Polymarket Opens Waitlist Access as US Relaunch Gains Momentum

Polymarket has entered a new phase of expansion as its US relaunch begins after years away from the domestic market. According to recent reports, the platform is moving quickly to bring waitlisted users into its updated app, starting with sports event contracts. Regulatory clearance arrived earlier this year, opening the door for a compliant return.

In brief

- Polymarket begins its US relaunch by opening waitlist access, starting with sports markets after securing CFTC clearance.

- ICE commits $2B at an $8B valuation, with projections suggesting Polymarket could reach $10B–$15B as new funding emerges.

- Prediction markets grow rapidly, with weekly volumes nearing $1B and strong interest in elections, sports, and global events.

- Studies show that up to one-quarter of trades may be wash activity, yet user participation and platform visibility continue to rise.

CFTC No-Action Letter Clears Path for Polymarket’s Regulated US Comeback

After months of preparation, Polymarket has started opening its platform to users on the waitlist. Access now covers sports-related markets and will extend to more categories over time. The rollout follows a no-action letter issued by the US Commodity Futures Trading Commission (CFTC) in September.

Specifically, the letter approved a crypto derivatives exchange and clearinghouse acquired by Polymarket, allowing the company to return to the US under compliant conditions.

Following its forced exit in 2022 over compliance failures, the company is re-emerging with stronger backing and greater visibility. ICE—the owner of the New York Stock Exchange—has committed $2 billion and assigned an $8 billion valuation to the platform .

The firm plans to integrate Polymarket’s event-driven signals into its data services. Analysts expect the valuation could reach $10 billion in the near term, while other reports suggest the figure might climb toward $15 billion if new funding arrives.

Prediction Markets See Rapid Expansion as Trading Activity Climbs

Rising activity across prediction markets is creating strong momentum for the sector. Kalshi, which recently raised $1 billion at an $11 billion valuation , remains Polymarket’s main rival. Trading in event contracts climbed sharply through 2024 as users moved into markets connected to the US elections and major global events.

During parts of the year, weekly volume reached $961 million with 247,000 active traders. Social media campaigns, wallet flows, and token rewards helped sustain activity across political and sports-related markets.

A separate line of research, however, has raised questions about inflated trading volumes . Recently, a Columbia study found that up to one-quarter of trades may have been wash activity. Certain weeks showed nearly 60% of volume originating from repetitive loops among large wallet clusters. Despite these concerns, user growth and platform visibility continued to increase.

Several forces are shaping the prediction markets:

- Competition between Polymarket and Kalshi for volume and market share .

- Expanding interest in sports, politics, and global events.

- Strong institutional support for event-driven financial products.

- Ongoing questions about wash trading and reward-driven activity.

- Increased efforts by platforms to satisfy US regulatory requirements.

Industry expansion is drawing in additional players to the prediction markets . Coinbase is reportedly developing a prediction platform in partnership with Kalshi. Trump Media and Technology Group also announced plans in October to introduce event markets to Truth Social.

Trading data from Token Terminal shows Kalshi leading with about $4.4 billion in October volume, followed by Polymarket at just over $3 billion. Rising competition, new investment, and a return to regulated US access place Polymarket back at the center of the prediction-market race.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Electricity theft exceeds $1 billion, Malaysian bitcoin miners face severe crackdown

In Malaysia, the crackdown on illegal bitcoin mining gangs has turned into a game of cat and mouse.

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

SEC launches innovative exemption policy—Has U.S. crypto regulation entered a new era?

The door to exploration has just opened.

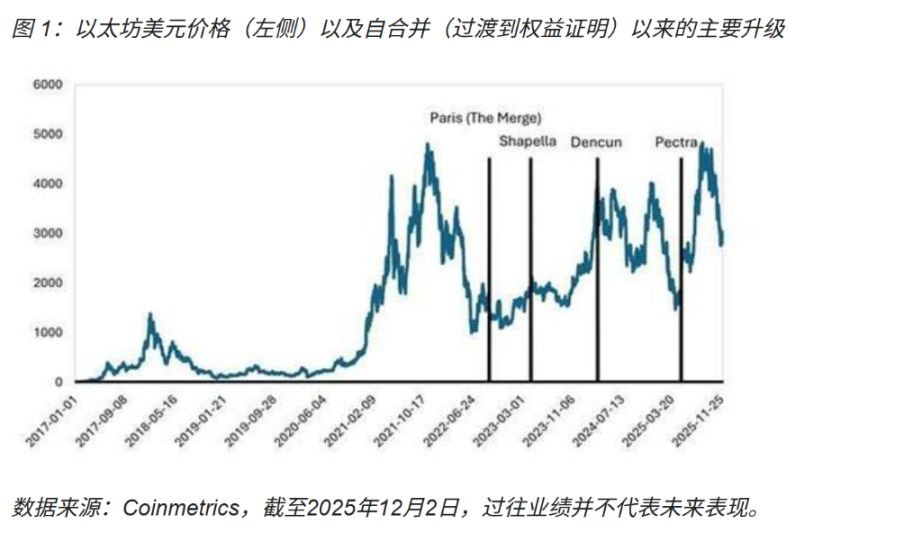

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.