Date: Fri, Nov 14, 2025 | 02:50 PM GMT

The cryptocurrency market continues to face heavy selling pressure as both Bitcoin (BTC) and Ethereum (ETH) plunged over 5% in the past 24 hours. The correction triggered more than $1.38 billion in liquidations across the market, with long positions taking the biggest hit — over $1.21 billion wiped out in a single day.

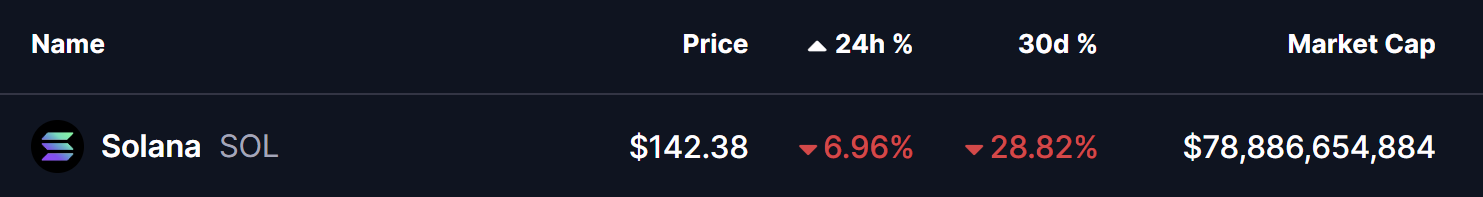

This intense volatility has weighed heavily on major altcoins , including the Layer-1 token Solana (SOL), which is down more than 6%. But beneath this dip, the chart reveals a technical structure that may be preparing SOL for a potential rebound in the coming sessions.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Pattern in Play

On the daily chart, SOL is currently trading inside a falling wedge — a well-known bullish pattern that typically forms when sellers begin to lose momentum and price compresses into a narrowing structure.

The recent sweep brought Solana down toward the wedge’s lower boundary around $135.76, a level that has acted as a firm reaction zone. From this point, SOL has managed to bounce, climbing back near $142.34, indicating that buyers are stepping in to defend this structure.

Solana (SOL) Daily Chart/Coinsprobe (Source: Tradingview)

Solana (SOL) Daily Chart/Coinsprobe (Source: Tradingview)

The chart also shows that every touch of the wedge’s lower boundary over the past several weeks has resulted in an immediate upward reaction. This type of price behavior often signals accumulation and seller exhaustion.

What’s Next for SOL?

If Solana continues to hold the support region and maintains strength along the wedge’s lower trendline, upward momentum may start building again. The next key zone to watch is the $156 region, which aligns with the wedge’s upper boundary and has historically acted as resistance.

A confirmed breakout above this level could shift momentum sharply in favor of the bulls, potentially opening the door for a move toward the $273 area — the next major resistance zone highlighted on the chart.

On the flip side, failure to defend the wedge support would be a warning sign. A breakdown could expose SOL to deeper downside pressure, dragging the price toward the $126 level, where the next meaningful support sits.