Bitget Daily Digest (Nov 13)|SEC Proposes "Token Taxonomy"; US House Passes Bill to End Government Shutdown; Trump Signs Temporary Funding Bill at 10:45am (UTC+8)

Today's Outlook

- White House: October non-farm payroll and inflation data may never be released.

- Market sources: The US House of Representatives has cleared a key procedural hurdle, paving the way for a full House vote on the funding bill already passed by the Senate, to end the government shutdown.

- The Block: Active addresses on Solana have dropped to 3.3 million, a 12-month low, down sharply from the more than 9 million peak seen in January.

- SEC Chairman Paul Atkins announced at the Philadelphia Fed Fintech Conference that the SEC will launch a new regulatory framework called "Token Taxonomy," aiming to redefine when crypto assets are considered securities.

Macro Hot Topics

- Market sources: Japanese exchanges are exploring ways to curb listed companies from hoarding cryptocurrencies.

- US Treasury Secretary: By 2030, the stablecoin market could grow by 10x, from the current $30 billion to $300 billion.

- White House: Trump signed a temporary funding bill today at 10:45am (UTC+8).

- Market news: Amid Trump’s increasing criticism of the Fed and his own upcoming re-election vote, Fed hawk Raphael Bostic unexpectedly steps down.

Market Overview

- BTC down ~3.5%, ETH down ~5.2%—short-term panic in the market. About $532 million in liquidations over the past 24 hours, mostly from long positions.

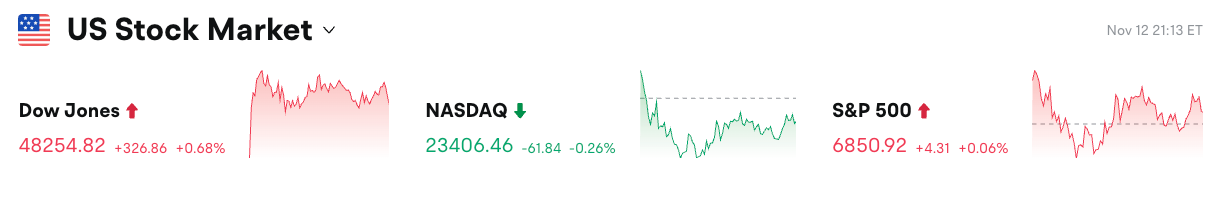

- US stock market closed mixed: Dow led with a gain of over 300 points while Nasdaq saw a slight pullback. Global risk appetite is weakening.

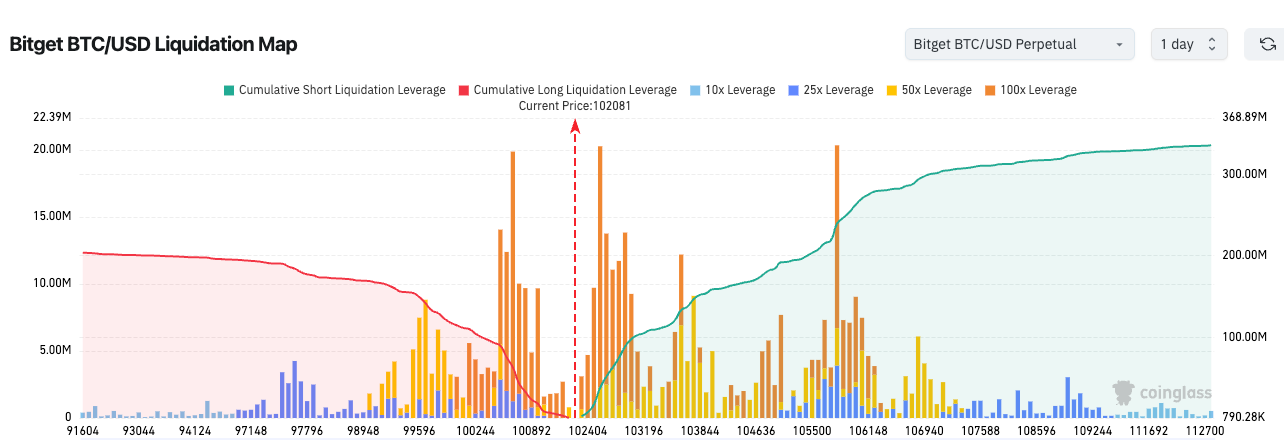

3.Bitget BTC/USDT liquidation heatmap shows current pressure concentrated below key long support levels, with wide distribution of short liquidations. Short-term volatility has increased; watch for support holding and rebound signals.

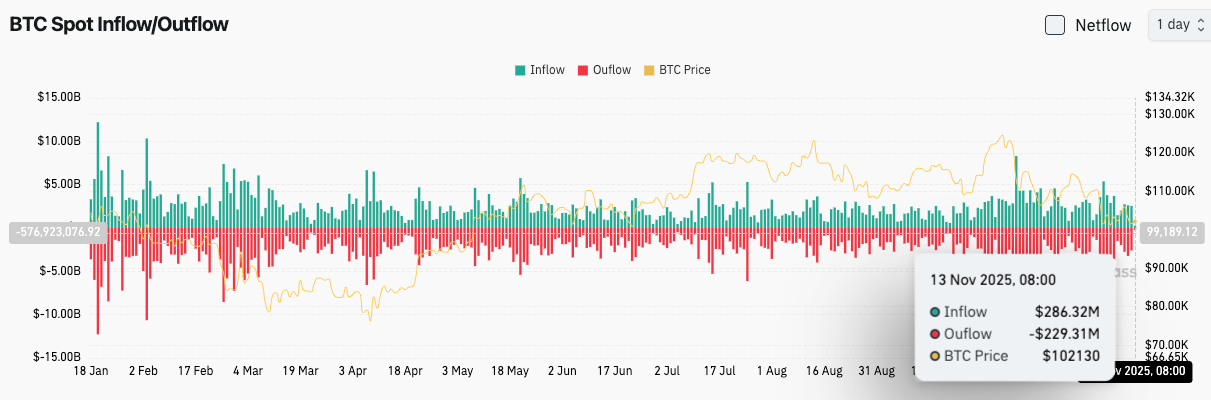

4.In the past 24 hours, BTC spot inflows totaled $2.86 billion, outflows $2.29 billion, with a net inflow of $570 million.

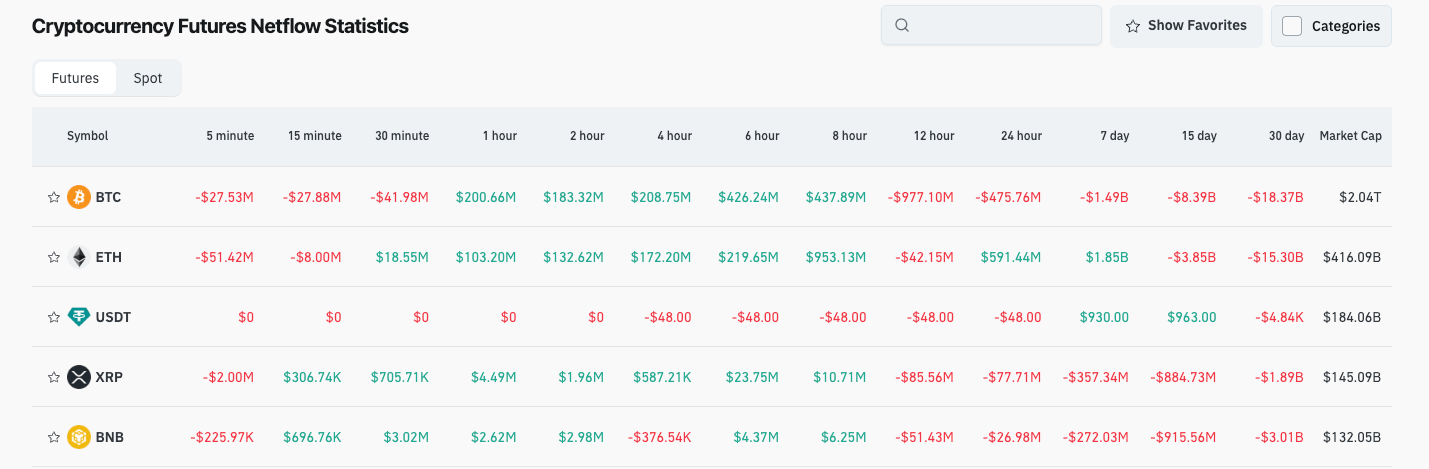

5.In the last 24 hours, contract trading in BTC, ETH, USDT, XRP, BNB, etc. saw net outflows, indicating potential trading opportunities.

News Highlights

- The US SEC is set to release a digital asset categorization framework, clarifying the distinction between securities and commodities.

- Analyst: The number of crypto projects with market caps over $100 million has fallen from 477 in Nov 2021 to 388 currently.

- SoFi Technologies launched an integrated crypto trading platform, becoming the first US bank to operate both retail crypto and traditional business.

- Ethereum Foundation: Account abstraction team and Vitalik jointly published the “Trustless Declaration” and put it on-chain.

Project Updates

- Ethereum co-founder Taylor Gerring’s affiliated address staked 7,455 ETH (~$25.35 million) early this morning.

- Sonic Network to undergo a mainnet upgrade, aiming to enhance infrastructure performance.

- SharpLink Q3 report: Total revenue up 1,100% YoY, with total crypto assets of around $3 billion.

- Since x402’s launch, its network facilitators have processed over 18.82 million transactions—a 35x increase since May.

- SoFi Technologies has integrated crypto trading services, broadening its digital banking business.

- FTX/Alameda redeemed 193,800 SOL from staking and distributed them to 28 addresses.

- Ethereum and Solana ETFs have received regulatory approval, enabling staking to enhance asset liquidity.

- Monad mainnet will launch officially on November 24, 2025, positioning itself as a high-performance Layer-1 blockchain solution.

- IRS has announced a safe harbor policy for crypto staking ETF trades, boosting project compliance.

- Beaconchain: Since July, the number of daily active validators on Ethereum has dropped by about 10%, hitting its lowest level since April 2024.

Disclaimer: This report is generated by AI, with human verification for information only. It does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum drops another 3% below $3,500 – Time for panic or opportunity?

Bitcoin’s second-largest whale accumulation fails to push BTC past $106K

Ethereum whale stacks $1.3B in ETH, fueling $4K recovery hopes

The US government restarts, $2.5 trillion in liquidity set to return: The silence in the crypto market is about to be broken