Nvidia’s Culture of Trust: The Role of Generous Leave in Driving Technological Leadership

- Nvidia offers 22-week paid maternity leave, 12 weeks for non-birthing parents, and 8 weeks of flexible scheduling, ranking No. 2 on Fortune's 2025 Best Workplaces for Parents list. - CEO Jensen Huang prioritizes employee care to attract talent, with 93% of Nvidia parents reporting "deep care" from the company versus 48% at typical U.S. workplaces. - The policy includes surrogacy/adoption coverage, backup childcare, and manager-led flexibility, correlating with 50% higher "extra effort" at work compared t

Valued at over $4 trillion, Nvidia Corp. (NVDA) has solidified its status as a pioneer in workplace flexibility, offering a paid maternity leave of 22 weeks—far surpassing typical U.S. standards. The company’s policy also grants 12 weeks of paid leave to non-birthing parents and provides an additional eight weeks of flexible work arrangements after leave,

There is no federal mandate for paid parental leave in the U.S., and most new mothers take only 10 weeks of unpaid leave under the Family and Medical Leave Act (FMLA). Nvidia’s 22-week paid maternity leave—along with similar support for adoption, surrogacy, and families with special needs—sets a high standard. Beau Davidson, Vice President of Employee Experience, stressed that the company’s achievements are built on a “culture of support” rather than simply offering benefits. “It’s not enough to just have a program; you need to foster a culture that truly supports families,” Davidson explained,

The company’s dedication goes beyond just leave policies.

The effectiveness of these initiatives is reflected in employee feedback. Research by Great Place To Work indicates that Nvidia parents are 50% more likely than average to say they put in “extra effort” at work (93% versus 62%), which boosts both productivity and innovation. Trust in the company is also significantly higher:

Nvidia’s policies are in step with wider trends in American business.

Some, however, question whether such extensive benefits can last during economic downturns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

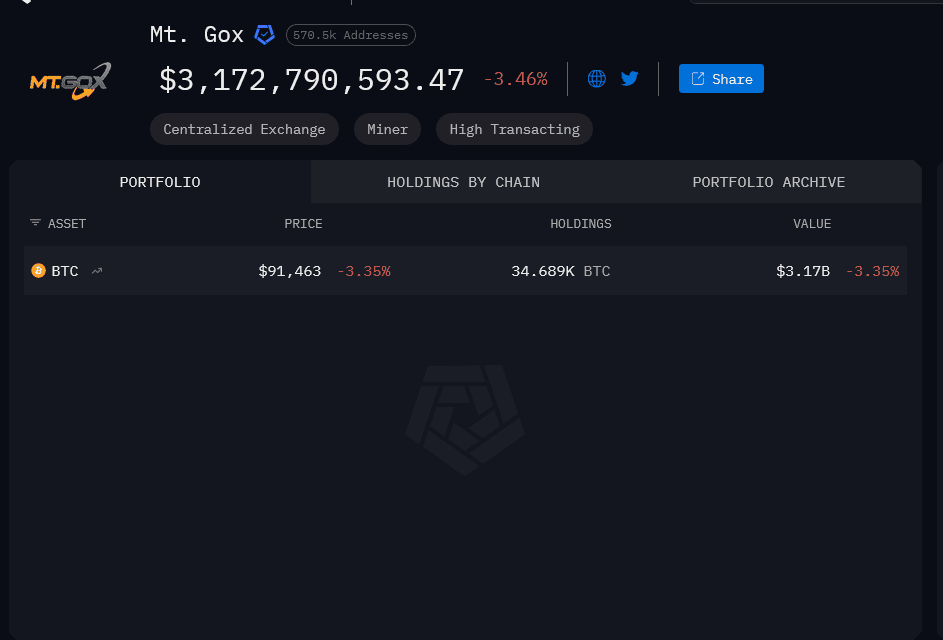

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).