The Fed's balance sheet reduction is nearing its end, with signs of stress emerging in the money market

BlockBeats News, October 28 — The Federal Reserve is expected to end its three-year quantitative tightening phase this week, easing pressure on banks amid concerns over excessively tight funding in the money markets. Earlier this month, some bank lenders tapped the Federal Reserve's backstop funding facility, reaching levels seen during the pandemic.

Policymakers will discuss this on Tuesday. Since launching the quantitative tightening program in June 2022, the Federal Reserve has allowed over $2 trillion worth of U.S. Treasuries and mortgage-backed securities to roll off its balance sheet, resulting in tighter financing conditions.

Krishna Guha, Vice Chairman of Evercore ISI, stated: "The market has basically reached a consensus that the Federal Reserve will end quantitative tightening this month."

Richard Clarida, current Director at Pacific Investment Management Company (PIMCO) and former Vice Chairman of the Federal Reserve, pointed out: "This will be a very close decision. But even without a formal resolution, we will receive a strong signal that the Federal Reserve will end quantitative tightening in December." (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

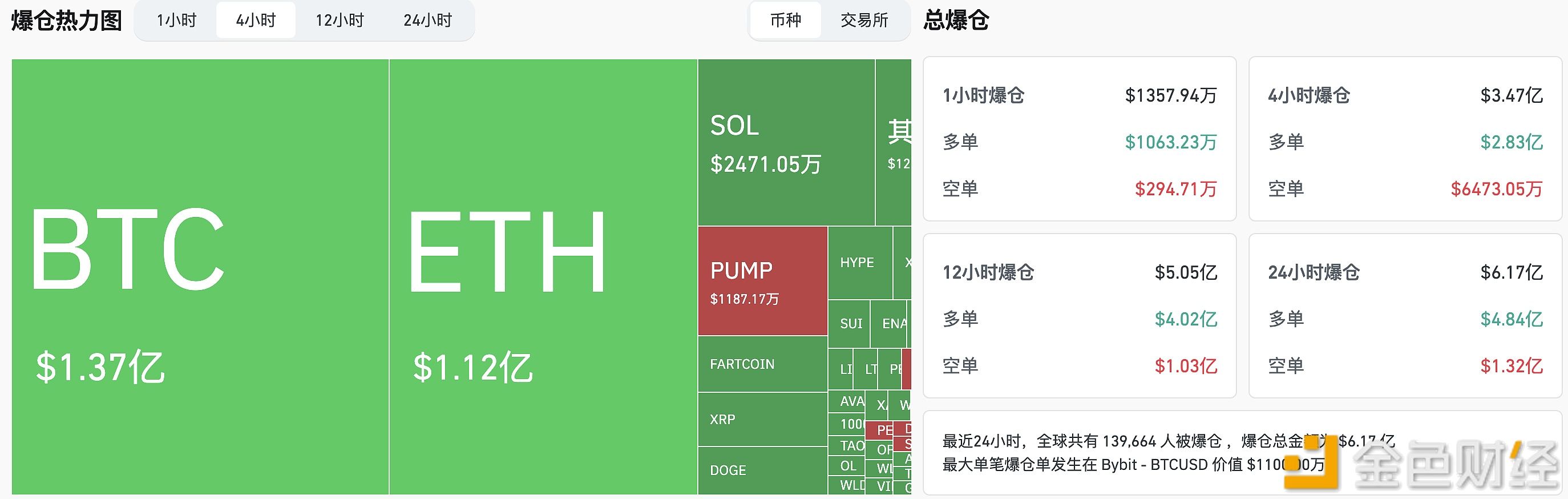

$347 million liquidated across the entire network in the past 4 hours

Data: TREE drops over 16% in 24 hours, YB rises over 10%

Powell: No Significant Deterioration Observed in Any Sector of the Economy