- SEC’s approval of Bitcoin ETF options allows increased market exposure, marking a significant development in crypto trading.

- Bitcoin ETF options enhance investment efficiency without altering inherent market volatility, offering more control per dollar.

Jeff Park, head of alpha strategies at Bitwise Asset Management, recently clarified that Bitcoin ETF options will not diminish the volatility of Bitcoin. He argues that, unlike central banks that adjust money supply for price stability, Bitcoin’s fixed limit of 21 million coins inherently subjects it to significant price fluctuations.

Central Banks vs. Bitcoin’s Fixed Supply

Central banks aim for stability by adjusting the monetary supply, whereas Bitcoin’s supply is permanently capped, which excludes the possibility of manipulating its quantity to stabilize prices. This structure is designed to maintain the integrity of the digital currency but comes with the side effect of heightened volatility.

Introduction of Bitcoin ETF Options

The recent SEC approval for trading options on BlackRock’s iShares Bitcoin Trust (IBIT) introduces a new layer to Bitcoin investment strategies . This development allows investors to increase their exposure to Bitcoin more significantly than before.

Park describes this approval as a landmark advancement in the crypto market because it introduces regulated leverage to a perpetually supply-constrained asset for the first time.

Effects of Options on Market

According to Park, the introduction of ETF options enables Bitcoin’s synthetic notional exposure to expand exponentially, which can enhance the financial utility of ETFs . Options trading allows investors to achieve greater delta, meaning they can control more of the asset for the same amount of money, providing more investment efficiency per dollar spent.

Bitcoin’s market characteristics, such as its negative Vanna and the tendency for a gamma squeeze, often lead to rapid price increases. These elements contribute to the overall volatility of Bitcoin , as its implied volatility increases alongside the spot price.

Debate Over Synthetic Exposure

The notion that the introduction of derivatives can dilute Bitcoin’s supply constraint has been suggested by figures like on-chain analyst Willy Woo. He argues that derivatives allow dollar holders to effectively sell Bitcoin, potentially altering its market.

However, Park counters this view by stating that options do not fabricate additional supply; rather, they facilitate reaching Bitcoin’s ‘neutral’ price more swiftly.

While Bitcoin ETF options introduce new investment mechanisms and can enhance the utility and accessibility of Bitcoin investments, they do not mitigate the intrinsic volatility associated with Bitcoin’s fixed supply.

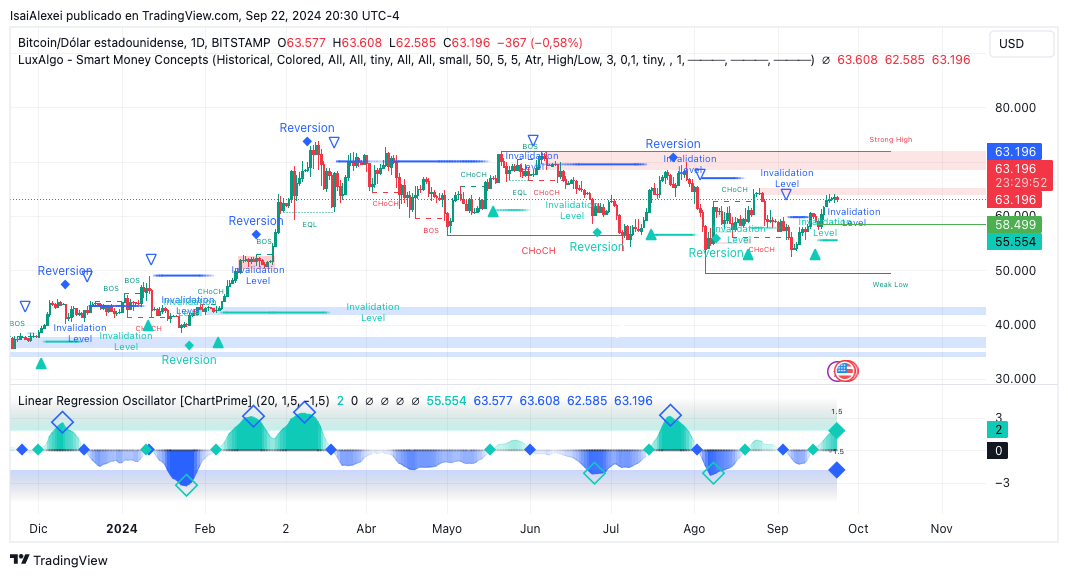

In my previous analysis, I highlighted a specific price level which, as evident from recent charts and price movements, has now been reached. Additionally, the current assessment of the daily chart indicates that the upward trend remains intact.

Source: Tradingview

Source: Tradingview

Under this scenario, the price has the potential to reach 68,500. Should this positive trend continue, the next targets would be 70,000 and 71,700.

However, should the price encounter resistance at the current order block, lower reaction levels might be considered at 61,400 and 58,180, extending down to the main support level at 54,250.