Bitcoin News Today: Bitcoin Faces $106K Challenge as Whales, Miners, and Broader Economic Factors Intersect

- Bitcoin nears critical descending channel, risking a sharp drop to $88,000 if $106,500 resistance fails, per analysts. - Mixed signals emerge: $1.15M ETF inflow and 23% trading volume surge hint at short-term stability, but macroeconomic headwinds and whale dumping persist. - Institutional adoption grows under Trump's policies, yet miners face existential threats as Bitfarms shifts to AI amid unprofitable operations. - Market bifurcation deepens: Wall Street thrives on digital assets while domestic minin

Bitcoin is currently navigating a critical juncture, with its price lingering near a significant downward channel that analysts warn could trigger a steep drop to $88,000. The cryptocurrency, now valued at approximately $105,000, is sending mixed signals: while institutional investments and technical metrics point to short-term steadiness, ongoing macroeconomic challenges and bearish moves by large holders cast uncertainty over its long-term prospects.

Latest figures indicate a modest $1.15 million inflow into U.S.-listed

From a technical standpoint, Bitcoin faces a crucial resistance at $106,500. To continue its upward move, the price must close above this level. Bitcoin has tested this resistance several times, currently hovering near the 38.2% Fibonacci retracement

Despite these challenges, some experts interpret the current pullback as a "mid-cycle consolidation" rather than the end of the 2025 bull run. Bitfinex researchers highlight that

Bearish forces remain in play. Blockchain data shows

The broader economic environment adds further uncertainty. Both Ted Pick of Morgan Stanley and David Solomon of Goldman Sachs have

Although Trump’s pro-Bitcoin initiatives—like the $17 billion Strategic Bitcoin Reserve and regulatory easing—have encouraged institutional participation, miners have not received similar support, exposing a policy gap

In summary, Bitcoin’s short-term outlook depends on its ability to surpass $106,500 and maintain institutional interest. If it fails, the price could revisit $88,000, with overall market sentiment and large-holder actions playing key roles.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

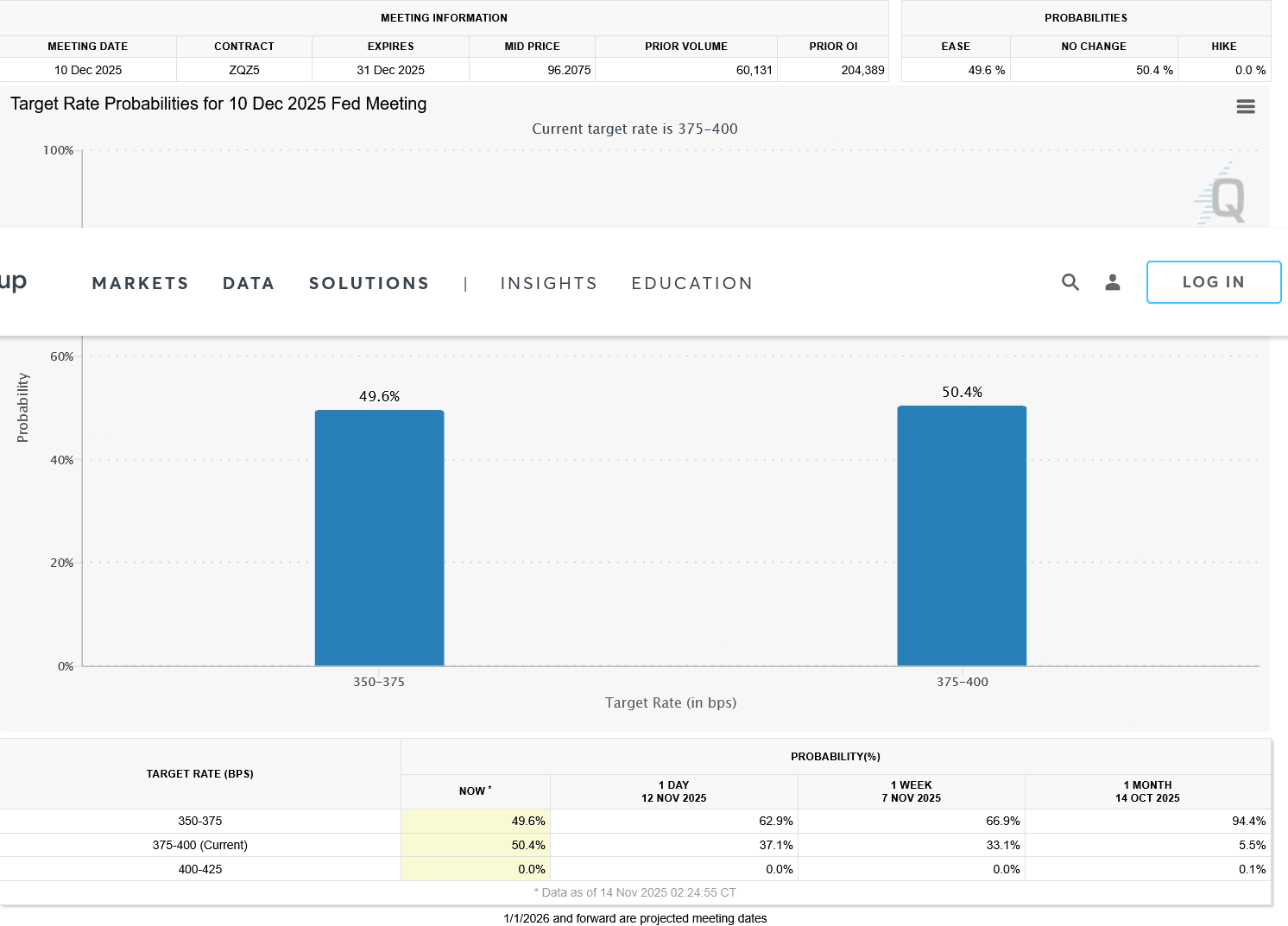

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Massive $869M Outflow Slams Bitcoin. Is a Crash Coming?

Ethereum Latest Updates: BitMine Commits $12 Billion to ETH—Chairman Predicts $12,000 Despite 13% Market Drop

- BitMine Immersion Technologies (BMNR) surged ETH purchases by 34% to 110,288 tokens weekly, now holding 3.5M ETH (2.9% supply) valued at $12.76B. - Leadership overhaul appoints Chi Tsang as CEO, aligning with chairman Tom Lee's "supercycle" vision and $12K ETH price target by 2025. - Market reacts mixed as ETH dips 13.4% in two weeks, with treasury buys currently underwater and regulatory shifts like CFTC oversight emerging. - Shareholders demand transparency amid unstaked ETH holdings and evolving crypt

Vitalik Buterin's Breakthrough in ZK Technology: Ushering in a New Age of Privacy and Blockchain Scalability

- Vitalik Buterin drives Ethereum's ZK innovations to solve scalability and privacy challenges, positioning ZK as crypto's next growth pillar. - Modexp precompile updates and GKR protocol reduce proof costs 50x-15x, enabling ZK-rollups to process 43,000 TPS with near-zero fees. - ZK integration with MPC/FHE/TEE expands use cases beyond DeFi, with ZK-FHE hybrids targeting enterprise adoption in healthcare and finance . - ZK Layer 2 market projected to grow at 60.7% CAGR to $90B by 2031, driven by institutio