurrencies have also soared to all-time highs.

The frenzy of retail trading is not only reshaping the market but also making them an influential political force. The power and anxiety of these investors have become so strong that they even forced the Korean government to reverse its policies for the first time.

Currently, global markets are at historic highs due to the AI infrastructure boom, but highly leveraged Korean retail investors are in an extremely vulnerable position. If market sentiment suddenly shifts, speculative positions could collapse instantly, and losses would be further magnified.

Such a reversal occurred just over a week ago. The escalation of U.S.-China tariff disputes triggered a cryptocurrency crash, with many altcoins instantly going to zero. Korean retail investors are known for their high-stakes bets on small-cap tokens. These tokens are highly volatile, accounting for over 80% of total trading volume on Korean crypto exchanges; in contrast, on global platforms, bitcoin and ethereum usually account for more than 50% of trading volume, forming a stark contrast.

For many Korean retail investors, all high-risk operations point to the same goal: to accumulate enough wealth in a fiercely competitive market to buy a home of their own. Koreans use the term "borrowed soul" to describe this struggle, a phrase that precisely reflects the emotional and economic pressures behind the dream of homeownership.

Recent government policies have further intensified retail investors' risk-taking. New President Lee Jae-myung's implementation of mortgage limits and rental market reforms have driven up rents, making homeownership even more out of reach. Last week, the government introduced several measures to cool the overheated real estate market, including tightening loan limits in the Greater Seoul area and lowering the loan-to-value ratio for mortgaged properties.

"Our parents' generation accumulated wealth through the real estate boom of the Miracle on the Han River, but our generation hasn't been so lucky," said 36-year-old Kim Soo-jin. She was once a business consultant and, after leaving her job, used all her severance pay to start investing in cryptocurrencies. "In my circle, about 30 people have already 'graduated'—meaning they've made enough money and exited high-risk investments." She said, "I also hope to 'graduate' one day."

The Han River in Seoul

Buyers Beware

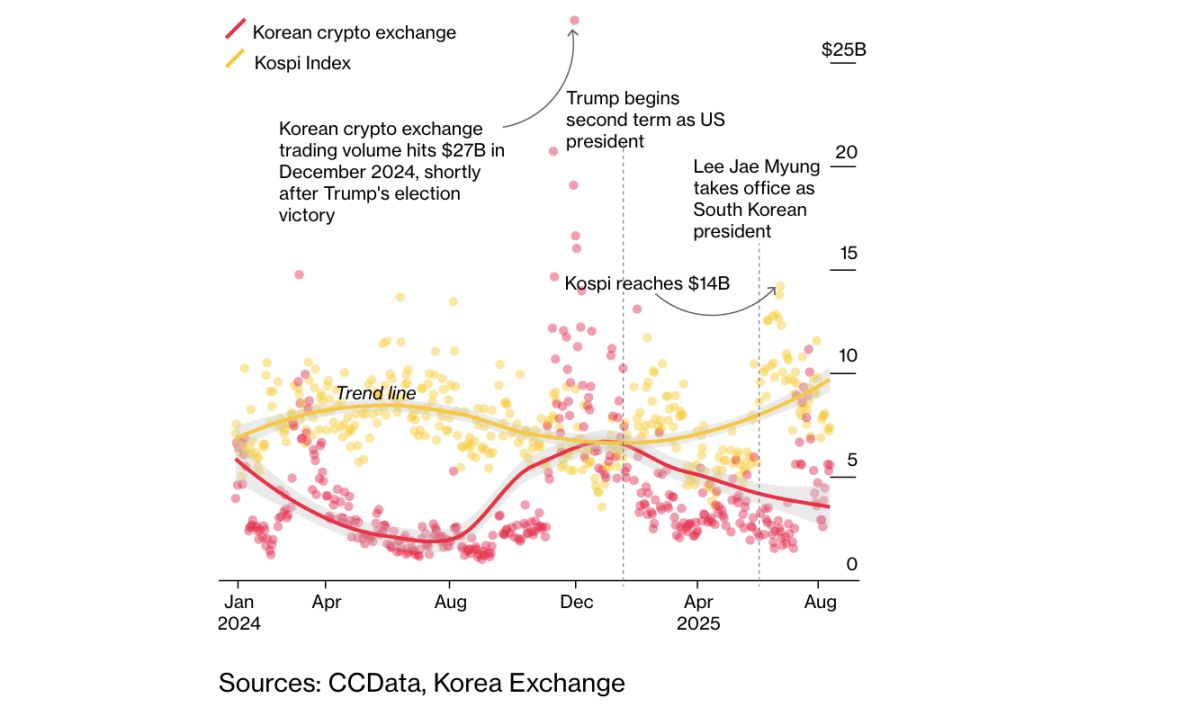

The momentum of Korean retail investors chasing gains is evident across all markets. Since Donald Trump won the U.S. election and began his second term last year, trading volume on Korean domestic crypto exchanges has soared, at one point reaching 80% of the trading volume of Korea's benchmark Kospi index; stablecoins pegged to fiat currencies have also attracted large amounts of retail funds.

Investors have also flocked to leveraged and inverse ETFs, products that use derivatives to amplify gains (and losses) by two to three times. Due to strict domestic regulations in Korea—such as simulated trading exercises and high margin requirements—retail investors have turned to overseas markets and have now become major participants in the global leveraged ETF market.

Comparison of trading volume between Korean crypto exchanges and the Kospi index

The high-risk behavior of Korean retail investors not only puts household savings at risk but also puts pressure on the financial system, threatening overall economic stability. As investors flock to high-yield, high-risk assets, traditional financial instruments are losing favor, and banks' channels for raising funds are being squeezed. In the six weeks after July this year, Korea's major banks lost nearly 40 trillion won (about $2.81 billions) in deposits.

"In Korea, investing is often seen as gambling rather than long-term planning—almost as brutal as 'Squid Game'," said Choi Jae-won, an economics professor at Seoul National University. "Once the bubble bursts and individuals suffer negative wealth shocks, the problem worsens: personal credit crises emerge, consumption capacity declines, and ultimately the entire national economy is affected."

Regulators are equally concerned. "We are worried that if the market crashes, it will impact retail investors' assets and the overall economy," said Lee Yoon-soo, standing member of the Korea Securities and Futures Commission.

Psychiatrists point out that high-risk investing is taking an increasing mental toll on individuals. "Without inherited wealth, owning an apartment in Gangnam (Seoul's wealthy district) is just a fantasy," said Park Jong-sik. He once lost about $250,000 in investments and now runs a clinic specializing in treating investment addiction. "In this anxiety-ridden society, even knowing the risks, people are still drawn to high-risk investments. It's as if the whole system is pushing them forward, trapping them in an anxiety-driven cycle of investment addiction."

Park Jong-sik

"Wiped Out Overnight"

For some, the scars of investment collapse are hard to heal. 35-year-old Han Jung-hoon once experienced the euphoria of his crypto wallet balance soaring 30-fold to 6.6 billion won, but the 2022 Luna crash wiped it all out.

TerraUSD was a stablecoin project launched by Korean Do Kwon, which ultimately failed. In August this year, Do Kwon pleaded guilty to fraud, and the project's collapse wiped out about $40 billions in market value within days.

"My 6.6 billion won profit disappeared overnight, and in the end, I got back less than 6 million won," Han Jung-hoon said.

This crash completely changed his life. Although he hasn't completely given up on cryptocurrencies, he has distanced himself from high-risk investments, turning instead to meditation and even starting a YouTube channel to share his favorite breathing techniques. Now, he lives on the remote Jeju Island and occasionally travels to Bali for meditation retreats.

Han Jung-hoon

Even so, social media platforms like YouTube are still filled with stories of bold investment successes. Couples investing all their savings in bitcoin, 27-year-old college students earning tens of thousands of dollars a month through high-frequency trading... These stories are the bait that attracts investors like Tony Kim.

Tony Kim is currently all-in on stocks like Nvidia and Tesla. "I've made money with leverage, and that feeling of easy profit is addictive." He recalls once "making $900 to $13,000 overnight," but lost all his gains in just three days. "You keep chasing that get-rich-quick thrill."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum’s Holesky Testnet Enters Its Final Phase

Quick Take Summary is AI generated, newsroom reviewed. Holesky testnet shutdown begins this week, with operators deactivating nodes over ten days. Ethereum Foundation cites completion of Fusaka testing and technical evolution as reasons for closure. Validators should migrate to Hoodi, while developers move to Sepolia for application testing. The shift marks Ethereum’s new modular testnet era, ensuring faster, cleaner, and scalable testing environments.References 🚨 UPDATE: Ethereum Foundation announces Hol

Interview with Bit Digital CEO Sam Tabar: We Sold All Our Bitcoin and Switched Entirely to Ethereum

A monologue from an ETH Maxi.

Three Major Questions Amid the Boom of Prediction Markets: Insider Trading, Compliance, and Lack of Chinese-Language Narratives

Prediction markets are becoming the focus of community discussions; however, beneath the immense spotlight, several major questions and concerns are gradually emerging.

Washington Shutdown, Street Protests Shout "No King, Long Live the People!"