The Bitcoin spot ETF had a net inflow of 32.58 million US dollars last week, while the Grayscale ETF GBTC saw a net outflow of 195 million US dollars for the week

According to SoSoValue data, during the trading week last week (Eastern Time August 12th to August 16th), Bitcoin spot ETFs had a net inflow of $32.58 million.

Among them, Grayscale's ETF GBTC had a weekly net outflow of $195 million, and the current historical net outflow of GBTC is $19.65 billion. The Bitcoin spot ETF with the highest single-week net inflow last week was Fidelity's FBTC, with a weekly net inflow of $82.11 million; currently, FBTC has reached a total historical net inflow of $9.8 billion. Next is BlackRock's IBIT ETF, which had a weekly net inflow of $71.07 million; currently, IBIT has reached a total historical net inflow of $20.39 billion.

As of press time, the total asset value for Bitcoin spot ETFs is at about $54.353 billion; the ratio between their assets and market capitalization (the proportion compared to Bitcoin’s overall market cap) stands at 4.65%. The cumulative historic flow into these funds totals around approximately USD 17.37 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Paradigm stakes 14.7 million HYPE tokens worth $581 million

CryptoQuant: BTC accumulation by "accumulation addresses" reaches an all-time high

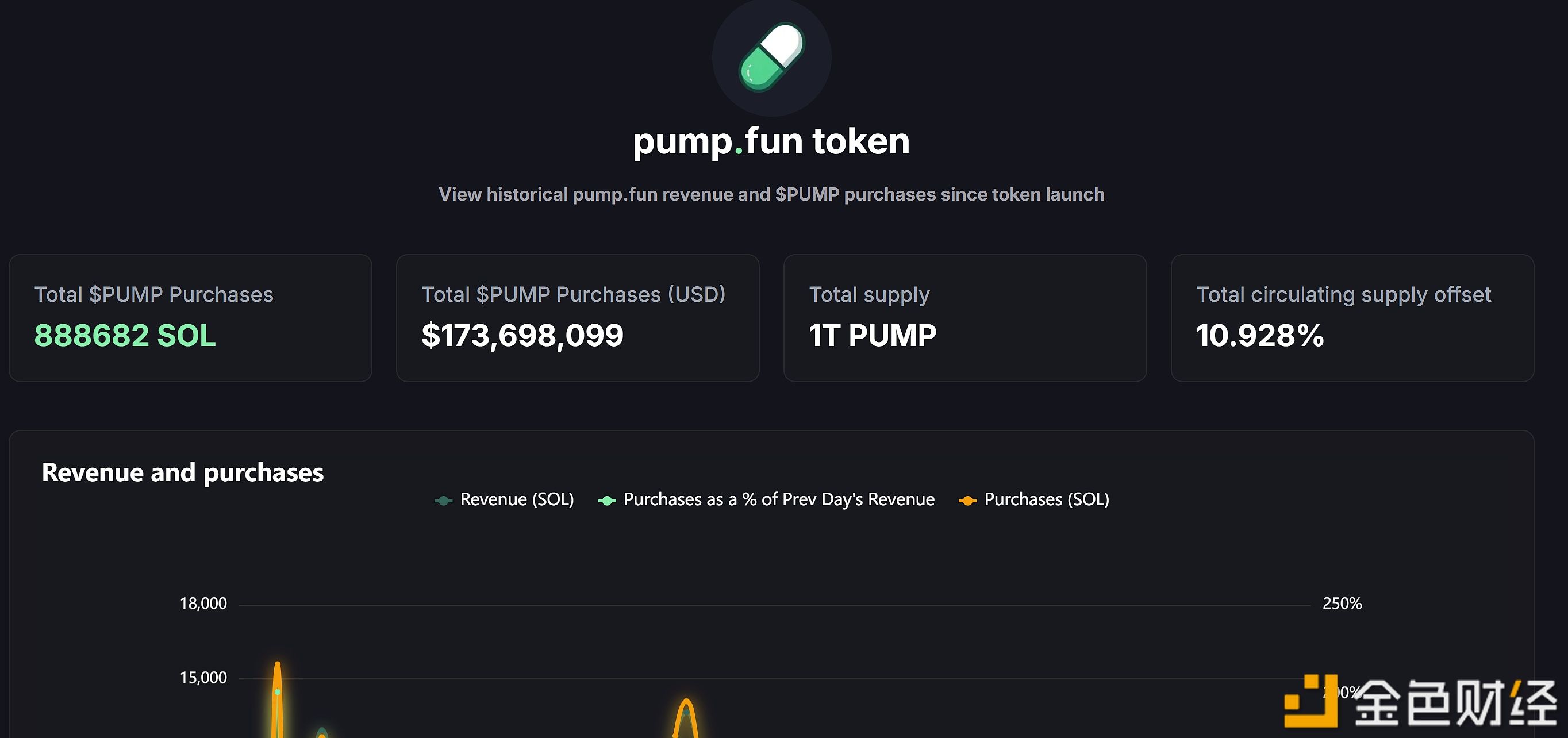

Pump.fun has cumulatively bought back over $170 million worth of PUMP tokens.