Bitcoin Leverage Liquidation Emergency: Fluctuations, Systemic Threats, and Routes Toward Stability

- October 2025 crypto liquidation wiped out $19B in perpetual futures, highlighting Bitcoin’s volatility and systemic risks. - Retail panic vs. institutional resilience as ETFs attracted $24B inflows amid retail selloffs. - Regulators focus on digital asset classification amid $73.6B in crypto-collateralized borrowing. - Experts split on recovery, with some forecasting $200K Bitcoin if ETF inflows and Fed cuts continue. - Market recalibration suggests long-term opportunities amid evolving dynamics and risk

How the October 2025 Liquidation Unfolded

The cascade of liquidations on October 10 wasn’t caused by leverage itself, but rather by automated risk management systems reacting to extreme price swings. As Bitcoin fell below $90,000, exchanges’ algorithms initiated widespread liquidations to protect solvency, with Hyperliquid, Bybit, and Binance

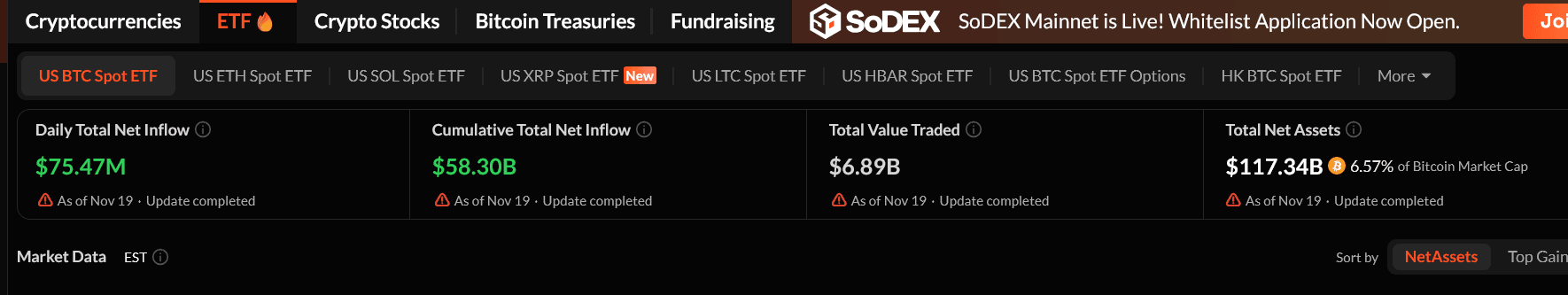

Retail Fear and Institutional Strength

Retail traders’ confidence hit rock bottom,

Regulation and Leverage in Focus

Regulatory bodies are putting more emphasis on defining digital assets to better control risks.

Is This a Correction or a Buying Window?

Opinions are divided.

For those investing, the future depends on balancing prudence with seizing opportunities. Retail traders, hurt by recent liquidations, may need time to regain trust, while institutions are better placed to take advantage of lower prices. The crucial factors will be keeping an eye on leverage sustainability and regulatory developments—both of which could either help stabilize the market or add to its volatility.

Summary

The October 2025 liquidation serves as a clear example of Bitcoin’s natural price instability, but also points to shifting market dynamics. While systemic threats remain, the interaction between institutional strength, regulatory progress, and retail sentiment suggests the market is adjusting rather than collapsing. For long-term investors, this period could offer a unique chance to buy at lower prices—provided that risk management stays at the forefront.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Are Back: Did the Crash Just End?

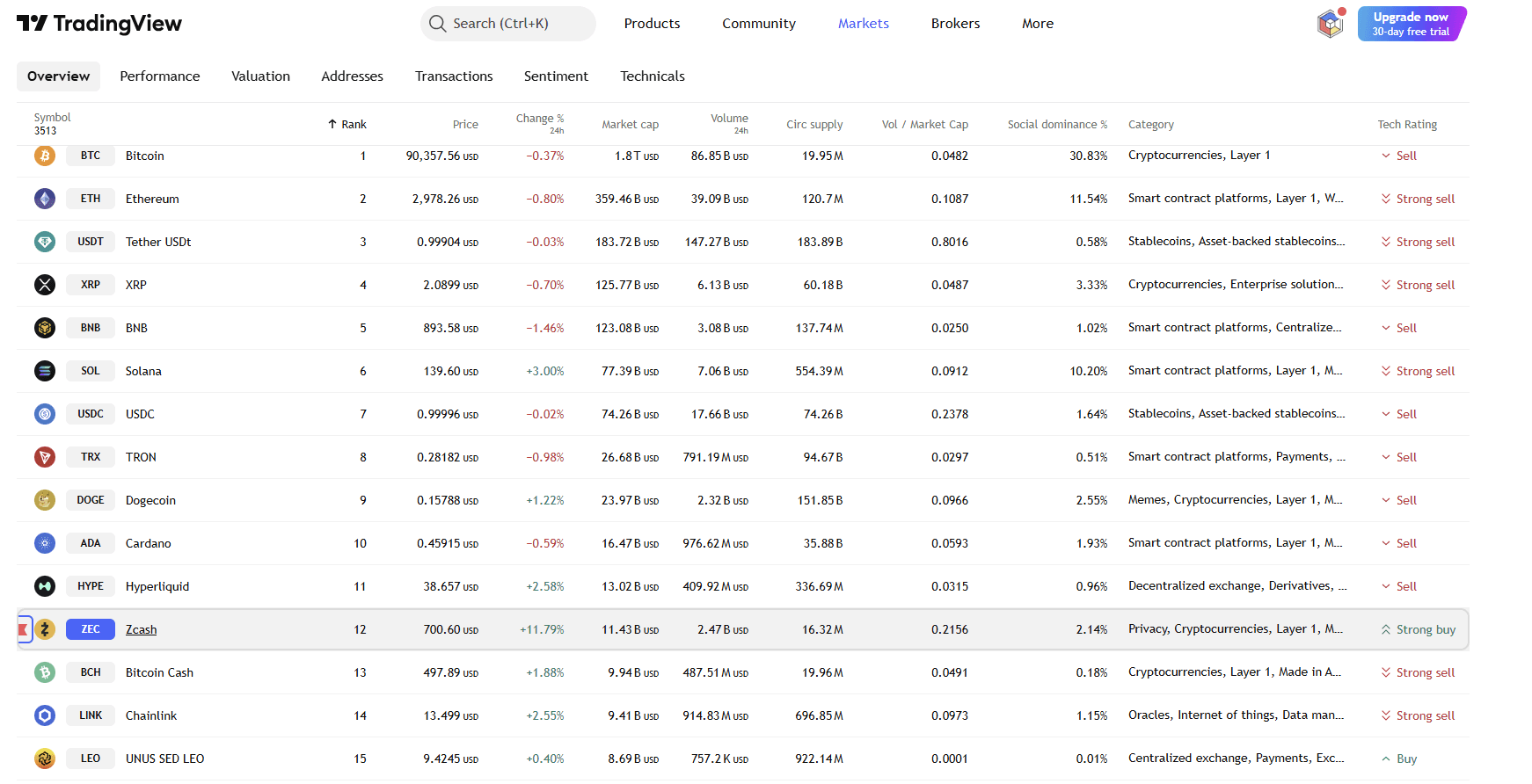

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening

Can Quantum Computers Break Crypto? Here's The Truth...

XRP News Today: Ripple Faces a Staking Dilemma on the XRP Ledger: Balancing Trust and Incentive Conflicts

- Ripple explores XRP Ledger staking to boost DeFi integration and institutional use. - CTO David Schwartz outlines two staking models, but implementation is distant due to architectural complexity. - Staking aims to enhance security and incentivize token holders, aligning with crypto trends while addressing bank needs for cost efficiency and compliance. - Ripple also seeks Fed account access to improve RLUSD stability, leveraging direct Treasury conversions for faster settlements.