Ethereum Price Signals Bearish Reversal as 1K–10K ETH Wallets Keep Selling

- An evening star candle pattern at the resistance trendline of the falling wedge pattern signals a potential downswing in Ethereum price.

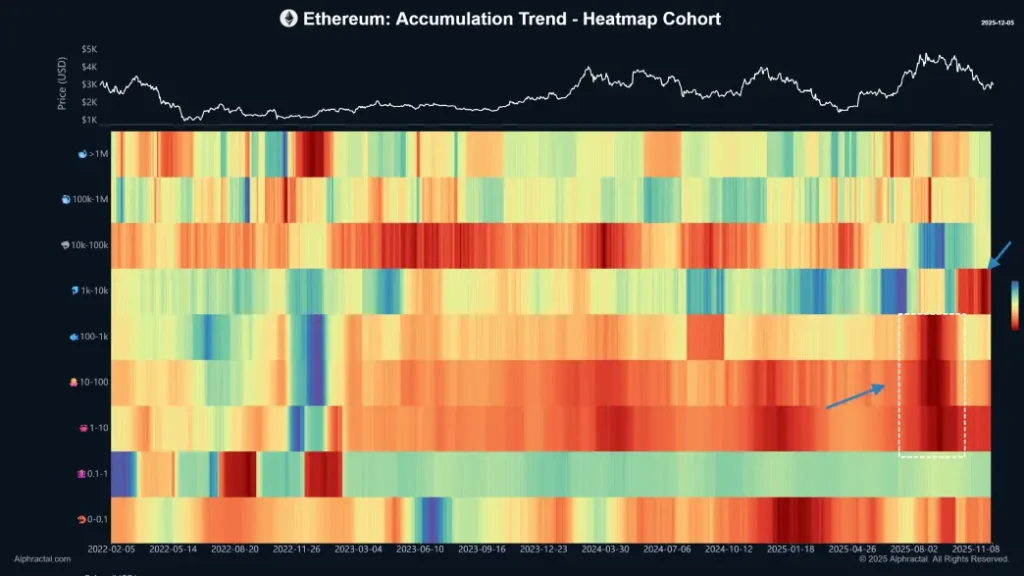

- The 1,000–10,000 ETH cohort made the heaviest selling at the peak and continues to distribute coins at the current market.

- A potential death crossover between 100-and 200-day EMA slopes could accelerate the market selling pressure.

ETH, the native cryptocurrency of the Ethereum blockchain, slips over 3.5% during Friday’s U.S. market hours to trade just above $2,000. The broader crypto market shows a similar downtick, as it seems that the early weeks recuperated the exhausted bearish momentum. However, the Ethereum price faced additional selling pressure as mid-size whales (1K–10K ETH) carried out heavy distribution. Will the top altcoin lose $3,000 again?

Middle-Tier Ethereum Whales Drive Post-Peak Selling Pressure

Over the past three months, the Ethereum price has witnessed a steady downtrend from its $4,955 all-time high (ATH) to its current trading value of $3,040, registering a 39% loss.

On-chain data of Ethereum’s supply distribution indicates that holders with balances between 1,000 and 10,000 ETH made the bulk of sales at the recent ATH. This cohort sold off positions aggressively at the peak of the price while there was widespread optimism among other market participants, celebrating the new highs.

The same bracket keeps on shrinking the holdings in the present moment, creating more persistent downward pressure despite the price trying to stabilize above $4,000. Daily net outflows from these addresses are still higher than pre-rally levels.

On the other hand, addresses with control over 10,000 ETH have shown much lower activity. Their collective balance has only decreased slightly since the top, with no indication of acceleration in selling or the accumulation of much. Transfers between the largest wallets remain within normal ranges, suggesting a wait-and-see approach rather than active repositioning.

Smaller holders below 1000 ETH have exhibited mixed behavior, with some cohorts adding tokens on dips and others trimming positions, although their combined impact is dwarfed by the middle-tier group.

The divergence can be seen in real-time supply measures: the 1,000-10,000 ETH tier has lost around 4-6% of its total supply since the local peak; the 10,000+ tier has lost less than 0.5% over the same period. This imbalance points out which segment currently controls the short-term direction of price action.

Ethereum Price Risks $2,500 Breakdown With this Reversal

In the last two days, the Ethereum price has shown a bearish pullback from $3,240 to its current trading value of $3,022, registering a 4.74% loss. This downtick displays an evening star bearish candle pattern at the resistance line of a falling wedge pattern.

The chart setup is characterized by two converging trendlines, which provide dynamic resistance and support to coin traders. Their downsloping nature drives the current price correction while maintaining a sell-the-bounce sentiment.

As the ETH price dives below the 20-day exponential moving average slope, the sellers could strengthen their group over this asset for a prolonged period. The post-reversal fall could push the price another 29% to seek the wedge pattern support at $2,115.

The current price position below the key EMAs (20, 50, 100, and 200) accentuates that the path of least resistance is down.

On the contrary, if the buyers flipped the overhead resistance into a potential support, ETH could recoup its bullish momentum for a sustainable price recovery. The post-breakout rally could face key resistance at $3,466, followed by $4,250.