Why Scott Bessent Is Cracking Down on Congress Stock Trading

By:BeInCrypto

Treasury Secretary Scott Bessent has renewed his call to end congressional stock trading, highlighting outsized returns by lawmakers that far outpace market benchmarks. In 2024, Senate Finance Committee Chair Ron Wydens portfolio surged 123.8%, compared with the SP 500s 24.9%, while Speaker Nancy Pelosis portfolio returned 70.9%. Bessent Urges End to Congressional Trading as House Leaders See Outsized Returns Scott Bessents warning comes as asset managers take record-long positions in US equities. SP 500 futures net long exposure has reached 49%, near historic highs. .@SpeakerPelosi and Senator @RonWyden are the poster children for a much larger problem; as I have said before, Congressional stock trading must end.As an example from the below @RCPolitics article, during Senator Wydens chairmanship of the Senate Finance Committee in 2024 his Treasury Secretary Scott Bessent (@SecScottBessent) December 15, 2025 Analysts say the intersection of extreme market positioning and growing political scrutiny raises questions about timing. According to EndGame Macro, a renowned analyst, regulatory attention to insider or political trading typically appears late in bull cycles, often when public frustration and valuations peak. When the rules tighten for the people closest to the information, its often because the upside has already been largely harvested, the analyst said. A growing body of research highlights the magnitude of congressional outperformance. A National Bureau of Economic Research working paper by Shang-Jin Wei and Yifan Zhou found that congressional leaders outperform peers by roughly 47% annually after assuming leadership positions. Superior stock trading performance by US congressional leaders, from Shang-Jin Wei and Yifan Zhou NBER (@nberpubs) December 6, 2025 The analysis identifies two drivers: Direct political influence Such as trading before regulatory actions or investing in firms expected to gain government contracts, and Access to nonpublic information About home-state or donor companies, information that is unavailable to the average investor. Historical examples illustrate this advantage. Pelosi reportedly achieved cumulative returns of 854% after the 2012 STOCK Act, compared with 263% for the SP 500. Wyden, as Senate Finance Committee chair in 2024, allegedly gained 123.8%, while his 2023 performance was 78.5%, well above the SP 500s 24.8%. These figures exceed many professional hedge fund returns, highlighting significant information asymmetries and raising concerns over market fairness. Bessents intervention frames the debate as a credibility issue for Congress rather than a partisan matter. When members of Congressional leadership post returns that far exceed many of the worlds top performing hedge funds, it undermines the fundamental credibility of Congress itself, he said in the post. Public support for banning congressional trading is strong, with a 2024 YouGov poll showing 77% of Republicans, 73% of Democrats, and 71% of independents in favor. Legislative efforts, such as the Restore Trust in Congress Act, would require lawmakers and their close relatives to divest individual stocks within 180 days. However, it would allow them to retain mutual funds and ETFs. Yet, House leaders have not scheduled a floor vote, and only 23 of the required 218 signatures for a discharge petition had been gathered by December 2024. Opinions remain divided among lawmakers, with some warning that restrictions could deter qualified candidates, while others call reform common sense and a matter of good governance. Record-Bullish Market Positioning Signals Maturing Cycle The debate on congressional trading comes against a backdrop of historic bullishness in equities. The Kobeissi Letter reports that net long positions in SP 500 futures increased by 49%, representing a rise of roughly 400% since 2022. This is nearly double the long-term average and more than two standard deviations above historical norms. Nasdaq 100 futures are similarly elevated, and the SP 500 reached 37 all-time highs in 2025, the third-most since 2020. Asset managers are extremely bullish on US equities:Net long positioning by asset managers in SP 500 futures is up to 49%, near the highest on record.Since 2022, net exposure has surged +400%.Current positioning is now nearly double the long-term average of 26% and sits The Kobeissi Letter (@KobeissiLetter) December 16, 2025 Despite this, Bank of America (BofA) issues a cautious outlook. The bank forecasts the SP 500 to reach 7,100 by the end of 2026, only 4% above current levels. BofA cites AI-related valuation pressures and potential tech-driven consumption slowdowns. BofA ISSUES MOST BEARISH SP 500 OUTLOOK FOR 2026Bank of Americas Savita Subramanian forecasts the SP 500 ending 2026 at 7,100, implying just 4% upside and the most bearish Street view. She expects valuation multiple compression as AI-heavy buy-the-dream stocks face *Walter Bloomberg (@DeItaone) December 15, 2025 Analysts suggest that the combination of extreme positioning and potential regulatory action signals market maturity rather than a new expansion. The timing of reforms potentially highlights when insiders have already captured a significant portion of the upside. This convergence of record bullish bets and growing regulatory scrutiny serves as a barometer of market cycles, rather than an immediate warning of a crash. It is also a reminder that late-cycle dynamics are shaping both equity and risk asset markets, including crypto. Read the article at BeInCrypto

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

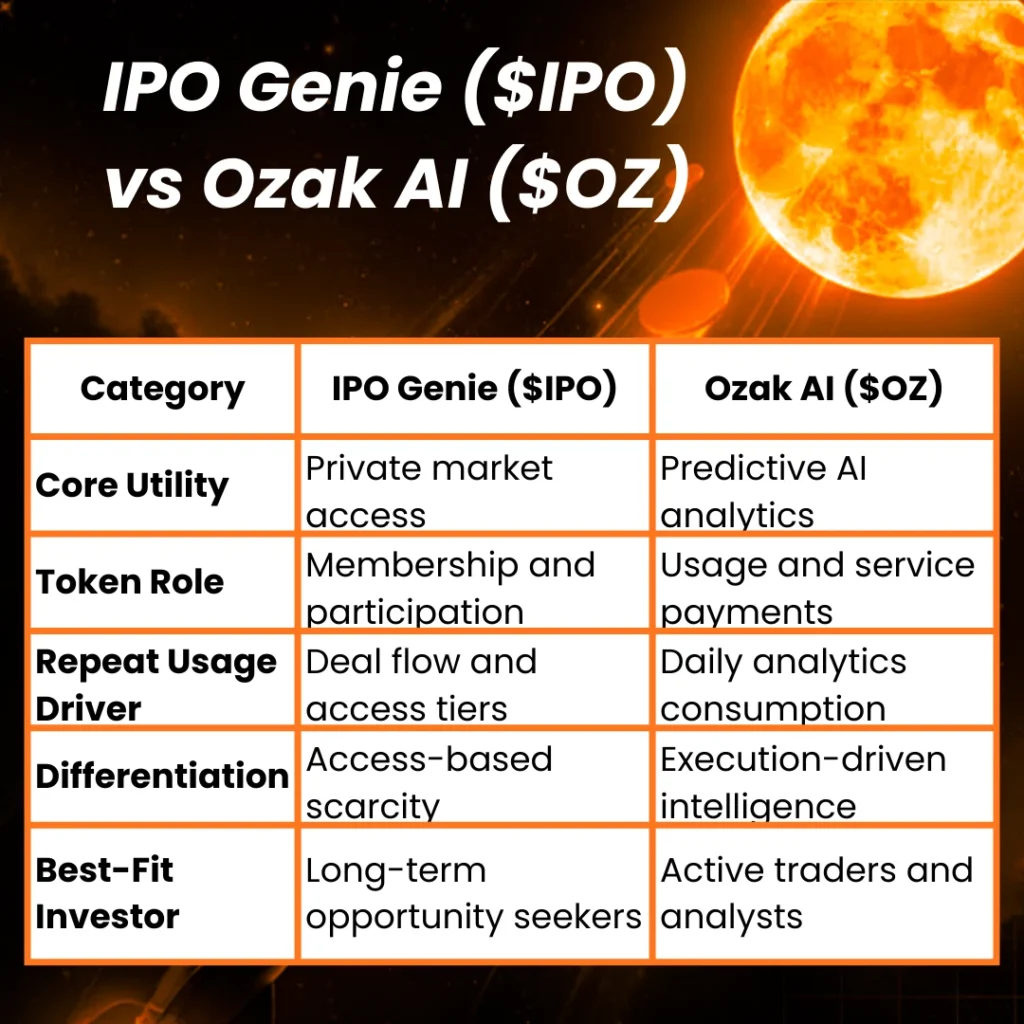

IPO Genie ($IPO) vs Ozak AI ($OZ): Which AI Presale Has Stronger Utility in 2026?

BlockchainReporter•2025/12/16 15:12

Private Investment Firm Shares Why XRP Is Their Leading Investment

Newsbtc•2025/12/16 15:06

Crucial Insight: US Major Indices Open Slightly Lower – What It Means for Crypto

Bitcoinworld•2025/12/16 15:00

India’s Digantara raises $50M for space-based missile defence tech

TechCrunch•2025/12/16 15:00