XRP News Today: Institutional Investors Embrace XRP ETFs to Connect Conventional Finance with the Crypto Sector

- Institutional investors are shifting to XRP ETFs as Bitwise predicts $100T in traditional capital could enter crypto via regulated products. - Canary Capital's XRPC ETF , approved for Nov 13, 2025 trading, marks first U.S. spot XRP ETF using auto-effective SEC registration. - ETFs simplify crypto access by eliminating custody/compliance challenges, attracting conservative investors with familiar investment structures. - XRP surged 9% post-DTCC listings but faces volatility, with analysts projecting $3 hi

The cryptocurrency landscape is experiencing a major transformation as institutional players increasingly focus on

Rising Institutional Interest in XRP ETFs

Traditional financial institutions are attracted to XRP ETFs because they offer a streamlined way to access digital assets. By providing a familiar investment vehicle, ETFs remove the hurdles of custody, regulatory compliance, and direct wallet oversight,

The scale of this opportunity is immense. The executive noted that more than $100 trillion in global assets are still locked within traditional finance, with only a small portion moving onto blockchain networks.

Regulatory

Recent regulatory moves have

The market has already reacted.

Looking Forward

Despite the positive outlook, obstacles remain.

At present, the foundation is laid. With the debut of the first XRP ETF and additional offerings on the way, XRP has firmly established itself within mainstream finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

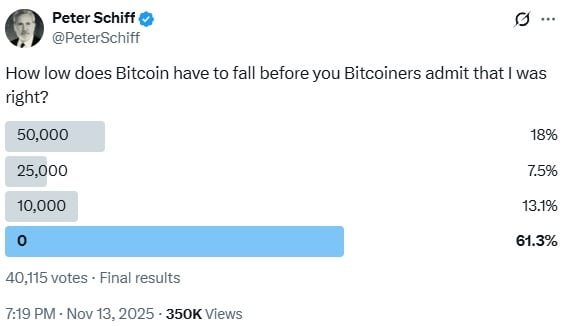

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.