News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

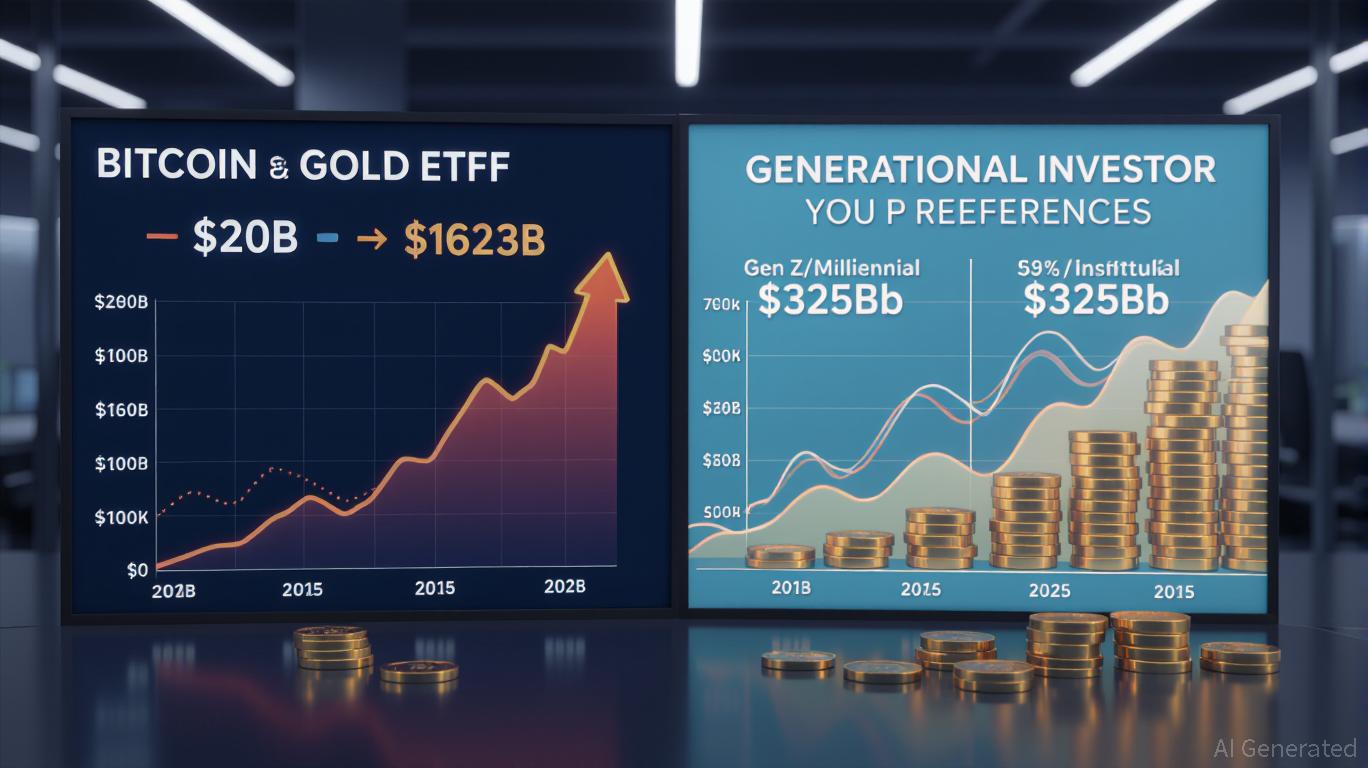

- Bitcoin and gold ETFs combined AUM surpassed $500B in 2025, with Bitcoin surging to $162B and gold at $325B. - Bitcoin ETFs grew 810% in 10 months post-SEC approval, while gold ETFs doubled amid central bank demand and de-dollarization trends. - Generational divides persist: 73% of Gen Z/Millennials prefer Bitcoin, while 59% of institutions allocate 10%+ to Bitcoin ETFs. - Gold retains stability during crises (e.g., $3.2B July inflows) and maintains institutional trust as a millennia-old store of value.

- Ethereum ETFs surged with $1.83B inflows over five days in August 2025, outpacing Bitcoin ETFs’ $800M outflows. - Institutional adoption favors Ethereum’s 4–6% staking yields, regulatory clarity as a utility token, and Dencun/Pectra upgrades boosting DeFi scalability. - Ethereum ETFs now hold $30.17B AUM (vs. Bitcoin’s $54.19B), with 68% Q2 2025 growth in institutional holdings and 60% allocation in yield-optimized portfolios. - Bitcoin’s 57.3% market share faces erosion as investors prioritize Ethereum’

Pi Coin enters September under heavy pressure, with selling and Bitcoin correlation threatening new lows unless $0.362 is reclaimed.

- Hong Kong enacted the Stablecoins Ordinance (Cap. 656) on August 1, 2025, establishing a legal framework for fiat-referenced stablecoins to position the city as a global digital asset hub. - The ordinance mandates HKMA licensing for stablecoin issuers, requiring HK$25 million minimum capital and full backing by high-quality liquid assets like government bonds. - Strict AML/cybersecurity protocols and market reactions, including BitMart withdrawing VASP applications, highlight the regulatory rigor balanci

- U.S. Department of Commerce partners with Chainlink and Pyth to publish macroeconomic data on blockchain networks, enhancing transparency and tamper-proof integrity. - Key indicators like GDP and PCE are now accessible via onchain feeds, enabling DeFi applications to integrate real-time economic metrics for dynamic financial tools. - The initiative drives institutional blockchain adoption, with Pyth and Chainlink tokens surging post-announcement, reflecting growing trust in decentralized data infrastruct

- Gryphon's stock jumped 42.1% to $1.75 as merger with American Bitcoin nears, with shares up 231% since May. - Post-merger entity retains ABTC ticker, controlled by Trump family (98%) and Hut 8, with Winklevoss brothers as anchor investors. - Strategic move aligns with 2025 crypto IPO surge, including Circle and Bullish, amid U.S. policy shifts like the GENIUS Act. - Merged entity aims to expand BTC reserves through Asian acquisitions, leveraging $5B securities filing for growth-focused capitalization.

- EU explores Ethereum/Solana for digital euro, diverging from China's private blockchain model. - Public chains offer interoperability with DeFi but raise governance risks and state influence concerns. - ECB aims to reduce U.S. stablecoin dominance while balancing innovation and sovereignty. - Final decision pending until 2025, with no formal network selected yet.

- MoreMarkets and Flare launch XRP Earn Account, enabling non-custodial yield generation for XRP holders via Flare’s FAssets and DeFi strategies. - Users retain asset control while earning returns through liquid staking and lending, with FXRP representing XRP on Flare’s network. - Partnership aligns with Flare’s institutional-grade DeFi goals, supported by custodian integrations and regulatory clarity post-Ripple-SEC settlement. - XRP’s market cap exceeds $176B as adoption grows in cross-border payments an

- Tether integrates USDT on Bitcoin via RGB protocol, addressing scalability and privacy issues to enable mass adoption. - RGB protocol anchors stablecoin ownership to Bitcoin’s blockchain while processing transactions off-chain, ensuring trustless, censorship-resistant transfers. - Tether’s $86B USDT market cap now supports Bitcoin-based DeFi and tokenized assets, strengthening its role as decentralized finance’s foundation. - Challenges include RGB wallet adoption and regulatory scrutiny, though Tether’s

- Pump.fun’s buyback program uses 30% of fees to repurchase and burn PUMP tokens, with 60% destroyed and 40% as staking rewards. - The platform dominates 77.4% of Solana memecoin trading volume, leveraging buybacks to stabilize prices amid market volatility. - Aggressive buybacks reduced PUMP’s supply by 0.766% since July 2025, creating algorithmic scarcity but facing risks from declining revenue and lawsuits. - Strategic initiatives like the Glass Full Foundation aim to sustain growth, though financial st

- 18:41Data: If BTC falls below $87,032, the cumulative long liquidation intensity on major CEXs will reach $1.376 billion.According to ChainCatcher, citing data from Coinglass, if BTC falls below $87,032, the cumulative long liquidation intensity on major CEXs will reach $1.376 billions. Conversely, if BTC breaks above $95,300, the cumulative short liquidation intensity on major CEXs will reach $409 millions.

- 18:16The current total on-chain holdings of US spot Bitcoin ETFs is 1.332 million BTC.According to Jinse Finance, Dune data shows that the current total on-chain holdings of US spot Bitcoin ETFs amount to 1,332,000 BTC, accounting for 6.67% of the current BTC supply, with an on-chain holding value of $135.3 billions.

- 17:32The "1011 Insider Whale" is continuously increasing long positions in Ethereum, while also placing a limit buy order for 11,450 ETH.According to Jinse Finance, monitored by AI Aunt, the "1011 Insider Whale" continues to go long on Ethereum, with total holdings increasing to 22,827.14 ETH, valued at $69.16 million, with an average entry price of $2,989.51 and an unrealized profit of $1.19 million. Ten minutes ago, another $10 million margin was deposited, and a limit buy order for 11,450 ETH ($34.39 million) was placed. If filled, the total position will exceed $100 million.