Date: Fri, Nov 28, 2025 | 06:20 AM GMT

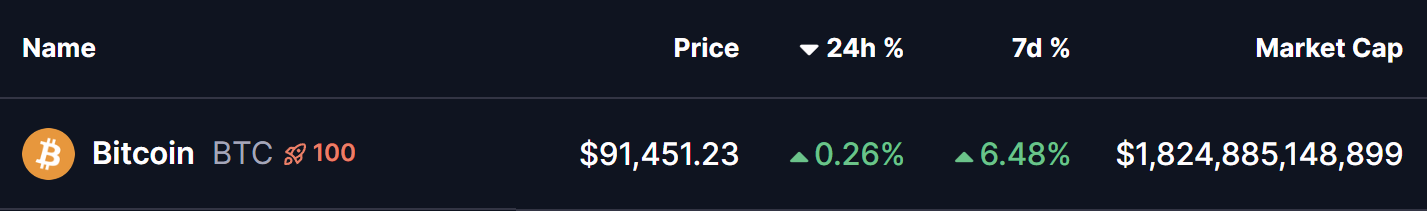

The broader cryptocurrency market continues its attempt at recovery after last week’s sharp volatility, which dragged Bitcoin (BTC) down to $80,925 before it stabilized and climbed back above the $91,000 level. While the rebound has brought some relief, the chart now highlights a potentially significant bullish formation that may shape BTC’s next direction.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Broadening Wedge Pattern in Play

On the daily timeframe, Bitcoin has been trading inside a descending broadening wedge — a bullish reversal structure that often forms during extended corrective phases. The widening nature of the pattern reflects increasing volatility, while the downward-sloping resistance and deeper tests of support typically lead to an upside breakout once sellers lose control.

BTC’s latest decline carried it directly into the lower wedge boundary near $80,925, where buyers reacted aggressively and prevented further downside. This bounce has since pushed the price back toward $91,624, signaling renewed demand and a potential shift in short-term momentum.

Bitcoin (BTC) Daily Chart//Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart//Coinsprobe (Source: Tradingview)

The price action is now approaching the wedge’s upper resistance line, where the recent candles show tightening movement. Such compression often precedes a breakout attempt as the market prepares its next major move.

What’s Next for BTC?

If momentum continues to build, Bitcoin may soon retest the upper wedge trendline around the $94,000 region. A convincing breakout above this level would confirm the bullish reversal pattern and could open the door for further upside. The next major target sits at the 200-day moving average, currently near $109,822, which would act as the first big test for any sustained rally.

However, failure to break the upper boundary could lead to another short-term correction. In that case, BTC would likely revisit the $85,300 area — a key demand zone that must hold to maintain the integrity of the bullish setup. A breakdown below this support could shift momentum back in favor of sellers and delay the anticipated recovery.

For now, BTC’s structure remains cautiously optimistic. The descending wedge is intact, buyers have defended major support, and price continues to push higher within the pattern. If sentiment remains stable, Bitcoin could be nearing a decisive breakout attempt in the sessions ahead.