The Federal Reserve ends QT: The main liquidity switch has been flipped, and a silent bull market is taking shape.

In the past few weeks, the market has seemed boring, flat, and completely lacking in volatility.

Mainstream assets are moving sideways, sentiment is sluggish, and retail investors are dormant.

But on the macro level, something has quietly happened that is enough to change the entire cycle:

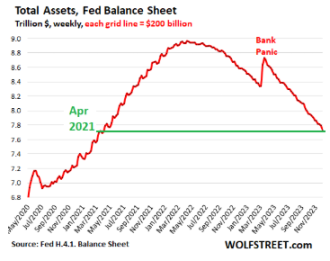

The Federal Reserve has officially ended QT (Quantitative Tightening)—the biggest brake on global risk assets has been completely released.

This is not just verbal rhetoric, but a structural change at the level of the balance sheet data.

The real liquidity switch has already been quietly flipped on a silent night, without any fanfare.

1. QT Ends: Two Years of Liquidity Bleeding Finally Stops

Over the past two years, the market has faced:

Continuous reduction of the balance sheet

Bank reserves being drained

Risk assets under pressure

Liquidity constantly evaporating

This has been the biggest root cause of all assets moving sideways or weakening.

But now, the situation has changed:

Liquidity is no longer flowing out.

The pressure is completely lifted.

Expansion mode is starting.

This is the most important but overlooked macro turning point of this cycle.

2. Back to 2019: What Happened After the Last QT Ended?

History provides us with the clearest reference.

The last time QT ended: August 2019.

At that time:

The market also seemed lifeless

Sentiment was extremely weak

Everyone thought it would move sideways for another year

But what happened next exceeded everyone’s expectations:

In the following six months, mainstream altcoins rebounded massively by 50–60%.

No news, no grand narrative, just the single main thread of “liquidity loosening.”

And now, we are once again standing in the same position.

3. Retail Investors Wait for “QE Return” News, but Whales Never Wait

Retail investors always think:

“Wait for QE to return, wait for the media to confirm, wait for analysts to call a bull market before getting in.”

But real market moves never work that way.

The historical pattern is:

Headline news always lags behind

The real rally starts when no one is paying attention

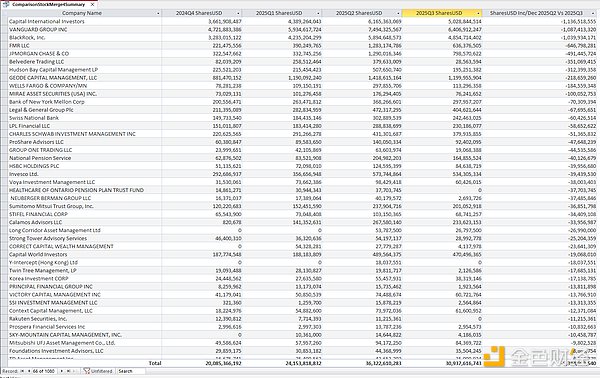

Whales quietly accumulate during the silent period

By the time retail investors see the signal, the easiest gains are already over

The silent period is a common feature of all major reversals.

4. Bank Reserves Are No Longer Being Drained, Liquidity Begins to Slowly Flow Back to the Market

The key turning point brought by the end of QT:

Banks are no longer losing reserves

Assets are no longer passively shrinking

The market no longer faces a “black hole” of disappearing liquidity

New money is starting to flow back into risk assets

And among all risk assets:

Cryptocurrencies are always the “first beneficiaries” when liquidity returns—and also the fastest to rise.

Because they are the most sensitive and directly reflect changes in US dollar liquidity.

5. Everyone Watches Interest Rate Decisions, but the Real Money Switch Is Hidden in the Balance Sheet

Almost everyone in the market is watching:

Interest rates

Meeting minutes

Federal Reserve speeches

Dot plots

But the real “start signal” has never been in these public contents.

The real key is:

Whether the balance sheet structure has stopped shrinking.

And this time—

It has completely stopped and has begun to expand again.

The sideways movement you see is not “no market,”

but the cold start phase of a new trend.

6. The Bull Market Will Not Start with Fireworks, but with Silence

The characteristics of the market at this moment are very obvious:

Poor sentiment

Low trading volume

No media coverage

Most people are bearish

Whales have already started entering the market

This is exactly the typical environment for a major cycle reversal.

History has proven countless times:

The real bull market never starts in a frenzy, but quietly in silence.

Conclusion:

If the current market could be summarized in one sentence, it would be:

“The liquidity turning point has already appeared, but only the whales have noticed.”

Therefore, the conclusion is very clear:

The market will continue to use “false calm” to cover up real capital flows

Sentiment will remain weak

The opportunity to buy the dip will not last long

Funds will gradually flow back into risk assets

Crypto assets will be the first to react and lead the rally

Altcoins will be the most explosive sector in the next six months

The liquidity cycle has officially shifted from “contraction” to “expansion”

This is precisely the most critical starting point of every major bull market

Don’t wait for news confirmation, don’t wait for KOLs to call the shots, don’t wait for market hype.

The real market move has already started at the silent bottom.

And altcoins are the rocket launchpad at the very front this time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Controversial Strategy: The Dilemma of BTC Faith Stocks After a Sharp Decline

SOL price capped at $140 as altcoin ETF rivals reshape crypto demand

Will USDT Collapse? A Comprehensive Analysis of Seven Years of FUD, Four Crises, and the Real Systemic Risks of Tether

Liquidity Shift Hidden Beneath the US-China Rivalry