LUNA Rises 6.05% Over the Past Week Despite Market Fluctuations

- LUNA rose 6.05% in 7 days but fell 79.29% annually, reflecting mixed short-term optimism and long-term bearish trends. - Technical analysis highlights stalled $0.10 resistance and bearish pressure, despite recent buying interest. - Backtesting showed +14.6% 30-day returns after ≥5% surges, though win rates declined to 38% by day 30. - Analysts warn macroeconomic uncertainty and weak fundamentals could hinder LUNA's sustained recovery.

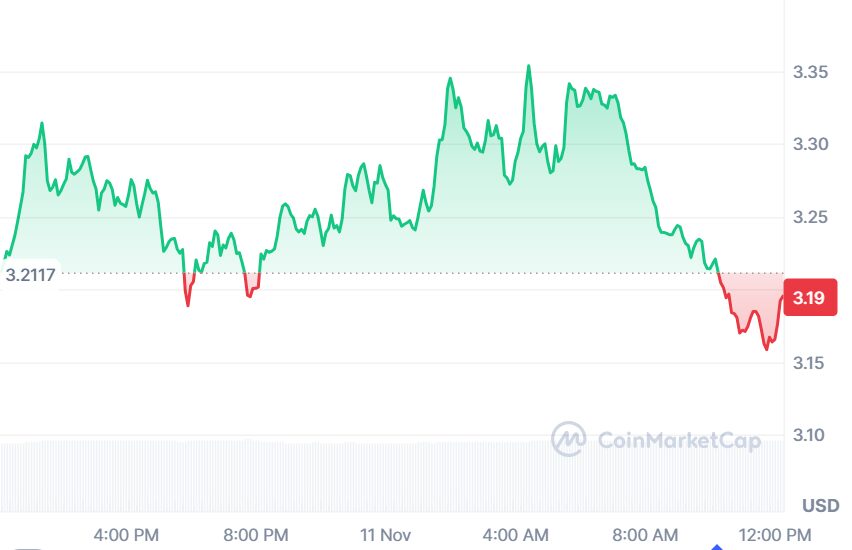

As of November 11, 2025, LUNA’s price held steady at $0.086, showing no change over the previous 24 hours. Over the last seven days, however, the token advanced by 6.05%, indicating a brief period of upward momentum. Despite this, LUNA has fallen 8.03% over the past month and has plummeted 79.29% over the last year, highlighting a persistent long-term downtrend. These numbers illustrate the prevailing market forces and investor attitudes impacting LUNA, even in light of its recent weekly improvement.

The 6.05% gain over the past week points to a short-lived positive shift in sentiment, which may be tied to broader market trends or traders reevaluating LUNA’s fundamentals. Nevertheless, this uptick comes amid a steep 79.29% drop over the past year, emphasizing the ongoing difficulties facing the token. Experts believe that ongoing market volatility and macroeconomic conditions will continue to shape LUNA’s path. While the recent weekly increase is encouraging, it does not compensate for the significant yearly losses, and the token will need to demonstrate more robust and sustained growth to reverse its fortunes.

Recent technical analysis of LUNA has centered on important price points and trading volume trends. Market participants have been closely watching the $0.10 resistance, a level that has historically served as both a psychological and tactical barrier. LUNA’s repeated failure to break through this threshold has sparked debate about the strength of buying interest and the possibility of continued downward pressure. Conversely, the 6.05% rise over the past week has led some to speculate whether the token is establishing a foundation for a potential trend reversal.

Backtest Hypothesis

A backtesting analysis was conducted to evaluate a trading strategy based on LUNA’s price action following significant upward moves. The review looked at LUNA’s performance after any single-day increase of 5% or more between January 1, 2022, and November 11, 2025, identifying 185 such instances. The median five-day return after these events was about +2.3%, notably better than the –0.3% benchmark. The most favorable risk-adjusted returns appeared around the sixth day, averaging +4.0%, with gains continuing to accumulate, though with less statistical significance over time. By the thirtieth day, the total return reached +14.6%. However, the win rate dropped from roughly 51% on the first day to about 38% by day 30, suggesting that while there were more significant winners, losses were more frequent as time progressed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest

Jack Dorsey backs diVine, a new version of Vine that features Vine’s original video library