Inflation and Employment: The Fed's Dilemma Over Interest Rate Reductions

- Fed officials split on rate cuts, with Schmid and Hammack prioritizing inflation control over labor-market easing. - Government shutdown delayed key economic data, raising uncertainty for policymakers like Goolsbee who demand clearer metrics. - Kashkari advocates a pause in cuts due to economic resilience, while Musalem warns against excessive accommodation. - Market expectations for December cuts dropped to 52% as inflation risks in core services intensify policy debates. - Analysts warn repeated shutdo

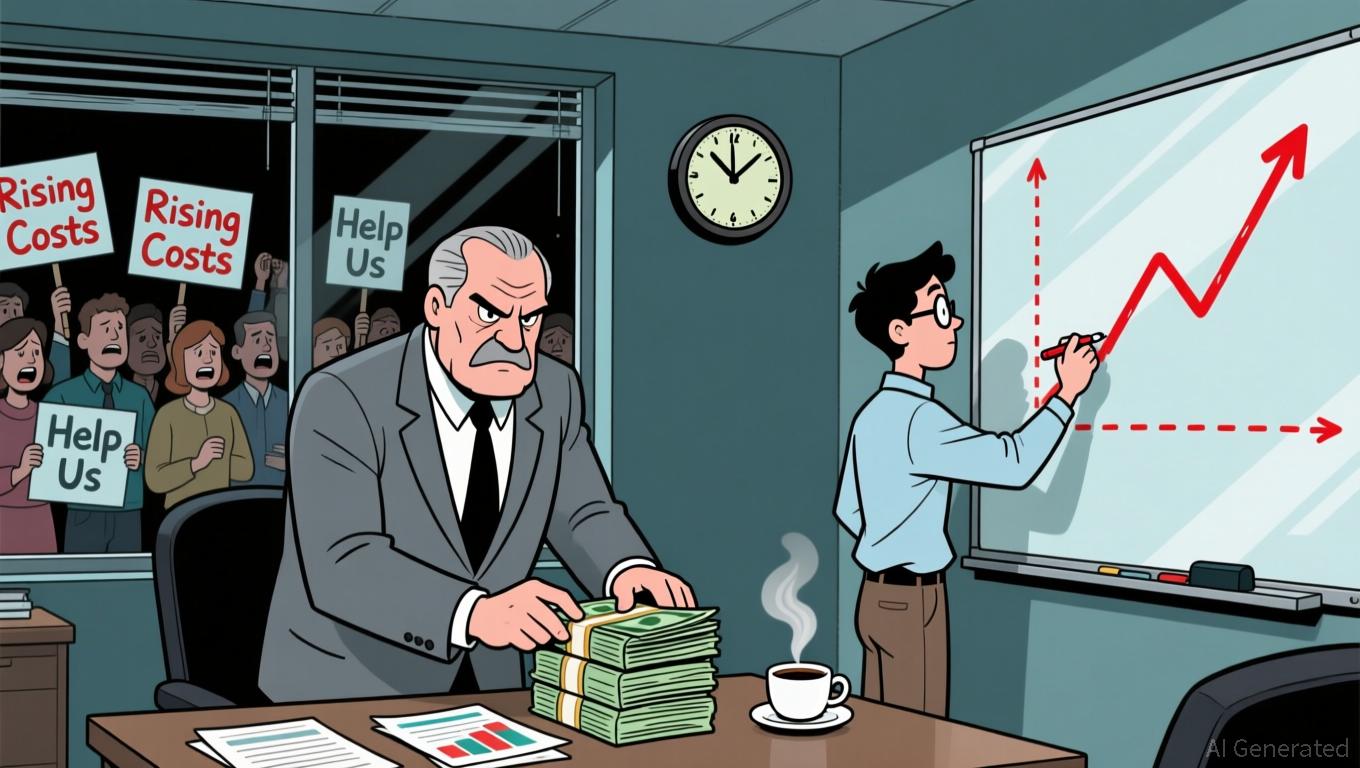

Debate within the Federal Reserve over whether to implement more rate cuts has grown more heated, as Kansas City Fed President Jeffrey Schmid cautioned that further reductions might jeopardize the progress made on curbing inflation. His recent comments have fueled a wider conversation among central bank officials about the potential dangers of loosening monetary policy prematurely. Schmid’s perspective highlights a deepening rift among policymakers, who are currently navigating mixed economic signals such as persistent inflation and emerging signs of a weakening job market

Schmid’s viewpoint is echoed by Cleveland Fed President Beth Hammack, who stressed that inflation is a “more urgent issue” than any softness in employment. Hammack insisted that policy must continue to “push back” against inflation, which she called “excessively high,” even as other officials, including Chicago Fed President Austan Goolsbee, voiced reservations due to the lack of fresh economic data during the latest government shutdown

The economic fallout from the government shutdown has further muddied the Fed’s outlook. Economists such as Jeffrey Campbell from Notre Dame University believe that reopening the government would quickly undo most of the negative effects, as furloughed employees return to work and SNAP payments resume. Still, Campbell warned that another shutdown before January 30 could destabilize the economy again, echoing analysts like Epstein, who described the current solution as merely a “temporary break” in a larger crisis

The ongoing discussion about rate reductions has also exposed differing opinions within the Fed. Minneapolis Fed President Neel Kashkari, who has not yet decided on the December meeting, argued that the economy’s recent strength—reflected in unexpectedly robust corporate earnings—supports holding off on additional rate cuts for now

The main issue now is whether the Fed will take action at its December meeting. Market sentiment has shifted, with the odds of a rate cut dropping from 94% in October to 52%

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRX News Today: Crypto's Rift: Solana's Reliability Compared to BullZilla's 100x Risk

- Crypto market shows divergence: Solana (SOL) leads DeFi with $5B+ DEX volumes, while BullZilla ($BZIL) emerges as a 100x presale contender. - TRX Gold Corp (TRX:CA) faces 22.86% monthly decline despite 69% 3-month gain, with analysts projecting 93.55% upside potential. - BNB and TRX show contrasting trends: BNB drops 2.63% amid liquidations, while TRX gains 0.90% with $760M trading volume. - BullZilla's $1M+ Stage 10 presale offers 1,986% potential return if listed at $0.00527, leveraging deflationary bu

SoftBank's Departure from Nvidia Fuels Discussion on AI Valuations During Volatile Market Changes

- SoftBank's exit from its Nvidia stake triggered a 1.1% premarket drop, sparking debates over AI valuation sustainability amid $4.85T market cap resilience. - BofA reaffirmed a "Buy" rating for Nvidia, citing 71.55% YoY revenue growth and $275 price target despite rising competition from custom AI chips. - Upcoming Q3 earnings ($54.8B forecast) face scrutiny over China market share losses and cloud spending cycles, with 64 "Strong Buy" ratings maintaining bullish sentiment. - Broader AI sector contends wi

2,800 Investors Left Reeling After Crypto CEO's $9.4 Million Ponzi Scheme Falls Apart

- Travis Ford , CEO of Wolf Capital, was sentenced to 5 years for a $9.4M crypto Ponzi scheme defrauding 2,800 investors. - Funds were misused for luxury purchases and gambling , with victims including retirees and young professionals. - The DOJ highlighted the case amid a global crypto fraud surge, including a $6B Chinese scheme and $1.5B ByBit theft. - Prosecutors condemned Ford's "market pressures" defense, as 2025 saw over $2.17B in U.S. crypto scam losses.

Baseball and Camels Unite Cultures in Middle Eastern Diplomatic Efforts