Date: Tue, Nov 04, 2025 | 05:25 AM GMT

The cryptocurrency market continues to face heightened volatility, shedding nearly 2% from the total market capitalization today. Both Bitcoin (BTC) and Ethereum (ETH) have seen sharp declines — with ETH dropping over 3% — leading to approximately $1.08 billion in total liquidations , including $943 million in long positions alone.

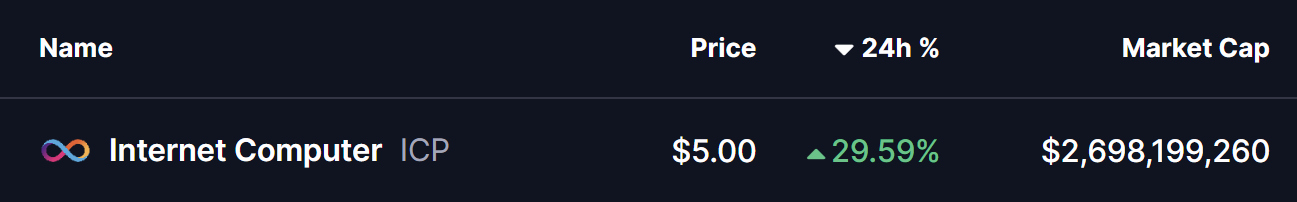

Despite the market downturn, Internet Computer (ICP) has managed to stand out with a solid 29% daily gain, hinting at potential underlying strength. More notably, its chart is flashing a “Power of 3” pattern, a structure often linked to institutional accumulation and the early stages of major bullish reversals.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play

On the daily chart, ICP is exhibiting a textbook Power of 3 structure — consisting of Accumulation, Manipulation, and Expansion phases.

Accumulation Phase

From March to September, ICP traded in a tight consolidation range between $6.10 and $4.58, forming a horizontal rectangle. This range likely represented a period of accumulation, where larger market participants quietly built their positions as price volatility contracted.

Manipulation Phase

In October, ICP briefly broke below its accumulation range, plunging to around $2.78. This sharp move triggered stop-losses and induced panic selling — a typical “manipulation” move seen before a reversal. The price quickly recovered, signaling that sellers were exhausted and strong hands were stepping back in.

Internet Computer (ICP) Daily Chart/Coinsprobe (Source: Tradingview)

Internet Computer (ICP) Daily Chart/Coinsprobe (Source: Tradingview)

Expansion Phase in Play?

Following the bottom, ICP rebounded sharply, reclaiming the $4.58 range low and recently breaking above the 200-day moving average (MA) at $4.87. Currently, the token trades around $5.00, suggesting that the expansion phase — the final leg of the Power of 3 — may now be in motion.

What’s Next for ICP?

If ICP sustains above the $4.58 support and decisively breaks above $6.10, it would confirm the completion of the Power of 3 structure. Such a breakout could fuel a strong upward move toward $9.41, representing an 88% potential upside from current levels — in line with the measured move of the accumulation range.

However, traders should watch for confirmation signals such as a high-volume breakout and sustained closes above $6.10. Failure to hold the $4.58 support could invalidate the bullish setup and push ICP back into a consolidation phase.

For now, all eyes remain on whether ICP can maintain its momentum and transition fully into the expansion phase — a move that could mark the beginning of a broader bullish cycle for the token.