Starknet Faces a Pivotal Moment: Will the Rally Continue or Will the Downtrend Resume?

- Starknet (STRK) broke a 623-day resistance, signaling a potential bullish reversal with RSI/MACD support. - Traders eye $0.350 as a key target, with a successful breakout confirming an upward trend or triggering bearish pressure. - Analysts highlight risks, noting a breakdown below $0.11 could reignite the downtrend toward $0.065.

Starknet (STRK) has captured the attention of investors after its price climbed above a significant descending wedge formation, fueling discussions about a possible bullish turnaround. The token, which had been trading within the $0.10 to $0.17 range for several months, recently surpassed a resistance trend line that had held for 623 days. Analysts interpret this breakout as a potential indicator of a new upward phase. Technical signals, such as bullish divergences in both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), have added to traders’ growing confidence

This breakout has placed

Experts have noted similarities to a typical five-wave decline that STRK completed since February 2024. Recent price developments point to either an A-B-C corrective move or the start of a fresh five-wave advance. In both cases, the $0.350 mark remains a key objective. Short-term traders are also watching the behavior of the fourth wave, with some projections suggesting a possible fifth-wave surge to the same resistance if STRK maintains crucial support levels

With STRK currently trading near $0.138, some analysts are targeting a short-term rise to $0.205, representing a 50% increase. Achieving this depends on the token staying above its 200-day exponential moving average (EMA) and maintaining strong trading volumes that signal active buying

However, caution is still warranted. The price structure remains delicate, and several analysts stress the importance of waiting for confirmation before entering long trades. For example, a drop below $0.11 could restart the downward trend toward $0.065, highlighting why traders should employ strict stop-loss measures

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

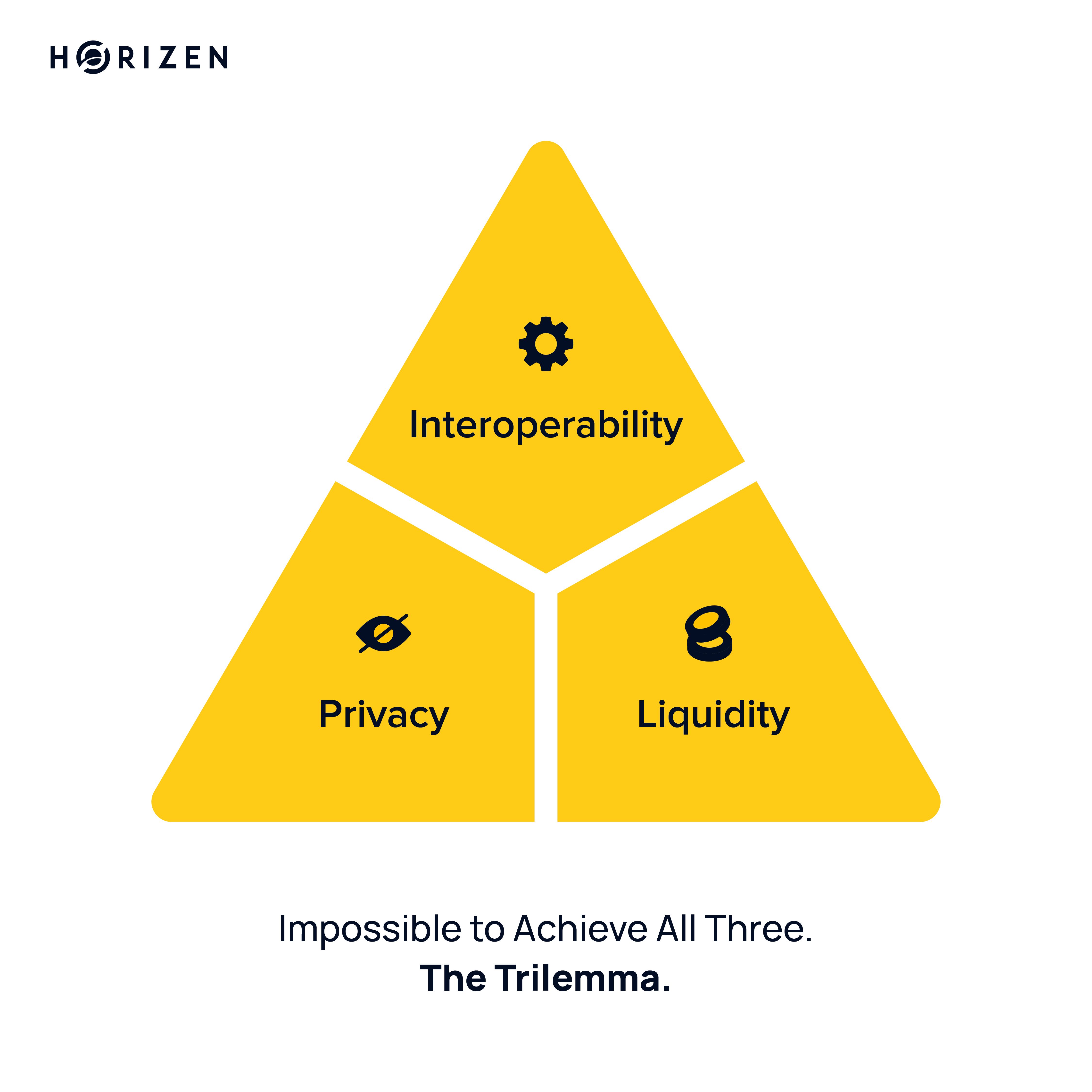

The Institutional Blockchain Trilemma

Visa Now Lets You Get Paid in Stablecoins

BNB News Today: BNB Surges Back to $1,000—Is This a Genuine Breakout or Just a Temporary Rally?

- Binance Coin (BNB) rebounds above $1,000 after hitting $900 lows, sparking debate over sustained recovery or bearish reversal. - BNB Chain upgrades security by migrating multi-signature wallets to Safe Global, aiming to boost user confidence and EVM compatibility. - Nano Labs repays bonds early to mitigate risk, reflecting institutional focus on liquidity amid crypto market volatility. - AI models predict $1,600 BNB by 2026 if on-chain activity and institutional demand persist, but key resistance at $1,1

Bipartisan Agreement Concludes 43-Day Government Shutdown, Delaying Healthcare Dispute

- U.S. House to vote on bipartisan deal ending 43-day government shutdown, with short-term funding extending through January 30. - Agreement includes three-year appropriations bills but fails to extend Affordable Care Act subsidies, sparking Democratic criticism over unmet healthcare demands. - Economic fallout includes 1.5% GDP growth drop, unpaid federal workers, and disrupted SNAP programs affecting 42 million Americans. - Market rebounded with Bitcoin surging past $106,000, but partisan tensions persis