Bitcoin Latest Updates: Major Investors Increase Their Holdings, Keeping Bitcoin Steady Over $105K Despite $1.7B ETF Withdrawals

- Bitcoin stabilizes above $105,000 amid a falling wedge pattern on 4-hour charts, with analysts eyeing a potential $120,000 breakout if key resistance is breached. - Whale activity (holders of >10,000 BTC) doubled holdings by 36,000 BTC, countering $1.7B ETF outflows and anchoring prices above $100,000 despite mid-sized investor exits. - Macroeconomic factors—including U.S. government shutdown resolution and Fed pause expectations—bolster risk-on sentiment, while Bitcoin’s decoupling from NASDAQ and M2 mo

Bitcoin has maintained its position above $105,000, with market watchers focusing on a descending wedge pattern on the 4-hour chart. If this pattern breaks upward, it could drive Bitcoin toward the $120,000 mark. The latest recovery comes after a late-October downturn, with solid support near $102,500 and the 50-day moving average providing an additional buffer around $103,000

The resolution of the U.S. government shutdown has further encouraged risk appetite, with Bitcoin climbing even as Treasury yields and the dollar both strengthened. Historically, Bitcoin has performed well during times of fiscal easing, and experts point out that the current environment—with persistent inflation expectations but reduced fiscal worries—resembles previous periods of strong rallies

On-chain metrics add to the positive outlook. The hash rate continues to rise, signaling strong network security and miner profitability, while exchange liquidity has improved as market makers return. The BTC/USD spread has tightened to $6–8 from $12–15 during the peak of shutdown-related volatility, and derivatives markets are showing lower funding rates, suggesting less speculative leverage—a healthy sign for price stability

Nevertheless, some risks persist. Should Bitcoin dip below $100,353—the 50% Fibonacci retracement—it could face renewed selling pressure. While the RSI and MACD currently indicate that bearish momentum is fading, a sustained recovery will require the RSI to move above the neutral 50 mark and further convergence of the MACD lines

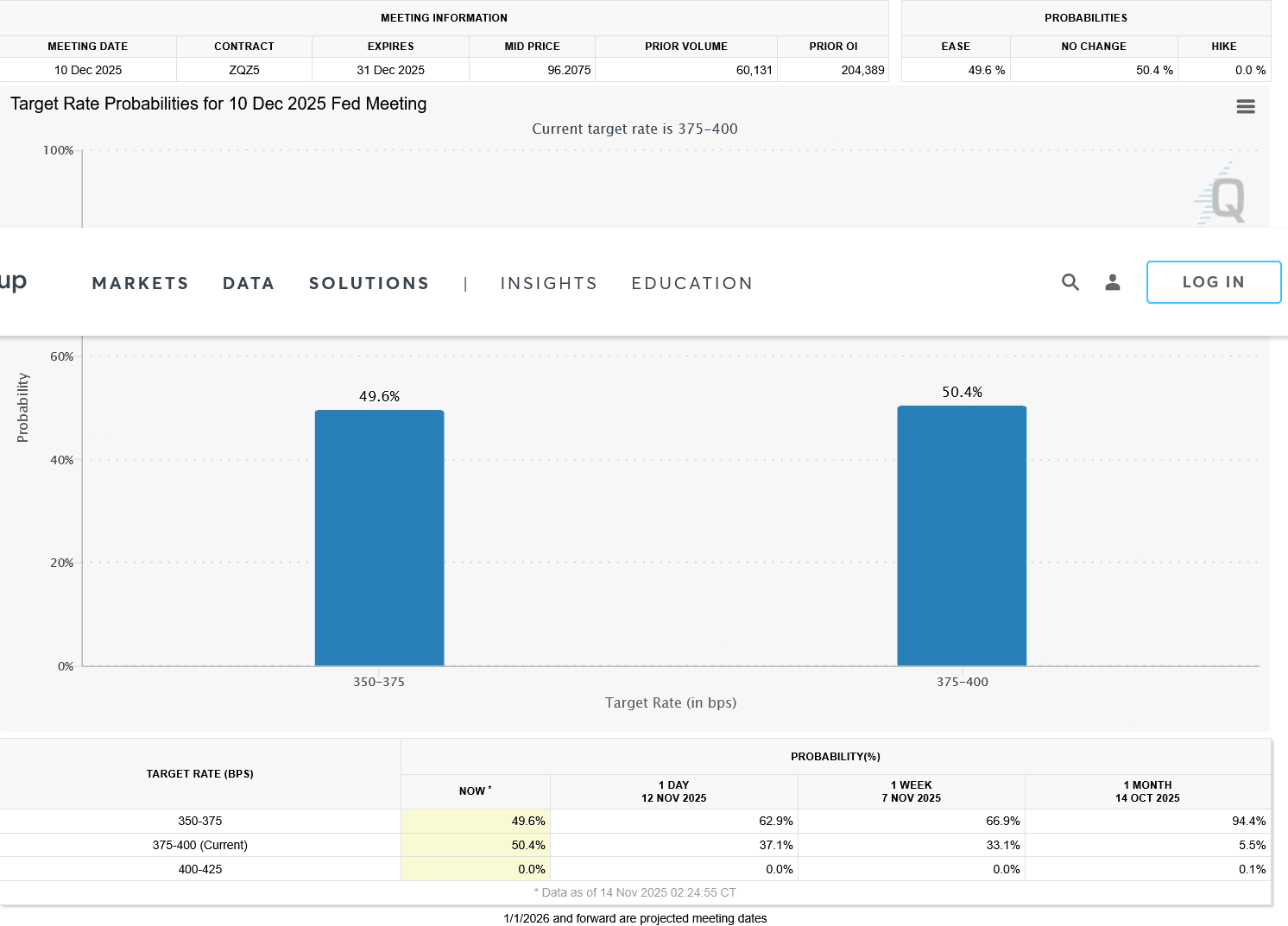

Wider macroeconomic factors are also favorable for Bitcoin's path. Stronger-than-expected employment or inflation figures could reinforce expectations that the Federal Reserve will hold rates steady through early 2026, indirectly supporting riskier assets. Additionally, Bitcoin's recent divergence from the global M2 money supply—a measure often linked to liquidity—suggests it is starting to lead macroeconomic cycles instead of just following them

As the crypto market prepares for possible volatility ahead of major economic reports, Bitcoin's technical positioning and supportive macro backdrop make a strong case for a breakout. With whales accumulating and institutional demand providing stability, the conditions are set for a challenge of key resistance levels in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

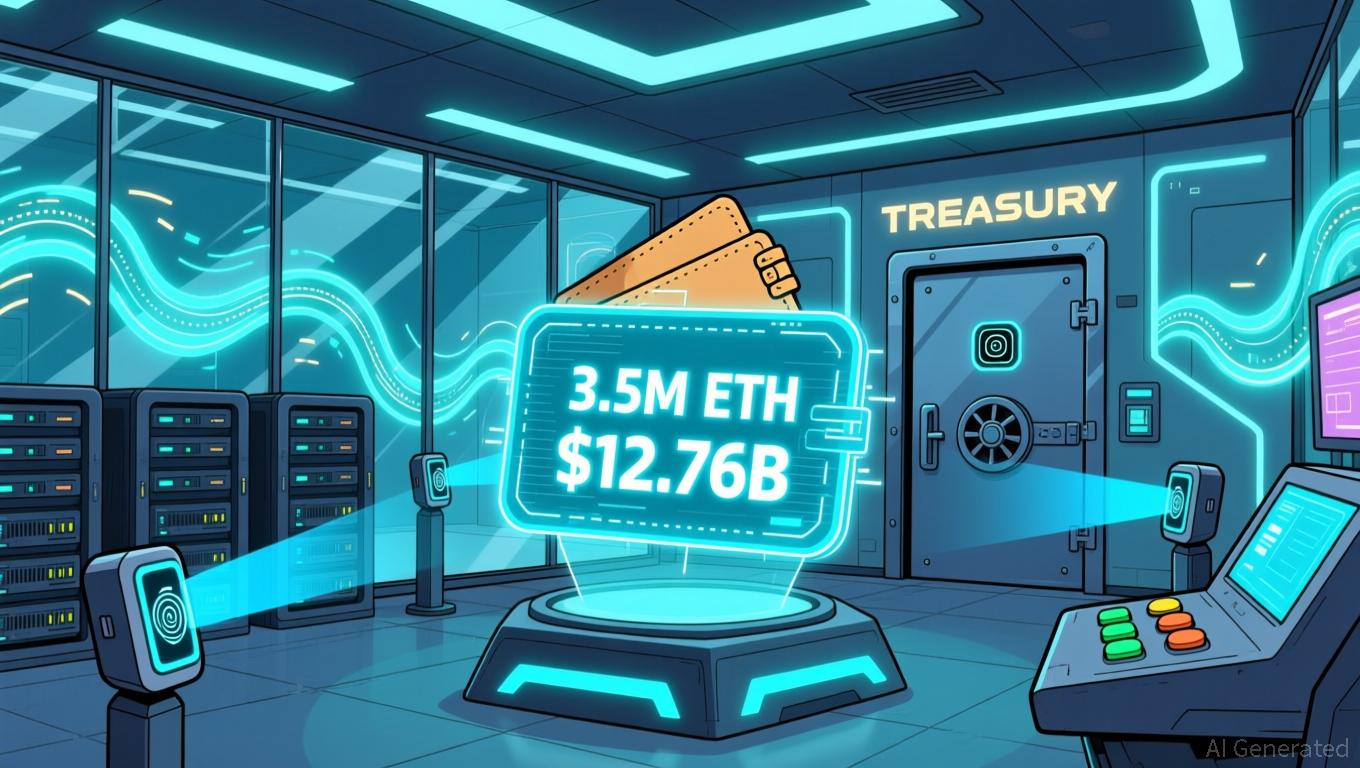

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio