Assessing the HYPE Token: Is a Meme-Based Cryptocurrency Capable of Maintaining Its Price Rally?

- HYPE token surged above $40 in 2025 despite crypto's bear market, driven by whale accumulation and $1.71B futures open interest. - Technical indicators show fading bearish pressure (RSI near 50) but highlight $44.48 resistance and $36.51 support levels. - Meme-inspired HYPE faces credibility challenges compared to transparent platforms like Jump.meme, with unclear utility beyond governance. - Market volatility and regulatory risks persist, contrasting with SOL ETF inflows yet mirroring Monad's failed tok

The Technical Perspective on HYPE

Hyperliquid’s tokenomics are designed to encourage user engagement. With a maximum supply of one billion tokens,

This technical optimism is set against the backdrop of wider market forces. For example,

The

Meme

Token Dilemma: Hype Versus Substance

Tokens inspired by memes like HYPE often rely on community-driven stories, but their legitimacy depends on moving beyond viral trends. Jump.meme, a cross-chain MemeFi platform,

The story of Monad’s token sale serves as a warning. Despite raising $43 million in just 23 minutes,

Investor Sentiment: Divided Views

Retail investors have shown mixed feelings toward HYPE. In October 2025,

At the same time,

Conclusion: Exercise Prudence

While HYPE’s technical signals and Hyperliquid’s open ecosystem provide reasons for short-term confidence, the token’s meme origins and the uncertain regulatory landscape

Ultimately, HYPE’s future will be determined by its ability to shift from a speculative plaything to a token with real-world utility. Until that happens, it remains a high-risk wager—one that could either ride the next crypto boom or falter under its own hype.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

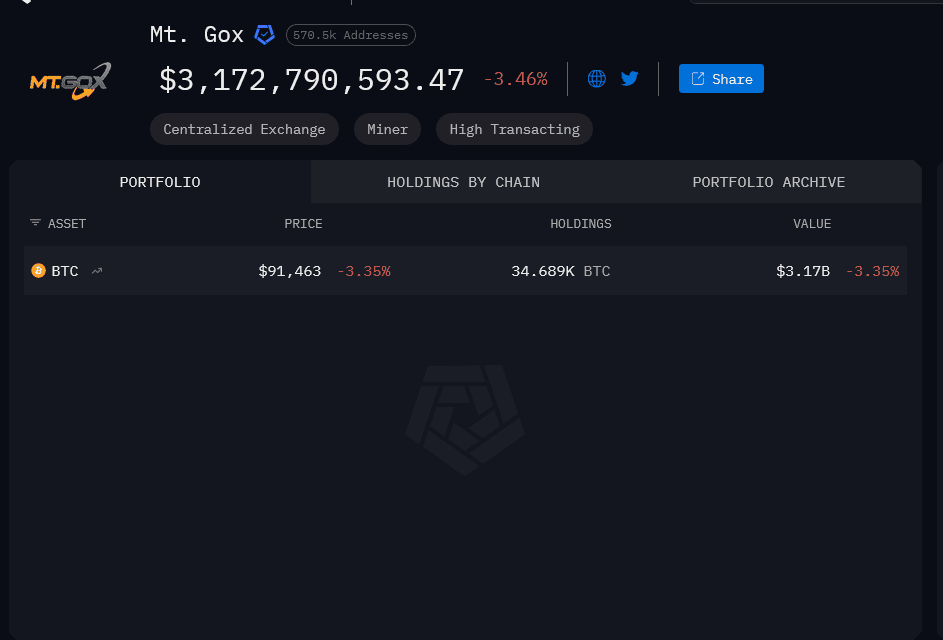

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).