Whale Makes $1.19M USDC Bet on UNI with Leverage

- Whale invests $1.19M USDC on UNI.

- 5x leverage trade opened on UNI.

- Liquidation risk at $7.40 for UNI.

Wallet 0xB29 made a notable move by depositing $1.19 million USDC into HyperLiquid, leveraging 5x to secure a long position on UNI. This action increased open interest on UNI, with a consequential liquidation price set at $7.40.

A cryptocurrency whale identified as wallet 0xB29 deposited $1.19 million USDC into HyperLiquid, leveraging the funds 5x to open a long position on UNI.

The transaction illustrates the potential for increased volatility in UNI markets, with notable risks if the price falls near the $7.40 liquidation point.

The whale wallet 0xB29 deposited $1.19 million USDC as margin into HyperLiquid , opening a leveraged long position with 5x leverage on UNI. This trade has a notional value of $4.47 million. The liquidation price is set at $7.40 for UNI, bringing market attention to potential cascading liquidation events. With a significant trade like this, UNI’s price can be impacted by increased open interest, magnifying volatility and liquidity shifts on exchanges.

The transaction has drawn attention from crypto analysts and experts, tracking any price fluctuations that could affect the broader DeFi market. If UNI approaches the liquidation price, it could trigger a chain reaction of liquidations, thus impacting market sentiment. Crypto community attention is focused on this whale activity, discussing potential risks and monitoring if the price nears $7.40. This follows similar past trading patterns with leveraged whale positions affecting market dynamics.

“Wallet 0xB29 deposited $1.19M USDC into HyperLiquid and opened a UNI long with 5x leverage, with the position valued at $4.47M and a liquidation price of $7.40.” – Onchain Lens, Data Analyst, OnchainLens source

Historical patterns suggest that such whale activity can lead to price volatility, affecting UNI and spreading effects to related markets. The implications include potential shifts in trading volume and liquidity on DeFi platforms. No official reactions from Uniswap or HyperLiquid teams have been recorded about this particular trade. Meanwhile, crypto analysts and whale watchers remain vigilant as similar whale trades have historically impacted token prices significantly. The activity is absent from regulator and institutional commentary, creating an uncertain outcome for market participants.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

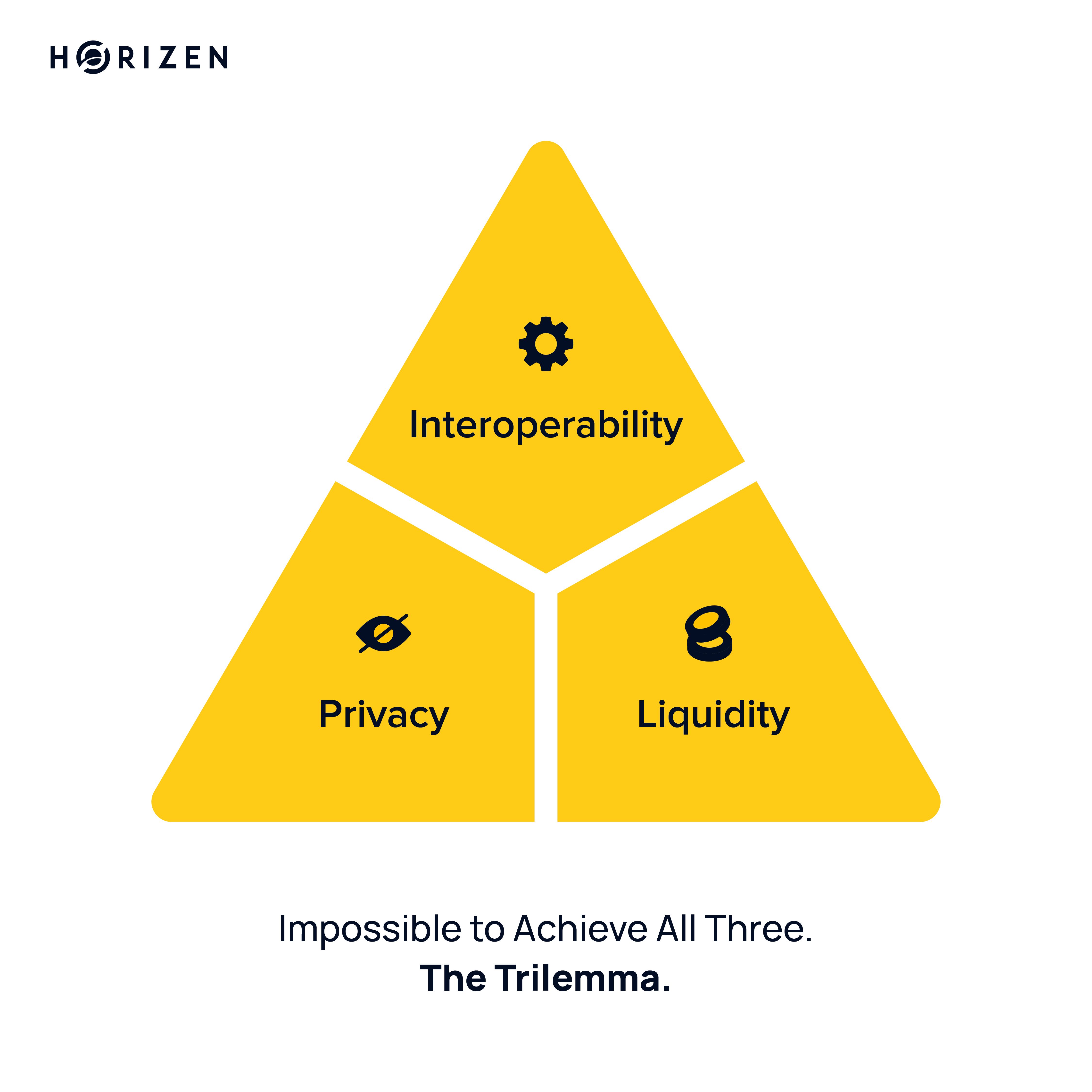

The Institutional Blockchain Trilemma

Visa Now Lets You Get Paid in Stablecoins

BNB News Today: BNB Surges Back to $1,000—Is This a Genuine Breakout or Just a Temporary Rally?

- Binance Coin (BNB) rebounds above $1,000 after hitting $900 lows, sparking debate over sustained recovery or bearish reversal. - BNB Chain upgrades security by migrating multi-signature wallets to Safe Global, aiming to boost user confidence and EVM compatibility. - Nano Labs repays bonds early to mitigate risk, reflecting institutional focus on liquidity amid crypto market volatility. - AI models predict $1,600 BNB by 2026 if on-chain activity and institutional demand persist, but key resistance at $1,1

Bipartisan Agreement Concludes 43-Day Government Shutdown, Delaying Healthcare Dispute

- U.S. House to vote on bipartisan deal ending 43-day government shutdown, with short-term funding extending through January 30. - Agreement includes three-year appropriations bills but fails to extend Affordable Care Act subsidies, sparking Democratic criticism over unmet healthcare demands. - Economic fallout includes 1.5% GDP growth drop, unpaid federal workers, and disrupted SNAP programs affecting 42 million Americans. - Market rebounded with Bitcoin surging past $106,000, but partisan tensions persis