Bitcoin Exchange Reserves Hit a Record Low — So Why Isn’t the Price Rising?

By:BeInCrypto

Investors have long viewed exchange reserves as a key indicator of accumulation and asset scarcity. Bitcoin held on exchanges reached a new all-time low this month. However, as Bitcoin enters the final days of 2025, the price risks closing the year below its opening level. Why do falling exchange reserves fail to support higher prices? How Declining Exchange Reserves Are Backfiring on Bitcoins Price Under normal conditions, a sharp drop in exchange reserves signals that long-term investors are moving BTC to cold wallets. This behavior reduces selling pressure and often pushes prices higher. CryptoQuant data shows that exchange reserves (blue line) have been declining steadily since the start of the year. The metric reached a new low near the end of 2025. Holders have accelerated BTC withdrawals since September. Approximately 2.751 million BTC are currently held on exchanges. Bitcoin Exchange Reserve. At the same time, Bitcoins price fell from above $126,000 to around $86,500. Several recent analyses highlight a different side of the issue. A decrease in the number of BTC on exchanges can sometimes have a counterproductive effect. First, the Inter-Exchange Flow Pulse (IFP) has weakened. IFP measures the movement of Bitcoin between exchanges, reflecting overall trading activity. Bitcoin Inter-Exchange Flow Pulse (IFP). When IFP is high, arbitrage and liquidity provision function smoothly. Order books stay thick, and price movements tend to be more stable. When IFP declines, market blood flow weakens. Prices become more sensitive to relatively small trades, Analyst XWIN Research Japan explained. XWIN Research Japan added that this liquidity decline coincides with historically low exchange reserves. Scarcity no longer supports prices as expected. Instead, thinner order books make the market fragile. Even modest selling pressure can trigger price pullbacks. Second, most exchanges have recently shown BTC accumulation, as reflected by negative BTC Flow. In contrast, Binancethe exchange with the largest liquidity sharerecorded significant inflows of Bitcoin. BTC Exchange Flow. This matters because Binance is the largest Bitcoin liquidity hub. User and whale behavior there often has an outsized impact on short-term price action. When Bitcoin flows into Binance, even as other exchanges see outflows, overall market strength can remain muted,analyst Crazzyblockk explained. In other words, Binance acts as the markets primary liquidity center. Capital concentration on this exchange weakens broader market momentum. It also offsets accumulation signals from different platforms. Exchange reserves have dropped to record lows. However, weak liquidity and capital concentration on Binance continue to suppress Bitcoins upside. In addition, a recent analysis noted that Bitcoin fell as traders de-risked ahead of a potential Bank of Japan rate hike. Such a move could threaten global liquidity and the yen carry trade. Market dynamics in late 2025 highlight a key lesson. On-chain data does not always lend itself to a single, straightforward interpretation.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

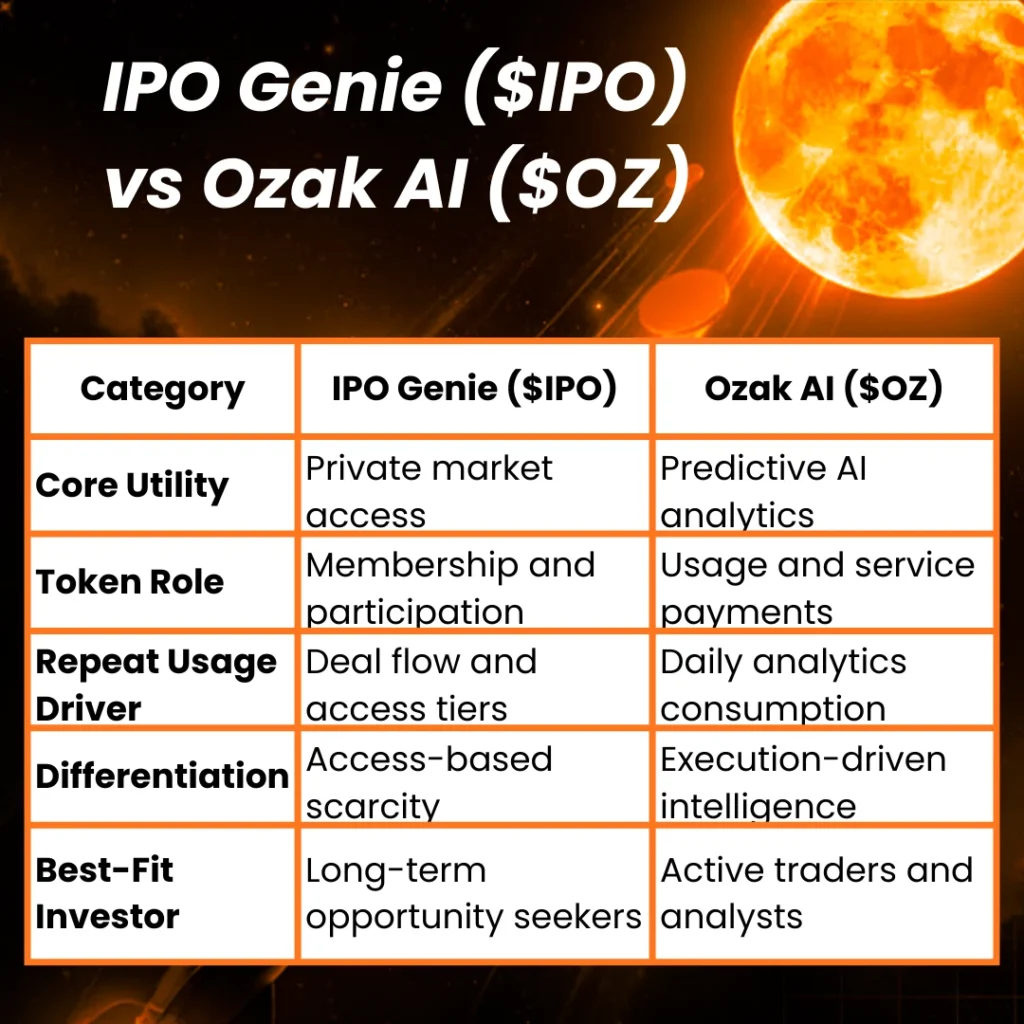

IPO Genie ($IPO) vs Ozak AI ($OZ): Which AI Presale Has Stronger Utility in 2026?

BlockchainReporter•2025/12/16 15:12

Private Investment Firm Shares Why XRP Is Their Leading Investment

Newsbtc•2025/12/16 15:06

Crucial Insight: US Major Indices Open Slightly Lower – What It Means for Crypto

Bitcoinworld•2025/12/16 15:00

India’s Digantara raises $50M for space-based missile defence tech

TechCrunch•2025/12/16 15:00