Japan Strengthens Cryptocurrency Regulations and Tests Stablecoins to Foster Innovation While Ensuring Investor Confidence

- Japan's FSA and JPX are strengthening crypto regulations to prevent risks from hoarding and insecure management, balancing innovation with investor protection. - The FSA's proposed pre-approval system for crypto providers aims to address vulnerabilities exposed by the $312M DMM Bitcoin hack linked to Tokyo firm Ginco. - JPX plans to restrict listed companies from accumulating digital assets, following global trends as Japan hosts 14 listed Bitcoin buyers—the most in Asia. - Parallel stablecoin pilots wit

Japan’s Financial Services Agency (FSA) and the Japan Exchange Group (JPX) are working together to tackle the dangers linked to excessive cryptocurrency accumulation and weak management systems, as authorities aim to encourage innovation while safeguarding investors. The FSA is moving forward with a system that requires advance notification from crypto asset management firms, and JPX is considering restrictions on listed companies amassing digital assets to avoid governance and market stability problems, according to a

The FSA’s plan would make it mandatory for businesses providing crypto management solutions to obtain approval in advance, addressing weaknesses revealed by incidents such as the DMM

At the same time, the FSA is running stablecoin trials with leading banks such as Mizuho, MUFG, and SMBC to

Meanwhile, JPX is weighing tighter regulations to curb the expansion of publicly traded digital-asset treasury companies (DATs), which have experienced steep value drops after initial growth, as highlighted in the

These regulatory actions come as stablecoins face increasing scrutiny worldwide. South Korea’s Financial Services Commission (FSC) has advised caution, pointing to risks such as capital outflows and challenges to monetary policy, while also recognizing the importance of keeping pace with developments in the U.S. and Japan, as reported in a

Industry specialists emphasize the need for proactive regulation. An unnamed FSA advisor remarked, “Strengthening pre-approval requirements is vital for protecting user assets and ensuring market stability,” as referenced in the

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Filecoin (FIL) to Bounce Back? This Emerging MA Fractal Setup Suggests So!

Finloop and 1exchange Unite to Build Regulated RWA Tokenization Network for Crypto-Linked Assets

Why is the Crypto Market Down Today Amid the End of the U.S. Government?

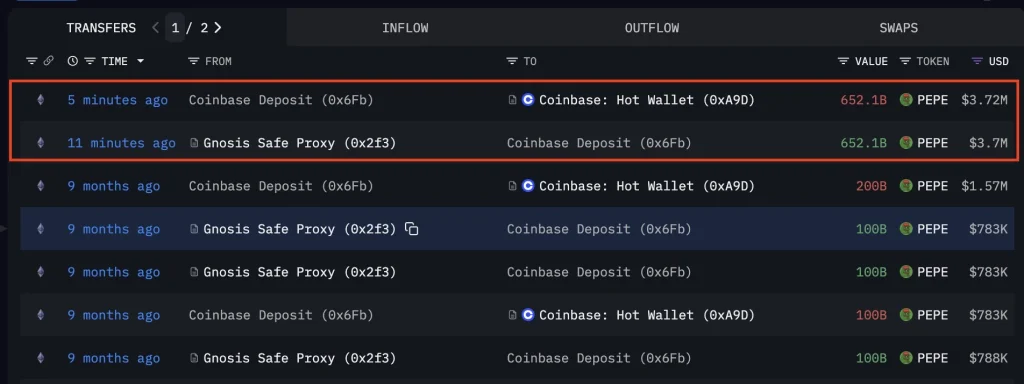

Pepe Price on the Cusp of Further Selloff as Top Whales Capitulate