Bitcoin News Update: Investors Experience 'Intense Fear' Amid Crypto Market Hovering Around $3.7 Trillion Valuation

- Bitcoin's price stagnation near $3.7T cap mirrors a muted IPO, driven by declining on-chain liquidity, looming token unlocks, and institutional outflows. - $7.94B drop in DeFi liquidity and $310M+ token unlocks over two weeks amplify downward pressure, with sellers dominating the bearish market. - ETF redemptions ($1.22B in 2 days) and record-low corporate crypto purchases ($364M) signal deepening investor caution and supply flooding. - Whale activity and $240M liquidations highlight fragile momentum, wh

Bitcoin’s price has been largely stagnant lately, prompting some to liken its current state to a subdued IPO, as the market faces a mix of negative factors. Experts highlight shrinking on-chain liquidity, upcoming

Liquidity on-chain—a vital indicator for DeFi platforms—has dropped by $7.94 billion since reaching a high of $157.64 billion on October 27, now sitting at $149.7 billion. This sharp decline signals waning buying interest, with sellers taking control as uncertainty mounts. Making matters worse, more than $310.56 million worth of tokens are set to be unlocked in the next two weeks, including $51.26 million this week. Analysts warn that these new tokens entering circulation could intensify the downward trend in an already delicate market. “When tokens unlock during periods of fear, volatility increases as holders rush to sell before prices fall further,” explained blockchain analyst Alex Thorn.

Institutional withdrawals have added to the market’s woes. Exchange-traded funds (ETFs) for

Recent blockchain activity paints a mixed picture. A prominent Bitcoin whale, known as Owen Gunden, moved 193.77 BTC (worth $21.49 million) to Kraken on November 2, according to

The outlook remains unclear. Should liquidity keep shrinking and token unlocks continue as scheduled, analysts expect ongoing downward pressure on the crypto market, possibly challenging support around a $3.5 trillion market cap, according to the Coinotag report. Still, positive developments such as regulatory improvements or favorable economic conditions could change the market’s direction. For now, investors are encouraged to focus on risk management and keep an eye on on-chain data for signs of stabilization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

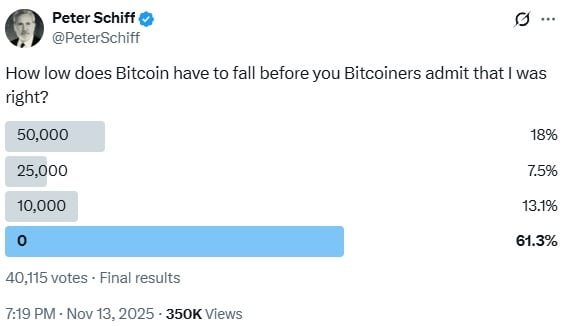

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.