Will Bitcoin rise or fall next year? Institutions and traders are fiercely debating

Bitcoin continues to decline, once again dropping below 100,000.

After experiencing the rapid plunge of "10.11" and being hit by the consecutive blows of the U.S. government shutdown in November, the crypto market has become rather jittery.

What’s even more anxiety-inducing is that traders and institutions are seriously divided on the market’s future direction. Galaxy Digital just slashed its year-end target price from $185,000 to $120,000, but JPMorgan insists: in the next 6-12 months, bitcoin could reach $170,000.

Ultimately, the biggest factor affecting the crypto market’s rise and fall right now is liquidity. When U.S. dollar liquidity is abundant, funds flow into risk assets and bitcoin rises; when liquidity tightens, funds flow back to treasuries and cash, and bitcoin falls. This time, the U.S. government shutdown set a historic record, causing the Treasury General Account balance to approach $1 trillion, completely locking up liquidity and affecting almost all global financial markets. Bitcoin is, of course, no exception. This also shows that, in fact, political factors largely influence liquidity.

On November 4, the Democratic Party won big in local elections. What does this mean for the 2026 midterm elections? Will the Federal Reserve cut rates in December? Every move from the White House lately is worth careful analysis. Each event is changing expectations for liquidity.

So, as 2025 comes to an end and 2026 approaches, where will bitcoin go? Who is right, the bulls or the bears? BlockBeats has compiled the arguments from both sides.

What do the bears say?

Before analyzing the possibility of a rise, let’s first hear what the bears have to say.

Democrats strike back, Trump is anxious

“The Democratic Party’s recent wins in several state elections are the reason for the crypto market’s decline in recent weeks. The Democratic Party is very unfavorable to cryptocurrencies and capitalism,” says analyst borovik.eth—a view not without basis.

After the presidential election and before the congressional midterms, the U.S. still has several important local governor elections. These local elections can be seen both as a vote of confidence in the Republican Party by the American public and as a prelude to the midterms.

Recently, the Republican Party suffered three consecutive defeats in state-level elections, with the Democratic Party winning across the board:

1. Virginia Governor Election: Democratic candidate Abigail Spanberger won by a huge margin of 15 percentage points, becoming the state’s first female governor. The Democrats not only took the governor’s seat but also reclaimed three key positions: lieutenant governor, attorney general, and flipped at least 13 seats in the House of Delegates.

2. New Jersey Governor Election: Democratic candidate Mikie Sherrill also became the state’s first female governor. New Jersey is a moderate voter stronghold, but this time the Democrats won by 13.8 percentage points, the largest victory since 2005.

3. California passed a redistricting vote: This could add 5 House seats for the Democrats and redraw 3 districts. Next, Governor Newsom and others will become Trump and the Republican Party’s toughest opponents.

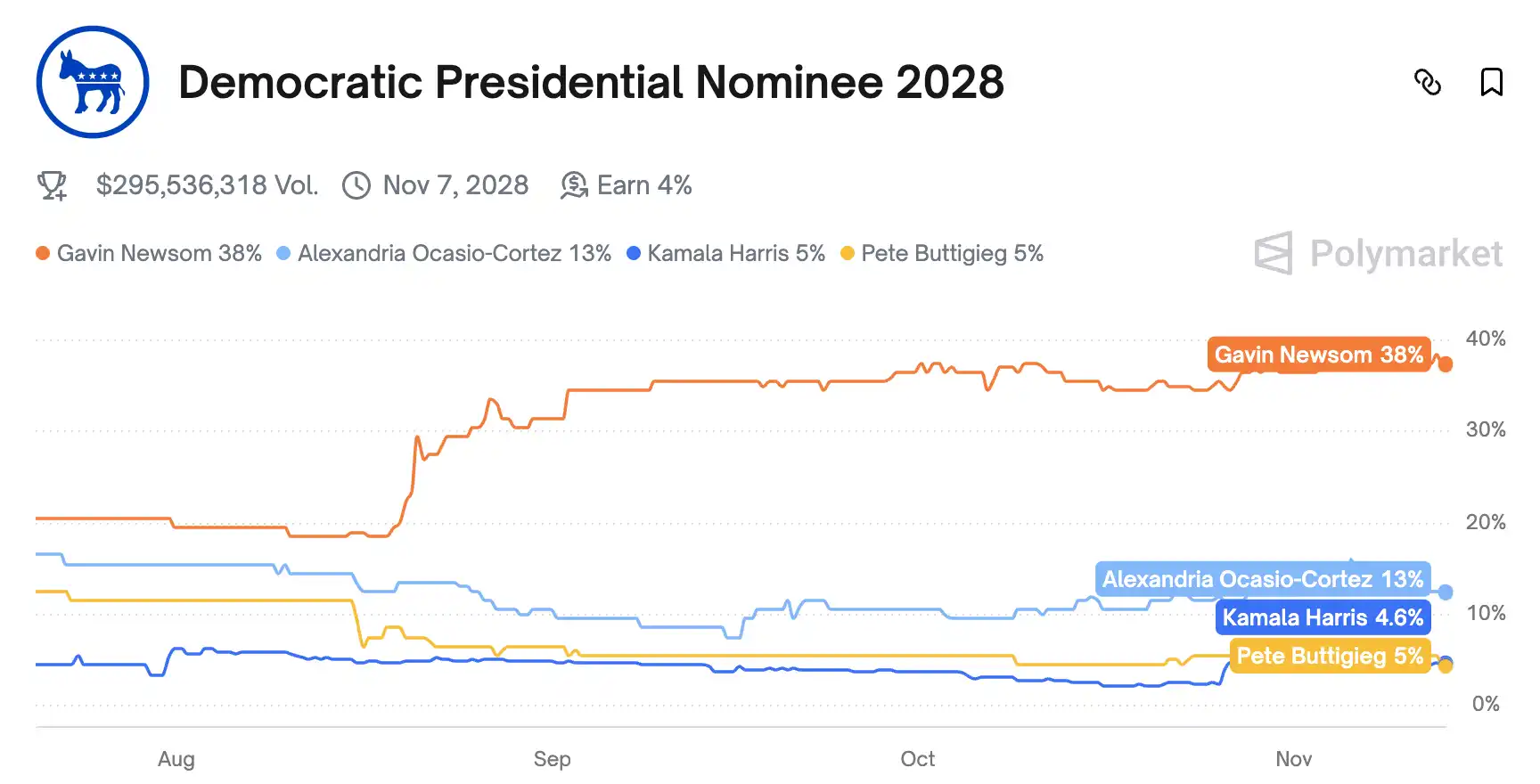

Newsom has consistently held the top spot for the 2028 Democratic presidential nomination on Polymarket

4. New York City Mayor Election: 34-year-old Democratic candidate Zohran Mamdani won easily, receiving over 1.03 million votes and a vote share of 52-55%. He became the first post-90s mayor, the first Muslim mayor, and the first Indian-American mayor in New York’s history.

More importantly, New York’s symbolic significance is extraordinary. Many votes for Mamdani came from young people who once supported Trump, and he is nicknamed the “leftist Trump.” In other words, in America’s largest city—Trump’s hometown—nearly 90% of young people have switched to the Democratic Party.

The timing of U.S. governor and mayoral elections is staggered to avoid the “down-ballot effect” of federal elections, allowing local voters to focus more on local issues. Most governors serve four-year terms, but election years vary by state; mayoral terms range from 2-4 years, with even more flexible election timing. But precisely because they are staggered, these local elections have become important indicators for federal elections and often predict national political trends. These governors and mayors are also key sources of future federal candidates.

For the 2026 midterm elections, the Democratic Party’s recent comprehensive victories in state elections provide strong momentum, and many foreign media and analysts believe this is a precursor to a “blue wave” similar to 2017. This also serves as a political warning for Trump: if he doesn’t act, he could repeat the scenario of losing local elections in 2017 during his first term and ultimately losing control of the House.

In U.S. politics, the first year of governance is often a honeymoon period, the second year is the “dislike” period, and the next two years are the lame-duck period. But Trump probably didn’t expect his honeymoon to be so short and his setbacks to come so quickly.

Even though he still controls both chambers, Trump can’t always do as he pleases. The recent U.S. government shutdown is a good example.

The core issue of this government shutdown is simple: the Senate needs 60 votes to reopen the government—this is a hard rule. Republicans want Democrats to vote, and the Democrats’ condition is to extend an expiring health insurance subsidy, but Trump disagrees.

Under Minority Leader Chuck Schumer, Democrats refused to vote 14 times, showing unity like a family.

In contrast, the Republican Party is full of infighting and division. Trump repeatedly demanded breaking the rules to eliminate the 60-vote threshold, but Senate Republican leaders refused, fearing that abolishing the filibuster would backfire if Democrats regained power. Reportedly, Trump was furious and lashed out at these Republican leaders.

The final result was that Republicans compromised, and Trump was forced to accept a package including Democratic priorities to reopen the government. This fully demonstrates that a united Democratic Party can block the Republican agenda, and Trump’s “dictatorial” control over both chambers is being eroded.

This shutdown set the longest record in U.S. history, with large numbers of civil servants left without pay and many poor people unable to receive subsidies. The resulting economic losses severely damaged the Republican Party’s image.

Americans’ dissatisfaction has reached a critical point. Livelihood issues are always the biggest politics.

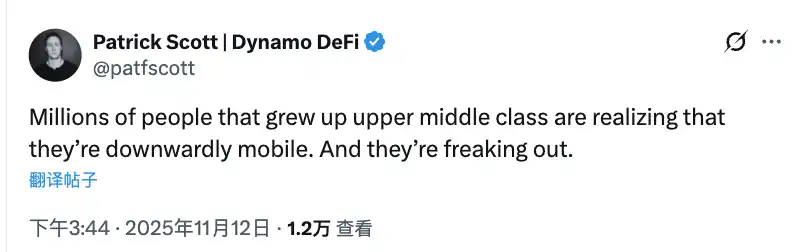

People are unhappy that living standards are actually declining, unhappy that crackdowns on illegal immigrants make everyone feel insecure, and unhappy that various divisions are making people anxious. Millions from the upper-middle class realize they are experiencing downward social mobility, and they are panicking because of it.

Millions from the upper-middle class realize they are experiencing downward social mobility, and they are panicking because of it

Food inflation is also key. What used to cost $100 now costs $250, and the quality is even worse. The egg price surge has just eased, but now Americans’ favorite beef is facing new inflation.

The latest Consumer Price Index (CPI) released on October 24 shows that the prices of roast beef and steak have risen year-on-year by 18.4% and 16.6%, respectively. According to the U.S. Department of Agriculture, the retail price of ground beef has soared to $6.1 per pound, a record high. Compared to three years ago, beef prices have risen by more than 50% cumulatively.

In addition, coffee prices are up 18.9%, natural gas prices up 11.7%, electricity up 5.1%, and car repair costs up 11.5%. Many young Americans burdened with college debt are feeling even more pressure as living costs continue to rise.

The 2026 U.S. midterm elections are scheduled for November 3. The Democratic Party’s recent big wins in the 2025 governor elections provide strong momentum for regaining control of the House. If next year’s midterms see both chambers controlled by the Democrats, Trump will undoubtedly be hamstrung for the next two years, becoming a complete lame duck.

For the crypto market, tighter regulation could mean that funds betting on Trump-friendly policies will have to reconsider, and the downward trend might not even wait for the midterms.

December rate cut is not a sure thing

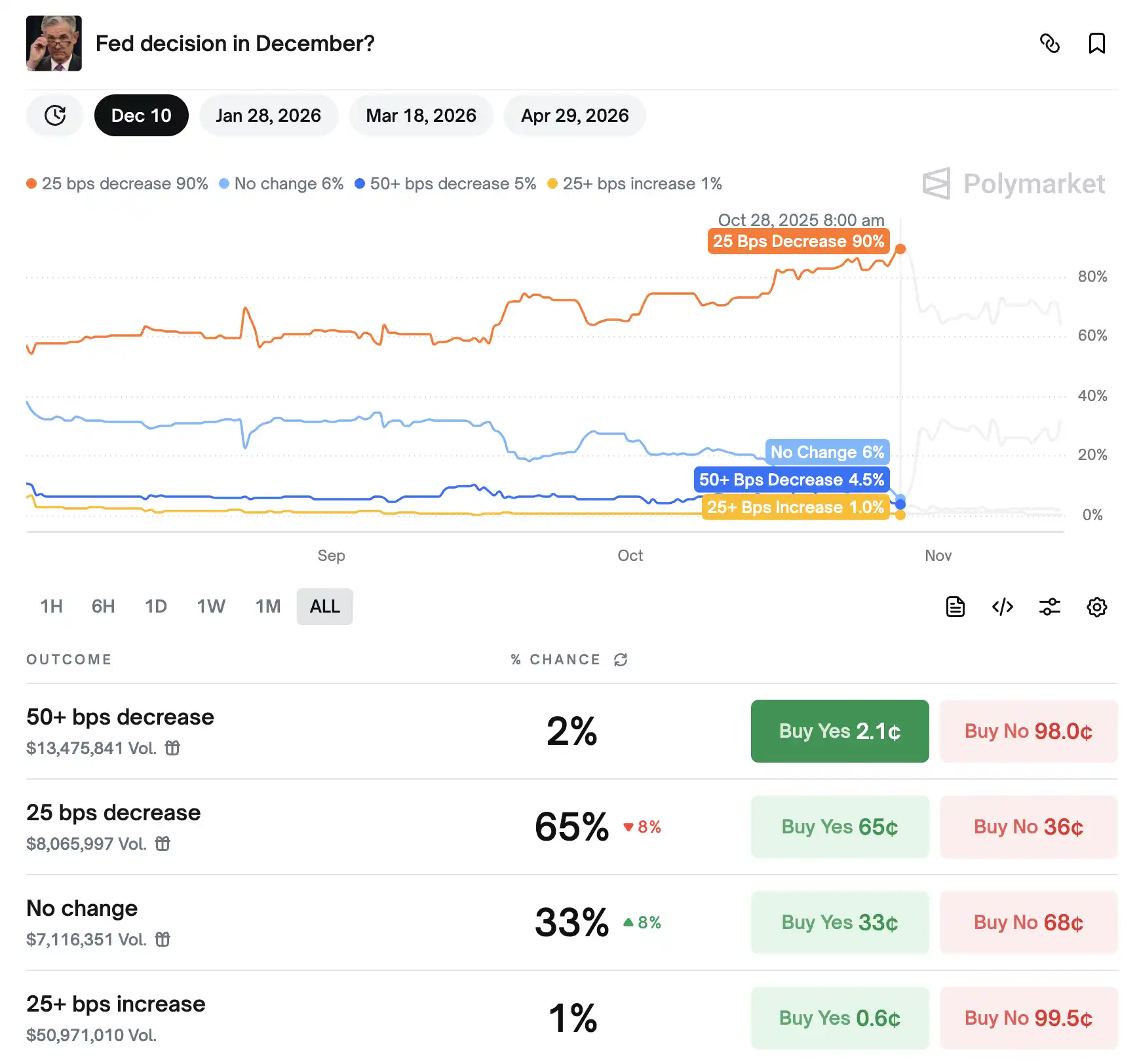

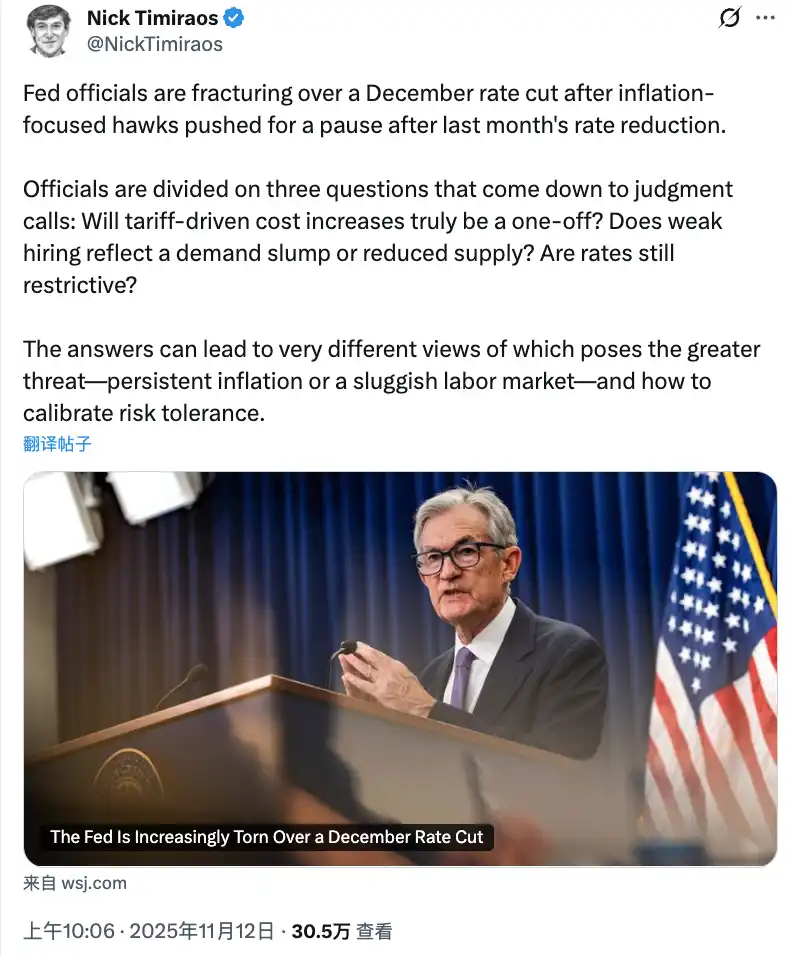

The probability of a rate cut at the December 10 Federal Reserve meeting, which was originally at 90%, has now dropped to 65% on Polymarket (51% at the time of writing).

“Fed whisperer” Nick Timiraos notes that four voting regional Fed presidents (Boston’s Collins, St. Louis’s Musalem, Chicago’s Goolsbee, and Kansas City’s Schmid, who voted against the October rate cut) are not actively pushing for another cut in December. Related reading: “Fed Whisperer Analysis: Why Has the Fed’s Rate Cut Path Suddenly Become Uncertain?”

Fed officials are increasingly divided over a December rate cut. Previously hawkish officials focused on inflation are now advocating a pause after last month’s cut, and there are three main points of contention:

First, is the cost increase caused by tariffs really just a one-off? Hawks worry that after absorbing the initial tariff costs, companies will pass more costs to consumers next year, pushing prices higher. Doves believe that companies’ reluctance to pass on more costs so far shows weak demand, insufficient to sustain inflation.

Second, is the slowdown in monthly nonfarm job growth due to weak labor demand or a reduced labor supply from fewer immigrants? If the former, maintaining high rates will cause a recession; if the latter, a rate cut could overstimulate demand.

Third, do rates still have a restrictive effect on the economy? Hawks argue that after this year’s 0.5 percentage point cut, rates are at or near neutral—neither stimulating nor restraining growth—so further cuts are risky. Doves believe rates are still restrictive and that cuts can support labor market recovery without reigniting inflation.

In August, Powell tried to calm the debate in his Jackson Hole speech, arguing that the impact of tariffs is temporary and that labor market weakness reflects weak demand, thus siding with the doves and supporting a rate cut. Data released weeks later confirmed his view: the economic slowdown had actually halted new job creation.

However, at the October 29 meeting, hawkish voices surged again.

Kansas City Fed President Jeff Schmid opposed the rate cut that month. Cleveland Fed President Beth Hammack and Dallas Fed President Lorie Logan, both non-voting members, also publicly opposed a cut.

At the post-meeting press conference, Powell bluntly stated that a December rate cut is not a foregone conclusion. Therefore, whether the Fed will cut rates again at the December 9-10 meeting remains uncertain.

More crucially, Fed Chair Powell’s term is also ending soon—his term ends on May 15, 2026. Most analysts believe Powell won’t risk appearing panicked and will choose to maintain the status quo.

The dual uncertainty of politics and monetary policy is also putting the crypto market through a stress test.

Well-known analyst Willy Woo has put forward a profound view: the two major cyclical forces that have driven bitcoin’s rise in the past are gradually disappearing, and in the future, what will truly determine the market will not be halving or liquidity, but the macroeconomy itself.

For more than a decade, bitcoin’s history has been almost entirely built on the “superimposed effect of two four-year cycles”: one is bitcoin’s own halving cycle, and the other is the global liquidity (M2) cycle. Whenever the narrative of supply contraction from halving coincides with liquidity expansion driven by central bank easing, a strong resonance is formed—this is the underlying driver of the last two bull markets. But now, as the cycles become misaligned, this resonance has disappeared, leaving only liquidity to play a role.

“The last two real economic recessions—the 2001 dot-com bubble burst and the 2008 financial crisis—both happened before bitcoin was born. In other words, we’ve never seen how bitcoin performs in a full-blown recession.”

Therefore, Willy Woo hints: the bull market era driven by dual-cycle resonance is over, bitcoin has lost its “natural accelerator,” and its upward momentum may be weaker and more dependent on the external environment. Bitcoin’s current trend may already be telling us “the top is in.”

Galaxy Digital has also recently lowered its bitcoin target price. They recently cut their year-end target from $185,000 to $120,000, citing large-scale selling by whales, capital rotation to gold and AI assets, and leveraged liquidations. Galaxy’s head of research, Alex Thorn, describes this period as the “mature era,” dominated by lower volatility and institutional absorption.

What do the bulls say?

Of course, not everyone is pessimistic.

U.S. government reopens and releases liquidity

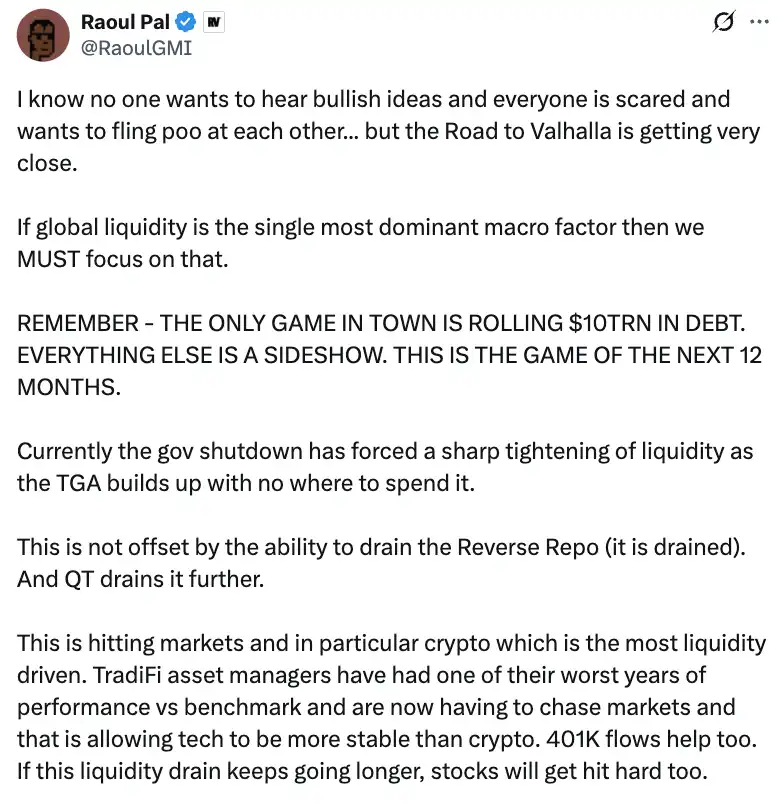

Real Vision CEO Raoul Pal is optimistic that the crypto market will soon recover from ongoing turmoil.

“The road to Valhalla is very close,” Pal says. In short, Pal believes the crypto industry will soon begin an uptrend after a series of market crashes.

Pal’s logic is as follows: the U.S. government shutdown did cause tight liquidity. Taxes are still flowing in, but spending is zero. The Treasury General Account (TGA) balance is approaching $1 trillion, which is the main reason for tight liquidity and bitcoin underperforming treasuries.

But this is precisely a signal of a turning point. Related reading: “The U.S. Government Is About to Reopen, Bitcoin Is Finally Going to Rise.”

In response, the Fed has been forced to restart overnight repo operations, planning to inject nearly $30 billion in liquidity into the market.

More crucially, in the next phase: once the government shutdown ends, the Treasury will begin spending $250-350 billion over the next few months.

When this happens, quantitative tightening ends and the balance sheet technically expands. This means the crypto sector will gain free-flowing liquidity.

Historical trends also support this judgment. When the Treasury replenishes reserves and liquidity becomes extremely tight, it often signals an imminent reversal. In other words, today’s pain is the darkness before dawn.

Raoul Pal also makes an important point: “The four-year cycle is now a five-year cycle... Bitcoin should peak in 2026, possibly in the second quarter.”

This directly addresses the bears’ concerns about the “disappearance of cycle resonance.”

Pal’s view is: the cycle hasn’t disappeared, it’s just lengthened. If the peak is in Q2 2026, then now is actually a good time to get on board.

Moreover, even if liquidity alone is at play, it’s enough to drive bitcoin higher—provided liquidity is indeed expanding. The government’s massive spending after reopening is the start of this expansion.

BitMEX co-founder Arthur Hayes echoes similar sentiments. He links bitcoin’s decline to an 8% drop in dollar liquidity since July, arguing that once the Treasury balance falls after the shutdown, dollar liquidity will rebound and push BTC higher.

In his latest Substack “Hallelujah,” Hayes provides a deeper analysis: The U.S. will issue about $2 trillion in new debt annually for the next few years and roll over old debt. As private sector and foreign central bank buying power declines, RV funds will increasingly rely on SRF financing. This will force the Fed to continually expand its balance sheet, resulting in a “stealth QE” effect. Ultimately, the dollar supply will keep expanding, which is the fuel for bitcoin price increases.

Therefore, Arthur believes the current crypto market weakness is only because liquidity is temporarily locked up by the Treasury—during the shutdown, the Treasury absorbed dollar liquidity by issuing debt but hasn’t released spending yet. When the government reopens, these funds will flow back into the market and liquidity will ease again. Meanwhile, the market may mistakenly think this is the top and sell bitcoin, but that would be a “major misjudgment.” The real bull market will reignite the moment “stealth QE” begins.

JPMorgan analysts are also still bullish on bitcoin, expecting that in the next 6 to 12 months, as futures market leverage resets, the price could climb to $170,000. This forecast is based on technical recovery.

The recent declines were largely due to leveraged liquidations. Once leverage resets and the drag from excessive leverage is gone, bitcoin will be easier to rise.

The rapidly advancing CLARITY Act

The second key reason for the bulls is that the regulatory environment is improving. At the core of this improvement is the CLARITY Act.

Real Vision CEO Raoul Pal repeatedly emphasizes that favorable crypto regulation will provide strong market support. His logic is simple: once the CLARITY Act passes, banks and brokers will get the regulatory green light to custody and trade spot crypto ETFs on a large scale.

The CLARITY Act passed the House on July 17 with bipartisan support—78 Democratic representatives voted in favor. This number is crucial, showing the bill isn’t just a Republican wish but has a cross-party foundation.

And two days ago, on November 10, the Senate Agriculture Committee released a bipartisan discussion draft. The timing is subtle—right after the government shutdown ended, marking the first major legislative progress.

The release came from the Senate Agriculture, Nutrition, and Forestry Committee, led by Chair John Boozman (Arkansas Republican) and senior member Cory Booker (New Jersey Democrat). Again, it’s bipartisan cooperation.

Market watchers expect the bill to pass by the end of Q4 2025. The White House’s goal is even clearer: complete legislation by the end of 2025.

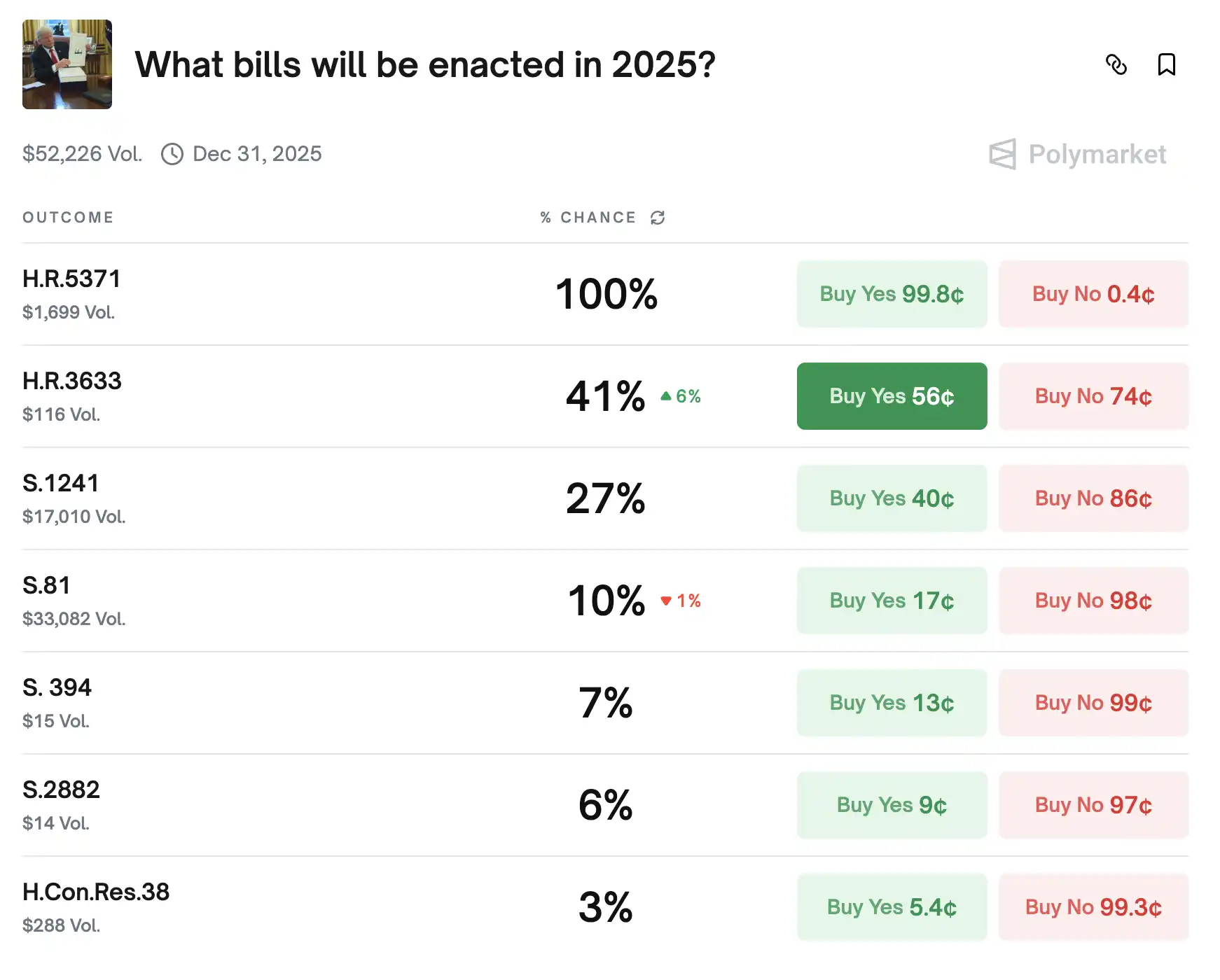

Currently, on Polymarket’s “Which bills will be enacted in 2025?” market, the probability of the CLARITY Act (H.R.3633) passing is 41%

It took only four months from July to November to move from the House to Senate discussion. This speed is rare in U.S. legislative history.

What exactly does this bill change? The core: it transfers primary regulatory authority over the spot digital commodity market to the CFTC, greatly reducing the SEC’s power.

Specifically: the CFTC gains exclusive jurisdiction over the spot digital commodity market, including major assets like bitcoin and ethereum. This means the CFTC can regulate digital commodity exchanges, brokers, dealers, and custodians, set anti-manipulation standards, system safeguards, and risk management requirements. Correspondingly, the SEC loses all but securities-related digital asset oversight. The previous uncertainty of “regulation by enforcement” will end completely.

The bill’s approach to stablecoins is even more ingenious. It creates a special status for “permitted payment stablecoins”: the CFTC’s regulatory scope will only cover the execution, solicitation, and acceptance of stablecoin transactions on registered platforms. It has no authority over stablecoin issuers’ operations, reserves, or issuance processes. This complements the GENIUS Act (focused on issuer licensing and reserves), avoiding regulatory conflict.

This design is clever. It separates the regulation of stablecoin trading from issuance, avoiding the awkward situation of one asset being overseen by two agencies. The market impact is direct: platforms must register with the CFTC to conduct spot stablecoin trading, but issuers retain autonomy and avoid overregulation.

This is a major positive for major stablecoins like Ripple’s RLUSD, Circle’s USDC, Tether’s USDT, and others.

Powell’s countdown

Powell, who doesn’t listen to Trump, is entering the final stretch of his term, which ends on May 15, 2026—just six months left.

In the coming months, the choice of the next Fed chair will become a market focus. The government has narrowed the list of candidates but hasn’t announced specifics.

Currently, the top candidate on Polymarket is Kevin Hassett, director of the White House National Economic Council and a close associate of President Trump. Due to his position, he analyzes economic data for Trump almost daily and is even called Trump’s “economics professor.” Their policy philosophies align, and he is a thorough dove, long advocating rate cuts to stimulate growth.

During Trump’s first term, Hassett repeatedly criticized Powell’s rate hikes, arguing that the Fed’s aggressive tightening would harm economic recovery.

This year, the Fed has faced unprecedented political pressure from the Trump administration for not cutting rates more aggressively. This pressure is shifting the internal power balance at the Fed, as seen in a recent example.

On November 13, according to “Fed whisperer” Nick Timiraos, Atlanta Fed President Raphael Bostic suddenly announced he would retire when his current five-year term ends in February next year. The timing is subtle, as a December rate cut is possible.

After all, Bostic is one of the Fed’s most hawkish members. His departure will weaken hawkish voices within the Fed during a politically sensitive period.

Futures market pricing shows that by the end of 2026, the Fed will cut rates at least four times, each by 25 basis points. If Hassett really becomes Fed chair and hawkish voices continue to fade, there’s no doubt that the pace and magnitude of rate cuts will exceed market expectations. Liquidity will be greatly released, and risk assets will see a strong rally.

This is a huge positive for the crypto market.

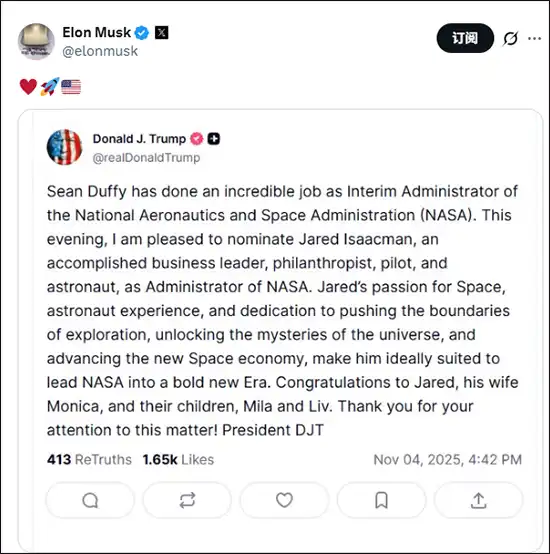

Another key political event is Trump mending ties with former allies. The signal: on November 4, Trump announced the re-nomination of Isaacman, a friend of Musk, as NASA administrator.

After the news was released, Isaacman’s friend, SpaceX CEO Elon Musk, quickly reposted it

Trump first nominated Isaacman as NASA administrator last December, but after a fierce argument with Musk over the “Beautiful Act” in May, he withdrew the nomination and appointed Transportation Secretary Sean Duffy as acting NASA administrator—a warning shot to Musk. The two then publicly feuded, staging a “breakup of the century.”

In August, a turning point appeared. According to The Wall Street Journal, while considering launching the “American Party,” Musk’s focus was on maintaining ties with Vice President Vance. Sources say Musk has kept in touch with Vance in recent weeks. He admitted to aides that if he continued with the party plan, it would harm his relationship with Vance. The report says Musk and his aides have told close associates that if Vance runs for president in 2028, Musk will consider using his vast wealth to support him—indeed, the optimal solution under rational thinking.

In September, media captured Trump and Musk together at Charlie Kirk’s memorial, shaking hands and talking, showing their relationship had warmed. Indeed, U.S. media report that as Musk’s ties with the Republican Party improve, Isaacman is gradually returning to the NASA administrator nomination discussion.

Trump and Musk have a long talk at Kirk’s memorial

The November 4 re-nomination is another sign of reconciliation, and the timing is subtle—right after the Democrats’ big local election wins.

The bears see Trump’s declining approval, Republican compromise, and a bleak outlook before 2026. The bulls see the Republicans consolidating, mending alliances, preparing to push key legislation by year-end, and continuing to target the 2026 midterms.

Uncertainty itself is the greatest certainty

How high will bitcoin go? Traders and analysts have given different answers, from $120,000 to $170,000.

After reviewing all the arguments from both sides, three points can be summarized.

First, short-term depends on liquidity, medium-term on regulation, long-term on cycles.

If we only look at the next few weeks, the government shutdown just ended + liquidity is still tight + political uncertainty is rising, which does create pressure. Galaxy’s $120,000 year-end target may be a relatively conservative but realistic expectation.

But if we look at the next six to twelve months, the combination of massive government spending + the CLARITY Act landing + liquidity release could push prices toward $170,000. JPMorgan’s view is reasonable.

As for Raoul Pal’s prediction of a peak in Q2 2026, that’s a longer-term cycle judgment. If the five-year cycle replaces the four-year cycle, now is actually a good time to position.

The key is to know which time frame you’re trading in. Short-term traders should focus on liquidity data and government spending progress, medium-term holders should watch the CLARITY Act and Fed leadership changes, and long-term investors should consider business cycles and bitcoin’s fundamental positioning.

Second, political risk is overestimated, but shouldn’t be ignored.

The Democratic Party’s local election victories do pose a threat to the 2026 midterms. But there’s still a full year until the midterms.

A lot can happen in a year in politics. Trump and Musk have reconciled, Republicans may push more favorable bills by year-end, and improved economic data could shift public opinion.

More importantly, even if Democrats retake Congress in 2026, if the key crypto regulatory framework is established in 2025, it’s unlikely to be overturned in the short term. The CLARITY Act passed the House with 78 Democratic votes, showing it has bipartisan support.

One feature of U.S. politics is that “big ships turn slowly.” Once a regulatory framework is established, even a change in party control is unlikely to reverse it quickly.

So, the logic chain of “Democratic victory spells doom for crypto” is overly simplistic. Political risk exists, but it’s not as fatal as the market imagines.

The real danger is political uncertainty itself. If the market doesn’t know who will win for a long time, funds will stay on the sidelines. This wait-and-see sentiment may hurt the market more than either side’s victory.

Third, the biggest risk is not politics, but economic recession.

The bears’ “business cycle” concern is actually the most important risk to watch.

If the U.S. economy really enters a recession, will bitcoin crash like tech stocks or become a safe haven like gold?

This question has no historical answer, because bitcoin has never experienced a full economic recession cycle. The 2001 dot-com bubble and 2008 financial crisis both happened before bitcoin was born.

Current data does show signs of economic slowdown: weak job growth, declining consumer spending, cautious business investment, and food inflation pressuring the middle class.

If these trends continue, 2026 could really face recession risk. At that point, liquidity release, friendly regulation, and Trump-Musk reconciliation may all fail. Bitcoin will face a real stress test.

This is why JPMorgan, despite its $170,000 target, emphasizes “the need for leverage reset”; why Raoul Pal, though bullish on 2026, admits “the market will be volatile before stealth QE begins.” They’re all waiting for a confirmation signal: can the economy achieve a soft landing?

When will the government reopen? When will the CLARITY Act pass? Will the Fed cut rates in December? What will be the outcome of the 2026 midterms? The answers to these questions will determine bitcoin’s short-term direction.

But the longer-term question is: how will bitcoin perform in the next recession? That answer may not be revealed until 2026. Until then, traders will keep debating, and the market will remain volatile. The only certainty is: uncertainty itself is still the greatest certainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polkadot native stablecoin pUSD is coming! Differences, risks, and unresolved questions compared to HOLLAR!

PBA & Hong Kong Cyberport jointly host a Polkadot offline event! See you in Hong Kong on October 13!