Crypto Venture Funding Rebounds: Surges to $5.11B in October

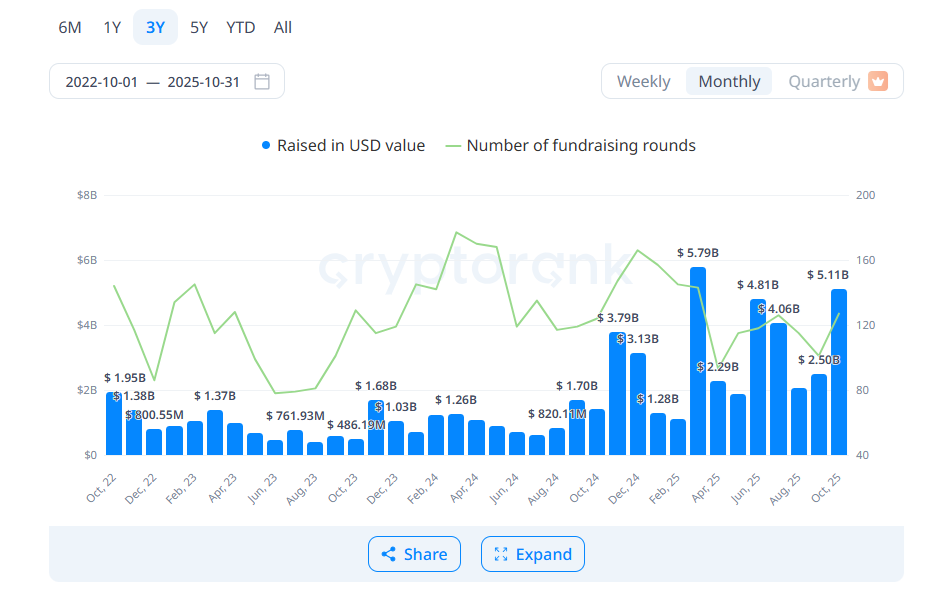

Crypto venture capital activity continued its steady recovery in October, closing the month with $5.11 billion in reported deals. Investor confidence strengthened after a slower summer, and funding levels nearly matched the March 2025 peak of $5.79 billion. Early data suggests that October’s final total could rise further once all undisclosed rounds are reported.

In brief

- October crypto VC deals hit $5.11B, the second-highest since 2022, signaling renewed investor confidence.

- The U.S. led with $2.26B in funding, while international projects added $1.63B in undisclosed deals.

- 127 rounds closed, led by Coinbase Ventures; Echo and Kalshi headline large late-stage raises.

- AI-linked crypto projects captured 32% of funding as NFT and gaming investments continued to fade.

US Leads Crypto VC Revival as October Funding Hits $5.11B

Venture activity gained momentum across late-stage projects, indicating that investors favored established ventures over early experimental platforms. The United States maintained its dominant position, securing $2.26 billion in deals.

Meanwhile, international projects with undisclosed deal details contributed another $1.63 billion. Overall, October ranked as the second-strongest month for crypto VC activity since 2022.

Over the past year, funding patterns have undergone notable shifts. Investors are focusing more on projects with proven business models and less on speculative tokens with limited liquidity. This change reflects lessons learned from the 2021–2022 cycle, during which many low-float assets struggled in secondary markets.

VC Market Recovers with 127 Deals and Late-Stage Focus

A total of 127 funding rounds closed in October, marking a return to typical investment activity levels. Coinbase Ventures once again led the space, participating in 10 rounds, followed by Yzi Labs with five deals.

Echo’s $375 million raise, led by Coinbase Ventures, was one of the month’s largest announcements. Founded by well-known crypto personality Jordan Fish (also known as Cobie), Echo attracted significant institutional attention. Prediction market platform Kalshi also raised $300 million, reinforcing the trend toward larger, late-stage investments.

Average deal sizes ranged between $3 million and $10 million, although major rounds such as Kalshi and Tempo helped lift overall totals. Larger fund allocations have become increasingly common as mature projects seek growth capital.

Investment activity was concentrated in several key sectors:

- AI-linked crypto projects accounted for 32% of all funding activity.

- Binance Alpha initiatives made up more than 15% of total deals.

- Real-world assets (RWA) and payment solutions remained steady investment targets.

- Developer tools continued attracting mid-sized rounds.

- NFT and gaming projects saw limited funding, reflecting a shift away from 2021’s dominant categories.

Coinbase Ventures also participated in several smaller rounds between $5 million and $20 million, expanding its footprint across early infrastructure and application layers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Latest Updates: While Cryptocurrencies Decline, Major Institutions Reinforce Their Commitment to Long-Term Prospects

- Bitwise CEO Hunter Horsley asserts crypto's long-term fundamentals remain strong despite recent market selloffs, citing ETF growth and regulatory progress. - Bitwise's $497M Solana Staking ETF (BSOL) dominates 98% of Solana ETF flows, offering 7.20% staking rewards and options trading since November. - U.S. regulators advance crypto-friendly measures including leveraged spot trading plans, while institutions like BlackRock expand digital asset offerings. - Despite Bitcoin's $95k dip and bearish technical

LUNA Rises 9.00% in a Day Following Debut of Namibian High-End Resort and Expansion of Mining Drilling Operations

- LUNA surged 9% in 24 hours but fell 79.24% annually amid mixed technical indicators. - Gondwana Collection Namibia launched the Luna Namib Collection, a luxury desert retreat opening July 2026 with private stargazing and tailored experiences. - NGEx Minerals began Phase 4 drilling at Lunahuasi, targeting 25,000 meters of high-grade copper, gold , and silver deposits with C$175M funding. - The "Luna" name gained cross-sector relevance in tourism and mining, prompting backtesting strategies to analyze pric

COAI's Latest Price Decline: An Overreaction by the Market and a Chance for Undervalued Investment

- COAI Index plunged 88% YTD in Nov 2025 amid AI/crypto AI sector selloff, driven by C3.ai's leadership turmoil, $116.8M losses, and regulatory ambiguity. - C3.ai's Q1 2025 revenue rose 21% to $87.2M, with 84% recurring subscription income, highlighting resilient business fundamentals despite unprofitability. - AI infrastructure stocks like Celestica (CLS) surged 5.78% as analysts raised price targets to $440, contrasting crypto AI's freefall and signaling market overcorrection. - Regulatory clarity on AI/

Aave News Update: MiCA Green Light Spurs Aave’s No-Fee On-Ramp, Accelerating Widespread DeFi Integration

- AAVE token gains bullish momentum as on-chain growth and MiCA regulatory approval align for potential $450 price surge. - Technical indicators like TD Sequential signal strong buy opportunities, with $250 breakout likely to trigger renewed uptrend. - Aave becomes first DeFi protocol authorized under MiCA, enabling zero-fee euro-crypto conversions across EEA via GHO stablecoin. - Protocol's $542M daily volume and $22.8B borrowed assets highlight operational growth outpacing undervalued market price. - MiC