Key Points

- SOL could experience more volatilty before the upcoming 11.2 million token unlock on March 1st.

- Recently, the Solana ecosystem was in a crisis, amidst significant price drops following the LIBRA fallout.

Solana (SOL) recorded a price recovery today, ahead of the upcoming SOL unlock scheduled for next week. The Solana ecosystem was seriously harmed following the LIBRA fallout and SOL recorded important price drops.

11.2 Million SOL Unlock on March 1st

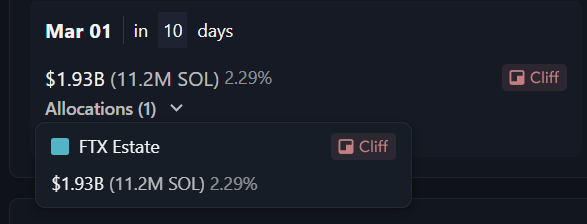

According to official data, on March 1 a significant amount of Solana tokens will be unlocked.

11.2 million SOL tokens, representing 2.29% of the total supply will be unlocked next week. The unlock amount is $1.93 billion, an important amount that might further contribute to SOL’s volatilty.

After March 1, the next SOL unlock will be on April 1 when 12,700 SOL tokens will be unlocked. The unlock amount will be $2.2 million, according to the Solana Portal powered by Messari.

Solana Portal dataThe upcoming token unlock includes tokens from the FTX estate.

Currently, SOL recorded a surge following its latest dip below $162 recorded yesterday.

SOL Price Rebounded Above $173 Today

At the moment of writing this article, SOL is trading above $173, up by over 3% for the day. SOL currently has a market cap of over $84.8 billion.

SOL price in USD todaySOL price managed to recover following yesterday’s significant price drop of over 9% triggered by the latest scandal around the LIBRA coin.

Solana’s Decline, Triggered by the LIBRA Scandal

A recent report from Galaxy Research stated that a major cause for Solana’s downfall was the chaos around LIBRA – the controversial crypto project launched on Solana. However, the report also noted that other contributors to Solana’s issues included the TRUMP memecoin launched last month.

Solana fundamentals recently declined along with SOL’s price drop mirroring a decreased investor interest.

Before the LIBRA scandal that dragged the crypto market down, Solana recorded important milestones and was surrounded by optimistic price predictions.

It remains to be seen how the next week’s SOL unlock will affect the coin’s price. So far, the market reaction has been clear with sellers shorting SOL before the upcoming unlock.