Arthur Hayes Dumps $ETH, $ENA, $PEPE Amid Tariff, Liquidity Crunch Fears

- Arthur Hayes’ $13M crypto sell-off signals growing fear of a Q3 liquidity crunch.

- Ethereum, Ethena, and Pepe sales align with rising U.S. tariff and credit worries.

- Hayes’ moves hint at a macro-driven strategy ahead of potential market turbulence.

Arthur Hayes executed a $13 million crypto sell-off, fueling speculation about rising U.S. tariffs, Q3 liquidity crunch fears, and stagnant credit growth. The BitMEX co-founder unloaded Ethereum, Ethena, and Pepe in quick succession, coinciding with a sharp market downturn. Analysts now question whether the move signals a tactical hedge or preparation for a short-term market reset.

Ethereum (ETH) Offload Sparks Market Attention

Arthur Hayes sold 2,373 ETH worth about $8.32 million during Friday’s trading session. The sale occurred after Ethereum’s price fell 5% to below $3,600 amid a broader market decline. This move aligns with liquidity crunch fears that have been building since U.S. tariff announcements rattled risk assets.

Ethereum’s sell-off occurred during a period of order book thinning, which increased price volatility. The sale did not cause an extreme disruption, which may indicate the existence of underlying liquidity. However, the timing suggests that Hayes might be lightening up in anticipation of possible macro-based shocks.

Such a move may signal a potential bounce preparation in case BTC hits $100,000 and ETH hits $3,000. However, it also indicates the truth that major economies are not producing sufficient credit growth to increase nominal GDP. The deal supports fears of a liquidity crunch and a short-term bearish crypto market.

Ethena (ENA) Disposal After Strong Rally

Hayes sold 7.76 million ENA worth about $4.62 million, days after the token surged over 40% to $0.70. The rally followed Ethena Labs’ $260 million token buyback announcement and the launch of a compliant USDtb stablecoin.

The price of Ethena before the reversal was boosted by good market demand and certain market optimism. The fear of liquidity crunch increased as news in the U.S. concerning the imposition of tariffs emerged, resulting in a decrease in risk appetite in altcoins.

The quick disposal suggests a shift in portfolio strategy, to reallocate capital or hold cash ahead of market volatility. While the market absorbed the ENA sale, momentum weakened as risk-off sentiment spread. This sequence strengthens the case that Hayes anticipates near-term turbulence before a possible recovery.

Pepe (PEPE) Sale Amid Weak Altcoin Sentiment

Hayes offloaded 38.86 billion PEPE worth approximately $414,700 during the same period. The meme token fell around 2% over 24 hours alongside other altcoins. Liquidity crunch fears continued to weigh heavily on speculative assets like PEPE.

The fall of PEPE was a result of the sharp fall of Bitcoin following new tariff announcements, which saw Bitcoin go down to $113,000. Risk-taking in the market dried up within minutes, causing sales in high-beta tokens. The departure of Hayes in PEPE reflects a larger trend of having less exposure to the volatile and less liquid assets.

This is a smaller-sized sale and conforms to the trend of risk-taking before potential macro shocks. The net effect of such deals indicates a strategic positioning move. With the liquidity crunch panic continuing, more high-profile portfolio readjustments in the crypto market could be coming during the weeks to come.

The post Arthur Hayes Dumps $ETH, $ENA, $PEPE Amid Tariff, Liquidity Crunch Fears appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Silent Revolution: The Cryptocurrency Market is Undergoing a "Wealth Redistribution"

Ethereum Crash Revelation: Leverage Liquidations and Volatility Amid Macroeconomic Shadows

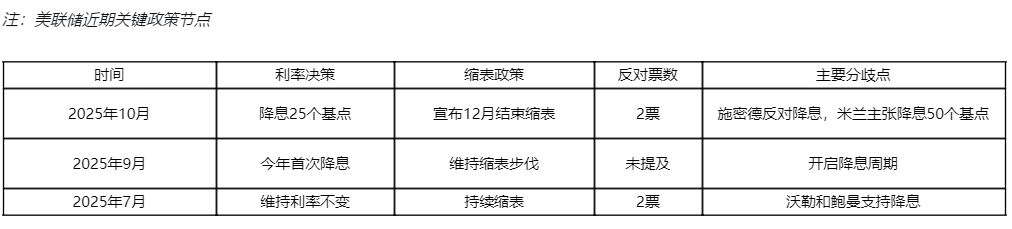

Undercurrents in the Race for Federal Reserve Chair: "Draining Wall Street" Becomes the Core Issue

Trump desires low interest rates, but the Federal Reserve chair candidates he favors advocate for restricting the central bank's primary tool for achieving low rates—quantitative easing.