Date: Sun, Dec 07, 2025 | 12:55 PM GMT

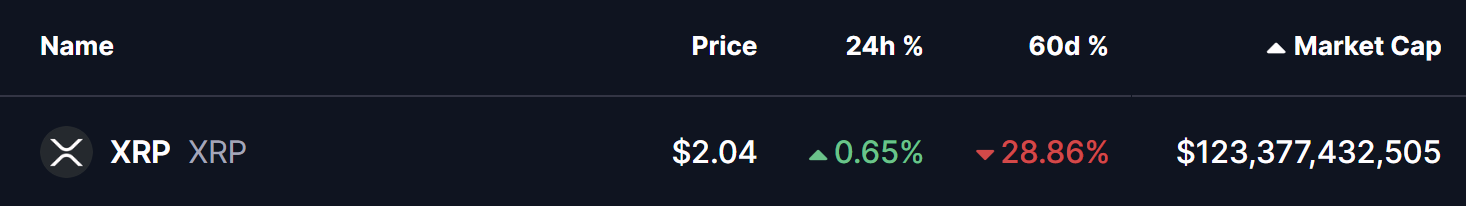

The broader altcoin market continues to struggle for momentum, and XRP has been no exception. After reaching an impressive July peak of $3.66, XRP has corrected by 28% over the last 60 days, pulling back into a critical price pocket. Yet, behind the surface-level decline, the weekly chart hints that this drop may be less of a breakdown and more of an accumulation phase before the next directional move.

Source: Coinmarketcap

Source: Coinmarketcap Key Pattern Hints at Potential Bullish Reversal

On the weekly view, XRP is trading inside a right-angled ascending broadening formation — a structure known for expanding volatility, multiple swing tests, and eventual strong directional breakouts. The earlier rejection from the upper resistance near $3.66 triggered a sharp 43% pullback, but importantly, price found its way back to the historically defended demand region.

This drop has cooled off overheated conditions and aligned XRP back into its broader consolidation highway rather than showing signs of trend collapse.

XRP Weekly Chart/Coinsprobe (Source: Tradingview)

XRP Weekly Chart/Coinsprobe (Source: Tradingview) The current zone between $1.90–$2.10 remains the key accumulation shelf. Every revisit to this range throughout the pattern has been met with strong defensive buying. That consistency shows not just passive support, but active absorption — a sign that large hands could be positioning, not exiting.

What’s Next for XRP?

Momentum remains fragile short-term, but structurally constructive. If XRP can continue holding above the wedge base and reclaim the 200-MA zone near $2.56, the next leg of upside rotation may begin, targeting:

• Ascending resistance trendline: ~$4.10

• Breakout implication: Potential continuation toward a new high territory

A successful breakout from the upper wedge boundary would likely confirm the next major bullish cycle for XRP, placing it back into an extended continuation phase.

However, the downside still matters. A clean breakdown below $1.90 would threaten the current wedge structure and shift the bias toward deeper retracement levels heading into Q1 2026. Until that happens, the market remains in a neutral-to-accumulation stance rather than a breakdown narrative.

For now, XRP sits in a decision pocket — where buyers have historically stepped in with conviction, and where the next directional trend for the asset could be quietly forming.