Klarna Achieves Highest Revenue Yet, but Strategic Lending Leads to Losses

- Klarna reported $903M Q3 revenue (up 31.6%) but $95M net loss due to higher loan loss provisions as it expands "Fair Financing" loans. - Klarna Card drove 4M sign-ups (15% of October transactions) and 23% GMV growth to $32.7B, central to its AI-driven banking strategy. - Q4 revenue guidance of $1.065B-$1.08B reflects $37.5B-$38.5B GMV, supported by $1B facility to sell U.S. loan receivables. - CEO cites stable loan portfolio and AI-driven efficiency (40% workforce reduction) but warns of macro risks incl

Klarna Group Plc (KLAR)

The firm’s revenue

Although Klarna exceeded revenue expectations, it

Klarna’s outlook for the fourth quarter

The company’s emphasis on artificial intelligence

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

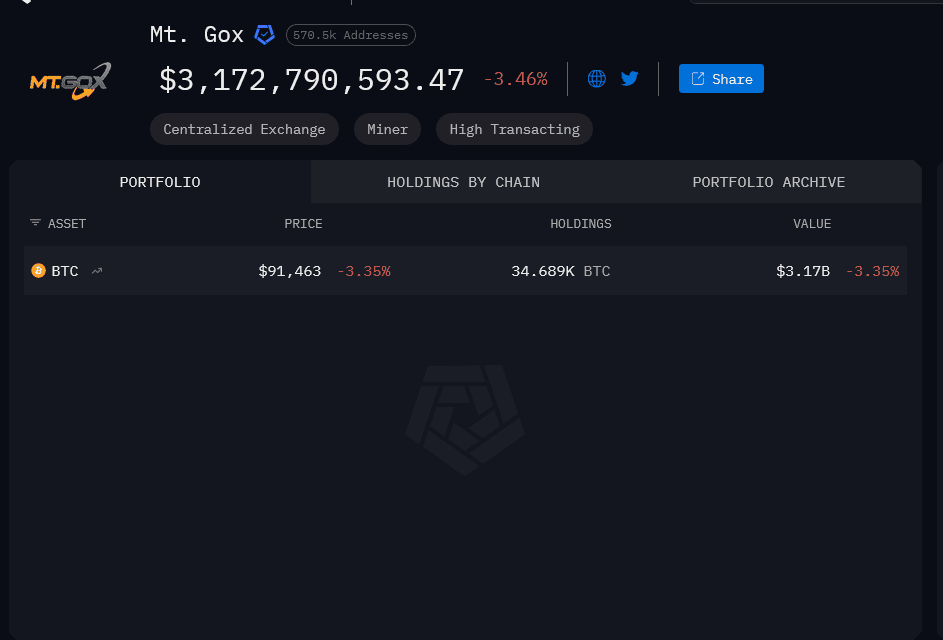

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).