Analyst: No need to be overly concerned about the current market downturn, as it is more about profit-taking than panic selling.

BlockBeats News, November 14, Reuters market analyst Jeremy Boulton stated that forex traders may be considering whether the long-feared stock market correction has finally begun. However, the deeper the stock market falls, the higher the probability of a rate cut in December. Currently, the market is pricing in about a 52% chance that the Federal Reserve will cut rates by 25 basis points in December. This round of profit-taking is mainly due to investors' concerns that there will be no rate cut in December. But note the key point: this is profit-taking, not forced liquidation of loss-making positions.

Traders often re-establish profitable positions after an adjustment, and this correction is providing a more attractive entry level. If there are stimulus factors that lead to an earlier-than-expected rate cut, it will give traders a reason to act. (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US Dollar Index rose by 0.14% on the 14th.

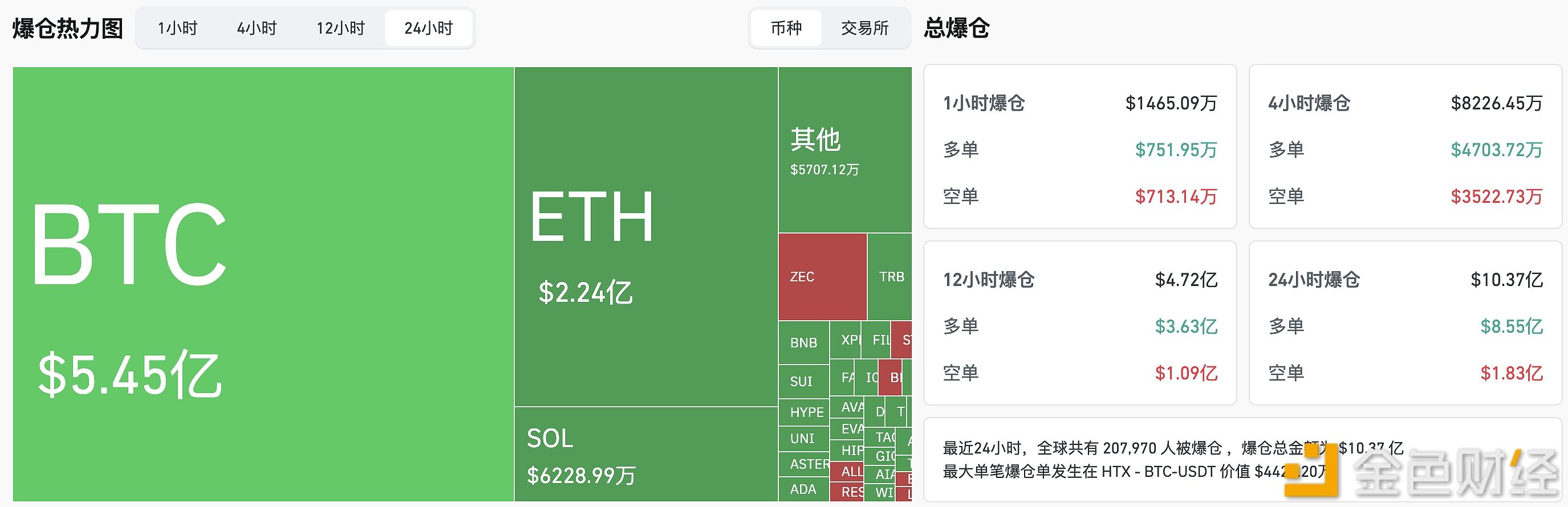

In the past 24 hours, liquidations across the entire network reached $1.037 billion.

Data: 100 WBTC transferred out from Galaxy Digital, worth approximately $9.51 million

Data: 1.927 million ENA flowed into a certain exchange's Prime, worth approximately $5.51 million