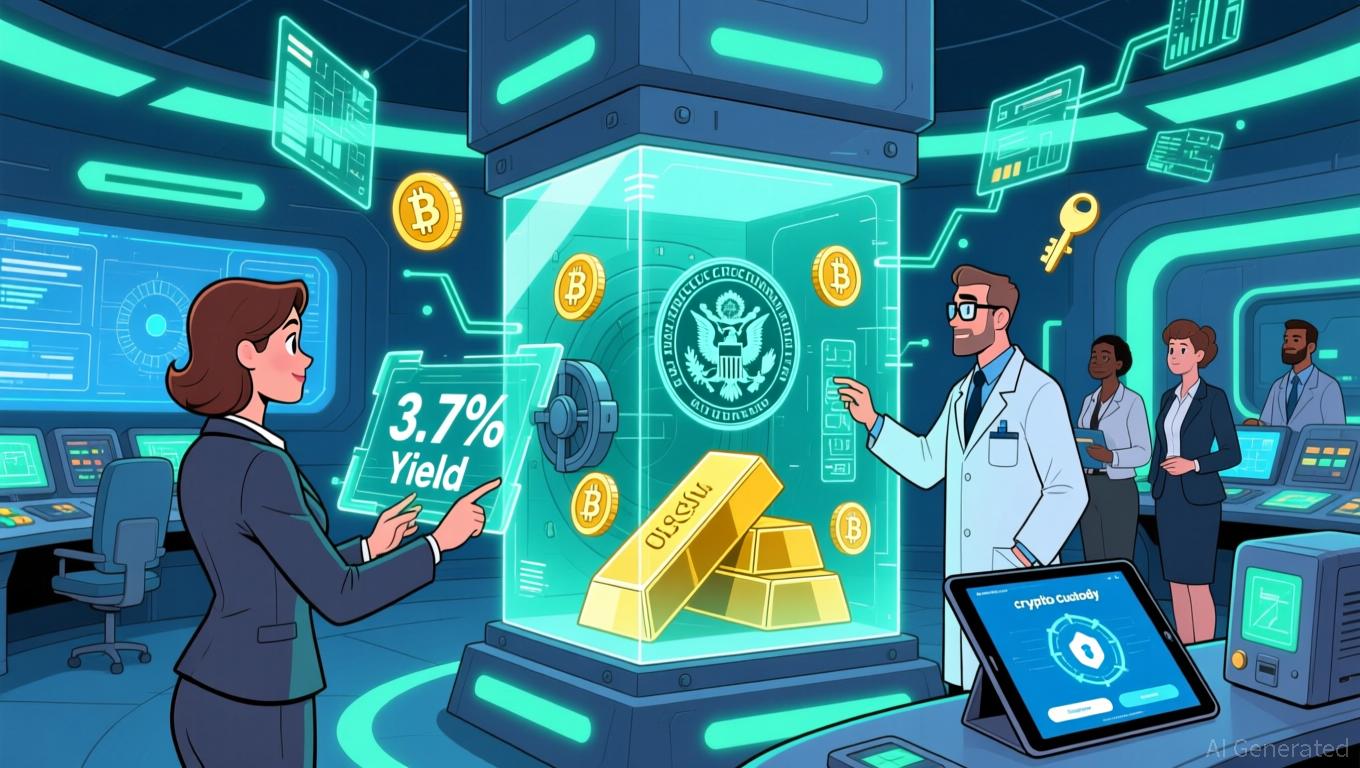

BNB News Update: BlackRock’s BUIDL Connects Conventional Finance with Blockchain Networks

- Binance partners with BlackRock to use BUIDL tokenized fund as institutional collateral via Securitize, bridging traditional finance and blockchain. - BUIDL ($2.5B AUM) offers 3.7% yield as compliant collateral, enhancing capital efficiency for institutional traders through Ceffu and triparty banking. - BUIDL expands to BNB Chain (via Wormhole) and multiple blockchains, accelerating real-world asset (RWA) adoption on public networks. - JPMorgan estimates $36B tokenized RWA market, with BUIDL redefining c

Binance, recognized as the leading cryptocurrency exchange by trading volume, has revealed that

The BUIDL fund,

This development mirrors larger trends in the RWA sector,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Progressive Shakeup in Seattle Indicates Nationwide Shift Driven by Calls for Greater Affordability

- Seattle progressive Katie Wilson defeated Mayor Bruce Harrell in a historic upset, reflecting national trends demanding affordability and systemic change. - Wilson's platform focused on capital gains taxes for housing funds and renter protections, contrasting Harrell's law-and-order approach amid rising costs and homelessness. - The win signals urban Democratic realignment, with progressive policies challenging traditional centrism as Trump-era policies galvanized left-leaning voters nationwide. - Harrel

Bitcoin Updates: Major Institutions Accumulate Bitcoin Amid Market Reaching "Extreme Fear" Levels

- Bitcoin's Fear & Greed Index plummeted to 15, signaling extreme fear as prices trigger panic-driven selling across crypto markets. - Institutional buyers like American Bitcoin Corp. added 3,000 BTC in Q3, boosting holdings to 3,418 BTC amid bearish conditions. - Analysts note historical correlations between extreme fear and market bottoms, though timing remains uncertain amid regulatory and macroeconomic challenges. - Market remains divided between retail panic and institutional buying, with some viewing

Ethereum Updates: Trust Through Verification—How ZKP Shapes a Trustless Future for Cryptocurrency

- Vitalik Buterin co-authored the Trustless Manifesto, redefining Ethereum's success by prioritizing "trust reduced per transaction" over transaction speed. - The manifesto challenges Ethereum's shift toward centralized models, emphasizing self-sovereignty and open protocols over convenience-driven UX. - ZKP blockchain embodies these principles through verifiability, using Zero-Knowledge Proofs to enable privacy and institutional-grade security without centralized control. - ZKP's code-first approach, incl

TRX News Today: Crypto's Rift: Solana's Reliability Compared to BullZilla's 100x Risk

- Crypto market shows divergence: Solana (SOL) leads DeFi with $5B+ DEX volumes, while BullZilla ($BZIL) emerges as a 100x presale contender. - TRX Gold Corp (TRX:CA) faces 22.86% monthly decline despite 69% 3-month gain, with analysts projecting 93.55% upside potential. - BNB and TRX show contrasting trends: BNB drops 2.63% amid liquidations, while TRX gains 0.90% with $760M trading volume. - BullZilla's $1M+ Stage 10 presale offers 1,986% potential return if listed at $0.00527, leveraging deflationary bu