Key Insights:

- Bitcoin price hits record weekly close near $106,500.

- Rare MVRV signal flips bullish, mirroring 2020 breakout.

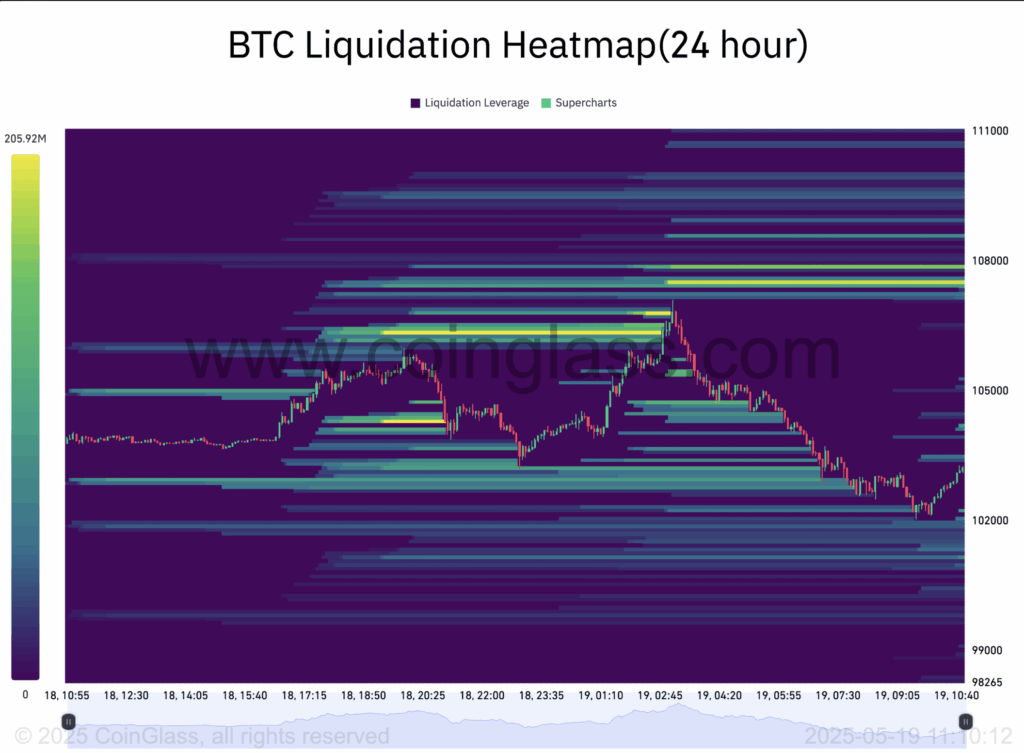

- $673M in liquidations follow weekend liquidity trap near $107K.

Over the weekend, a sharp move in the Bitcoin price triggered a classic liquidity grab above $107,000 before sliding back nearly 4%—a move that wiped out $673 million in crypto liquidations within 24 hours.

But beneath the short-term volatility, a rare on-chain signal has flipped bullish for the first time in months. The Market Cap vs. Realized Cap Ratio, tracked by independent analyst Markus Thielen, is back in positive territory, mirroring conditions last seen before Bitcoin’s 2020 breakout.

That flip now revives calls for a renewed Bitcoin price rally—possibly toward $130,000.

Liquidity Trap Jolts Bitcoin Traders

The BTC/USD pair climbed to multimonth highs near $107,000 late on May 18, only to correct sharply hours later. Data from CoinGlass showed that liquidity was cleared both above and below the range, squeezing shorts and trapping longs in quick succession.

BTC/USDT 4-hour price chart. Source: Michaël van de Poppe/X

BTC/USDT 4-hour price chart. Source: Michaël van de Poppe/X

Michaël van de Poppe described it on X as a “classic liquidity trap above the recent high and reversal downwards.” He added, “I think we’ll do the same at $100K before breaking ATHs.”

CoinGlass heat maps confirmed that asking liquidity at $107,500 capped further upside while bids at $102,000 were rapidly removed. The result was a broad liquidation event that triggered exits across the market.

BTC liquidation heatmap. Source: CoinGlass

BTC liquidation heatmap. Source: CoinGlass

Crypto trader CrypNuevo warned of elevated risk. “From a risk management perspective, I don’t see it worth it to go long right now at market price,” he posted before the volatility hit.

BTC/USDT 1-week chart. Source: CrypNuevo/X

BTC/USDT 1-week chart. Source: CrypNuevo/X

“We’re currently at resistance. Clearing it would make a much more attractive entry.”

Bitcoin Price Records Historic Weekly Close Despite Sharp Rejection

Bitcoin price posted a record weekly close near $106,500, despite falling 4% shortly after. The intraday high at $107,115 triggered a liquidity grab before the price retreated to around $103,000, as per Bitstamp data.

The daily chart shows BTC continuing to respect the rising parallel channel that began forming in early April. The price remains well above the 50-day (red) and 200-day (blue) exponential moving averages, confirming ongoing bullish structure.

The relative strength index (RSI) at 60.72 indicates BTC is not yet overbought, giving bulls some room. Key horizontal support remains in the $72,000–$76,000 range, with short-term resistance just above $107,000.

“This week likely ends in the green big time,” trader Jelle commented , anticipating a bounce from the early-week dip.

Swissblock Technologies echoed the view. “Bitcoin flirted with $107K, grabbed liquidity above $104K–$106K but failed to hold,” the firm posted. “Bulls have one job: defend this range.”

Rare On-Chain Signal Turns Bullish Again

A major driver behind the renewed optimism is the reappearance of a bullish flip in the Market Cap vs. Realized Cap Ratio. In a May 19 report, Thielen highlighted that the signal has turned positive just weeks after showing weakness.

“It’s unusual for an on-chain metric to reverse direction this fast,” he said, referencing a similar mid-cycle recovery in 2020. That move preceded Bitcoin’s run past $20,000 toward its previous cycle top.

“If this indicator maintains its positive momentum,” Thielen noted, “Bitcoin could indeed be on track to reach new all-time highs.”

The shift in MVRV is especially relevant given current macro conditions. Bitcoin has shown resilience amid rising interest rate uncertainty and the recent U.S. credit downgrade by Moody’s. The Kobeissi Letter noted Bitcoin is “now 4% away from a new all time high and up over +40% since its April low.”

Correlation with Stocks Still Unclear

Despite the bullish signal, analysts remain divided on whether Bitcoin’s movement remains tethered to stock market flows. Santiment data labeled the correlation “somewhat” intact, though RedStone Oracles pointed out that on a 30-day basis, the correlation between Bitcoin and the S&P 500 remains “valuable.”

However, many traders expressed frustration with Bitcoin mirroring traditional equities too closely. “It was a lot more enjoyable when BTC traded independently of stocks,” IncomeSharks said on May 19.

The week ahead offers limited macro triggers. All eyes are on jobless claims data due May 22 and remarks from Federal Reserve Chair Jerome Powell on May 25. Neither is expected to shift policy outlook meaningfully, but unexpected labor weakness could revive talk of rate cuts.

88.2% chance Fed holds rates at June meeting*. Source: CME Group*

88.2% chance Fed holds rates at June meeting*. Source: CME Group*

CME FedWatch data puts the odds of a cut in June at just 12%, keeping pressure on Bitcoin to drive its momentum through internal market structure rather than external catalysts.

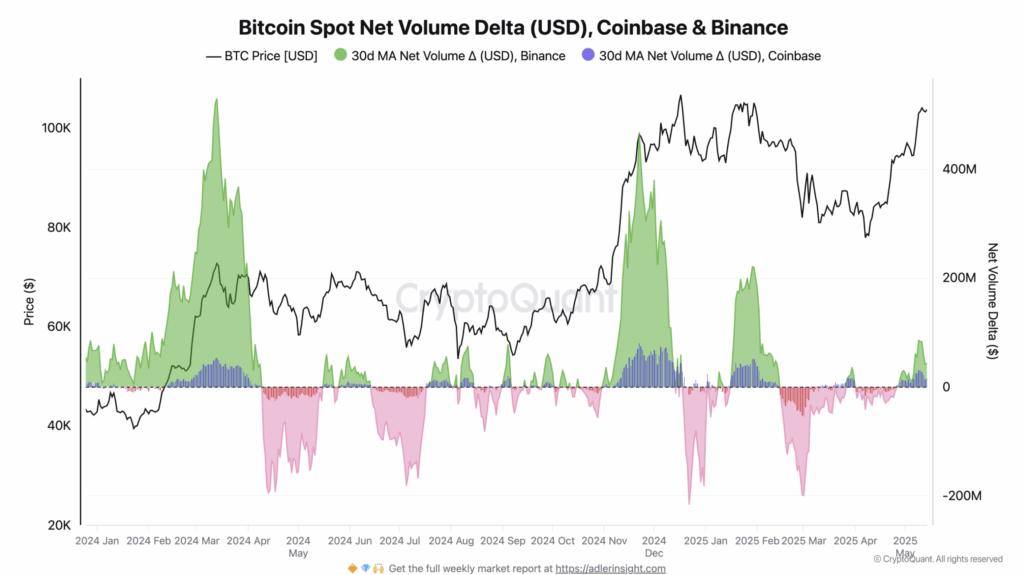

Spot Volume Delta Adds Short-Term Caution

Meanwhile, CryptoQuant flagged rising spot volume delta on Binance as a potential warning. The metric turned positive after the weekend correction, suggesting renewed buying. But rapid rises in spot volumes have historically coincided with local tops.

“Rather than being a warning sign, rising spot volumes at this point would be encouraging for market strength,” contributor Darkfost wrote.

Bitcoin net volume delta rebounds on Coinbase, Binance. Source: CryptoQuant

Bitcoin net volume delta rebounds on Coinbase, Binance. Source: CryptoQuant

Still, volume delta spikes often reflect aggressive breakouts that lack follow-through, especially when retail-driven. Traders may need to watch order book behavior closely in the coming sessions.

With the Bitcoin price holding near its highest-ever weekly close and on-chain indicators flashing rare bullish signals, the next few weeks could prove pivotal. If bulls defend the $100,000 range and the MVRV flip holds, the road to $130,000 may not be far off.