K33: Spot Solana ETF Will Attract Capital Inflows, Small Altcoin Funds May "Gradually Lose Influence"

Jinse Finance reported that according to K33's latest report, Solana ETF may see strong demand after its listing, while other altcoin ETFs could face weaker capital inflows in the absence of participation from BlackRock. The K33 analyst team, led by Vetle Lunde, stated in a report released on Tuesday that the spot SOL ETF is expected to attract substantial capital inflows, and signs of investor demand are already very evident. The analysts pointed out that the potential capital inflows for Solana funds can already be seen from the sustained demand for the 2x long SOL leveraged ETF launched by VolatilityShares—which currently holds an equivalent exposure of about 2.28 million SOL. Meanwhile, other issuers are also preparing to launch more altcoin ETFs. For example, the Litecoin (LTC) and Hedera (HBAR) related ETFs launched by Canary were listed on Tuesday. Lunde cautioned that in an increasingly crowded market, these smaller and less well-known altcoin ETFs may struggle to attract sufficient attention. "We expect demand for different ETFs to diverge," the analysts wrote in the report, adding that in a competitive environment where dozens of other altcoin ETFs are being launched, some altcoin funds may "become irrelevant."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

USDC Treasury newly mints 100 million USDC

The US Dollar Index rose by 0.56% on the 29th.

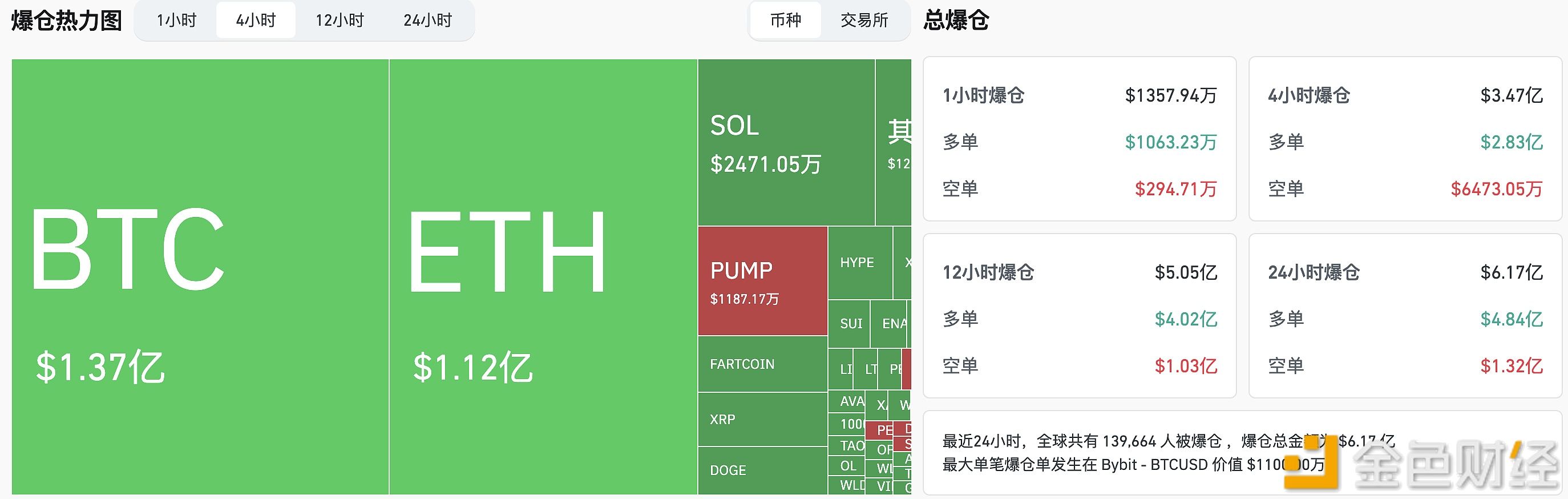

$347 million liquidated across the entire network in the past 4 hours