Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

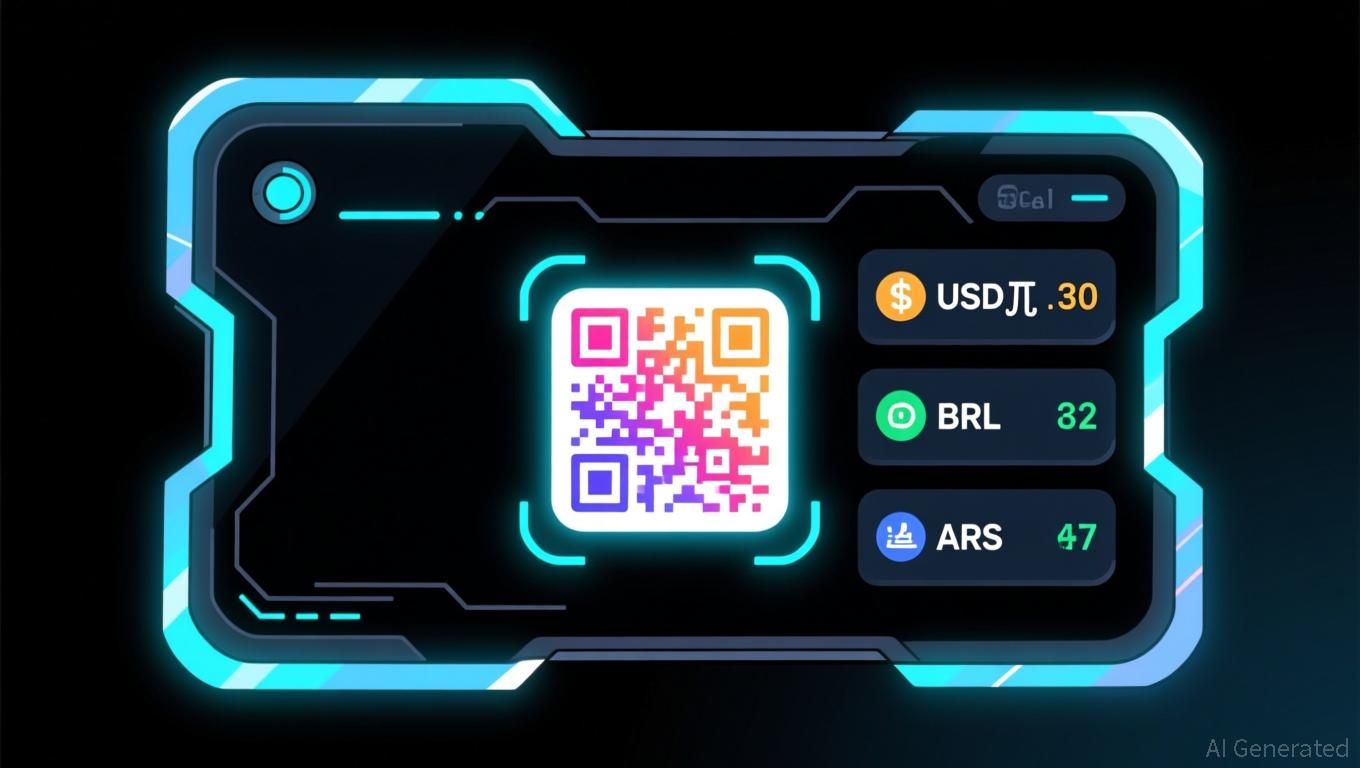

OxaPay White-Label: Launch Your Own Crypto Gateway in Under 24 Hours

The adoption of custom-branded cryptocurrency gateways is gaining momentum as businesses implement compliant and scalable platforms to connect digital currencies with everyday transactions. A standout example is OwlTing Group's (NASDAQ: OWLS) "Invisible Rails" initiative, which

This surge mirrors larger trends in the $209 billion web data infrastructure sector, where companies including Bright Data and Oxylabs are

Darren Wang of OwlTing remarked that "success in this industry will belong to those who excel at navigating regulations, not those who ignore them," a view shared by MiniPay’s Murray Spark, who

As the industry progresses, the relationship between AI-driven data demands, stablecoin integration, and regulatory oversight will shape how crypto becomes part of the global economic landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Ark's Optimistic Move Stands Out Amid Crypto Market Downturn

- Ark Invest spent $10.2M via three ETFs to buy Bullish shares, a Thiel-backed crypto exchange, amid broader market declines. - Bullish's stock fell 4.5% despite Ark's purchases, though Q2 profits rose sharply from $116M loss to $108M gain. - Ark's crypto strategy focuses on firms with regulatory progress (e.g., NY license) and financial resilience, including Circle and BitMine investments. - The firm divested Tesla/AMD shares while Bitcoin fell below $90K, highlighting shifting priorities toward crypto an

Bitcoin News Update: Eternal Bull Tom Lee Rejects Bearish Doubts, Maintains $200k Bitcoin Prediction

- Tom Lee, BitMine's permabull, predicts Bitcoin will hit $150k–$200k by January 2026 despite current $90k price drop. - He attributes the bearish phase to temporary factors like Fed uncertainty and October sell-off anxiety, citing technical exhaustion signs. - Lee also forecasts Ethereum's "supercycle" growth, comparing its trajectory to Bitcoin's 2017 pattern amid rising long-term holder accumulation. - Market skepticism persists with $3.79B Bitcoin ETF outflows and warnings of 50% drawdowns, testing Lee

Zcash News Today: Zcash’s Quantum-Resistant Privacy Transforms It into an “Encrypted Bitcoin” for Enterprises

- Zcash (ZEC) surged 31% in a week as institutional demand for quantum-resistant privacy coins grows, driven by Cypherpunk Technologies' $18M ZEC purchase. - Cypherpunk, now holding 1.43% of ZEC supply, emphasizes Zcash's zero-knowledge proofs and quantum-safe cryptography as "encrypted Bitcoin" for institutional portfolios. - Zcash's 125% 30-day rally outperformed Bitcoin's decline, with shielded pool usage hitting multi-year highs amid rising concerns over blockchain surveillance. - Analysts highlight Zc

Bitcoin News Update: As MSCI Adjusts Sector Guidelines, Investors Rethink Their Approaches to AI and Bitcoin

- MSCI's revised GICS rules raise concerns over investment flows and Michael Saylor's Bitcoin strategy stock valuation due to sector classification changes. - The updated framework introduces ambiguity in asset categorization, prompting warnings about distorted performance metrics and unintended portfolio rebalancing. - High-growth sectors like AI face heightened volatility, with Alger and Pzena reports highlighting risks from rapid obsolescence and fee sensitivity. - Market uncertainty intensifies amid eq