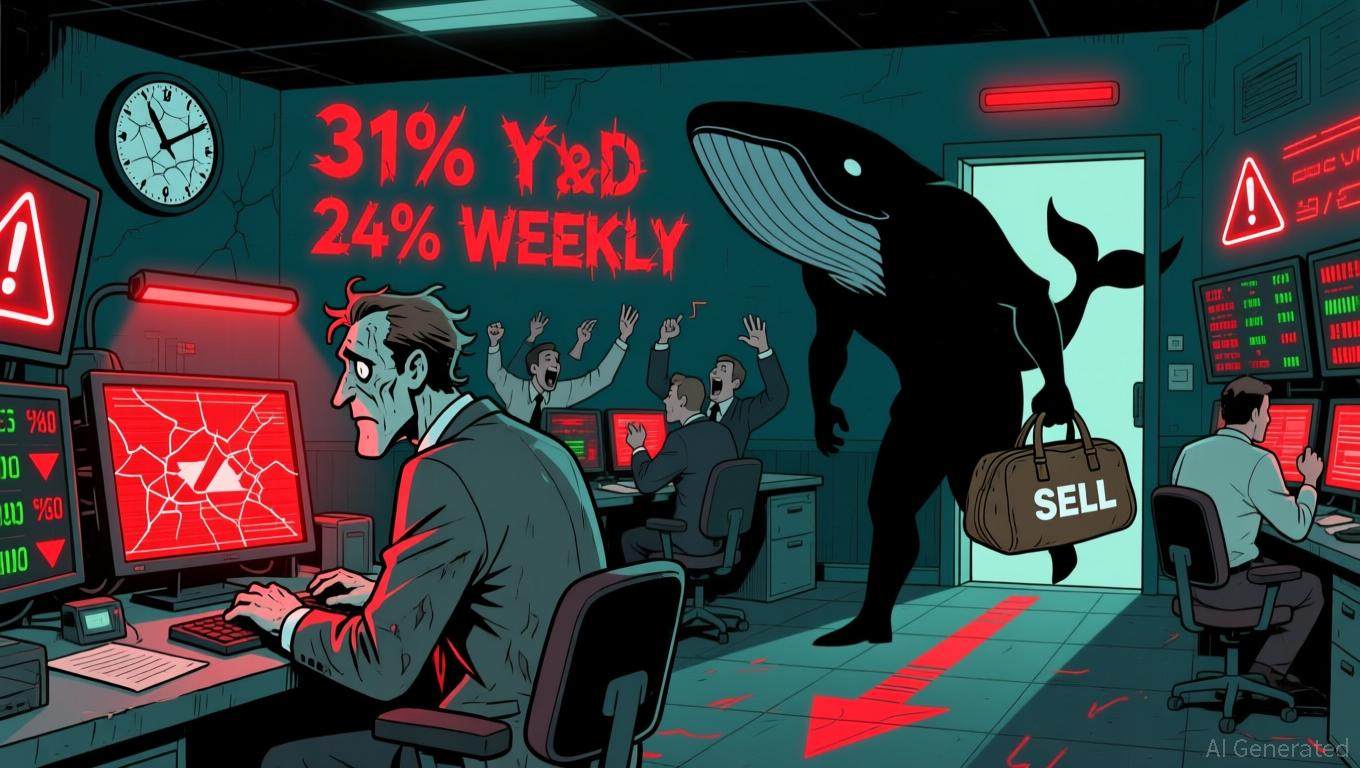

Whales Offload PEPE While Bulls Resist Decline, Forecasting Record High

- A major PEPE whale liquidated a $46M position this week, reflecting broader memecoin market weakness as prices fell 31% year-to-date. - Institutional holders offloaded 0.5% of PEPE holdings amid bearish technical indicators, while some long-term investors predict a new all-time high. - Cross-chain activity highlights volatile memecoin dynamics, with whales shifting focus to ASTER as Coinbase restructures in Texas over regulatory concerns. - Technical analysts warn of continued losses as PEPE forms a "bea

This week, a significant

This sell-off comes after a week marked by heavy whale selling, with large investors reducing their collective PEPE holdings by 0.5%. This mirrors a wider decline in the memecoin sector, as the CoinDesk Memecoin Index slid 23.4% over the same timeframe,

Market watchers are also monitoring regulatory shifts that could further sway sentiment. Coinbase, which received the PEPE whale’s final transfer, revealed plans to reincorporate in Texas, citing dissatisfaction with Delaware’s "unpredictable" corporate court system,

Technical experts caution that PEPE’s recent 5% daily drop and 24% weekly slide may signal additional declines ahead. According to CoinDesk Research, the token’s chart now displays a "bearish continuation pattern," putting critical support levels at risk,

This liquidation occurs against a backdrop of overall weakness in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK Faces Stablecoin Challenge: Balancing Innovation and Financial Security

- UK faces pressure to launch GBP stablecoin to compete globally, urged by ClearBank CEO Mark Fairless at Web Summit 2025. - BOE proposes 40% central bank deposit reserves for GBP stablecoins, with £20k/£10m user/business limits to mitigate systemic risks. - Critics argue 40% unremunerated reserves could stifle innovation, putting UK issuers at disadvantage compared to US/EU frameworks. - Regulatory balancing act emerges as UK aims to position itself as crypto innovation hub while maintaining financial sta

Morpho Surges to Record Profits but Faces a Sudden Downturn

In Brief Morpho ecosystem reached $370,000 in curator fees despite liquidity constraints. Steakhouse Financial led with $115,000 revenue, MEV Capital ranked third last week. MEV Capital experienced first recorded loss over $65,000 due to market changes.

Crypto and Technology Industries Undergo Transformation Amidst Evolving Laws, Regulations, and Leadership Changes Reshaping Industry Norms

- Coinbase faces legal and strategic challenges, including a $1B insider trading lawsuit and a Delaware-to-Texas "DExit" migration to reduce tax burdens. - Bermuda positions itself as a crypto regulatory leader by licensing DerivaDEX, a DAO-governed derivatives exchange with institutional-grade security and sub-5ms trade speeds. - C3.ai's founder-CEO Thomas Siebel resigns unexpectedly, creating leadership uncertainty and prompting speculation about a potential sale amid competitive AI market pressures. - T

Bitcoin Updates Today: Czech National Bank's Groundbreaking Crypto Experiment: Opening Doors to Token-Based Finance

- Czech National Bank invests $1M in crypto portfolio including Bitcoin for testing operational, regulatory impacts. - The pilot aims to explore blockchain's role in future finance without conflicting with ECB policies. - Global central banks increasingly experiment with digital assets, reflecting evolving monetary strategies.