XRP News Today: Memes and Markets Collide as First U.S. MOG ETF Application Fuels Speculation and Discussion

- Canary Capital filed first U.S. spot ETF for Mog Coin (MOG), a meme-based token, expanding crypto ETF options. - MOG's price rose 5.5% temporarily despite trading at fractions of a cent and an 80% annual decline. - The SEC's new generic ETF standards enabled niche token filings, with Canary's XRP ETF set for Nasdaq listing. - Critics warn memecoin ETFs prioritize speculation over utility, but $575M in altcoin ETF inflows show growing demand. - MOG ETF's 5% ETH allocation and cultural branding risks highl

Canary Capital has submitted an application for the inaugural U.S. spot exchange-traded fund (ETF) that tracks Mog Coin (MOG), a relatively obscure

The application highlights a growing pattern of asset managers submitting speculative crypto ETF requests to the U.S. Securities and Exchange Commission (SEC), especially for tokens whose primary value lies in cultural branding rather than blockchain utility, according to Cointelegraph.

Although MOG’s price increase was limited, it demonstrates the growing impact of ETFs on lesser-known cryptocurrencies. Following the news, the token’s market cap briefly reached $169.5 million, up from $140 million earlier that day, as reported by Cointelegraph. However, Canary’s prospectus cautions that MOG’s worth is mainly tied to its meme status and community-driven image, with no assurance that its popularity will last, as Cointelegraph notes. The ETF also plans to allocate up to 5% of its holdings to

The launch of the MOG ETF comes amid rising interest in altcoin ETFs. Bitwise and Grayscale’s

While some critics claim that memecoin ETFs are driven by speculative hype rather than lasting value, Canary’s approach reflects a demand among investors for access to trending digital assets. The SEC’s renewed review of crypto ETF applications, following the passage of a funding bill in the House, could speed up the approval process for these products, according to Cointelegraph. With the first MOG ETF possibly launching soon, this development marks a new stage in the evolution of the crypto market, where viral internet culture and institutional finance are becoming increasingly interconnected, as described in the Crypto.News article.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

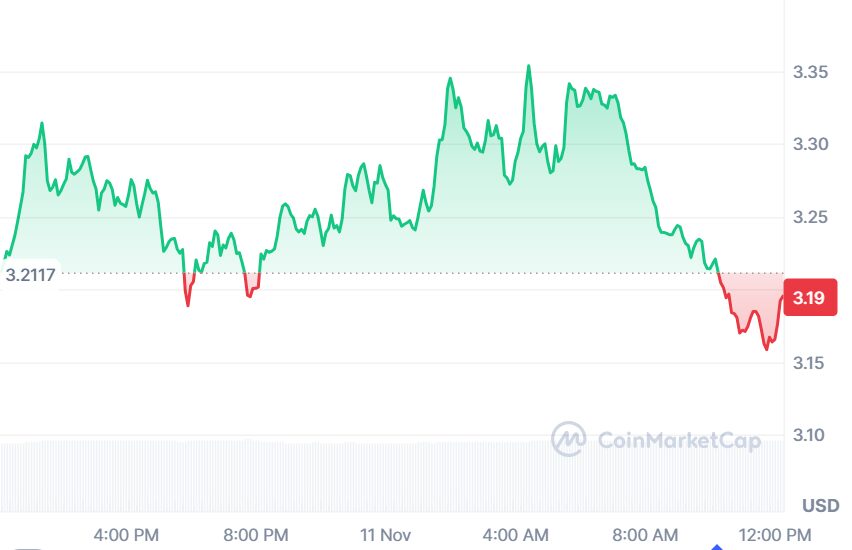

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest

Jack Dorsey backs diVine, a new version of Vine that features Vine’s original video library