U.S. Federal Reserve Should Embrace Innovations in Payments Like Blockchain Technology, Says Fed Governor Waller

Federal Reserve Governor Christopher Waller urges support for new technologies such as stablecoins and other digital assets, saying that these fuel growth in innovative new payment services.

In his speech at the Wyoming Blockchain Symposium 2025, Waller says that the payment system is experiencing what he calls a technology-driven revolution amid advances in computing power, data processing and distributed networks.

He says that while there are those who are skeptical of these innovations, the payment system has long been a story of technological advancement. Waller says that stablecoins, for instance, can potentially maintain and extend the international role of the US dollar as well as improve retail and cross-border payments.

“The technologies available today might be new, but leveraging innovative technology to build new payment services is not a new story.”

Waller says the Federal Reserve should continue supporting innovations. He says that the reliability of the US payment system is due to the central bank and the private sector working together to support technological advances.

“[I]t is important for the Federal Reserve to continue to embrace technological advancements to modernize its services and continue to support private sector innovation… The Federal Reserve could benefit from further engagement with innovators in industry, particularly as there is increased convergence between the traditional financial sector and the digital asset ecosystem.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

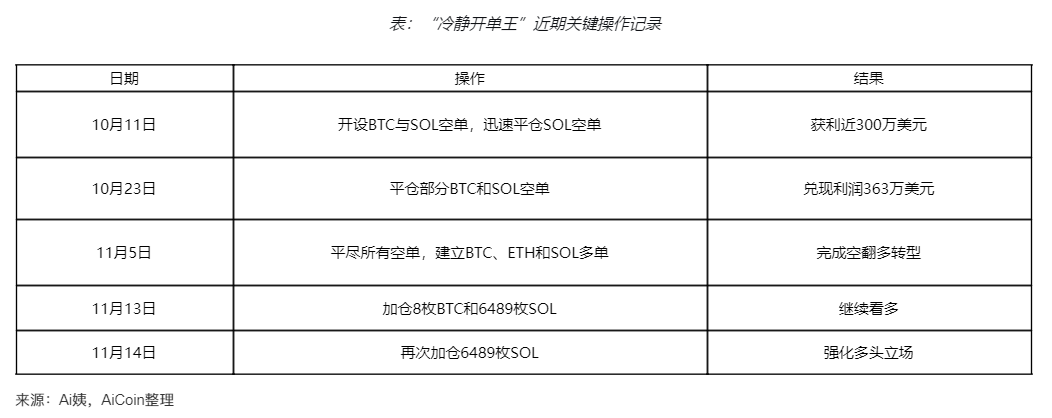

"The Calm Order King" increases positions against the trend, strengthening the bulls!

Nvidia earnings day could be awkward? Renowned analyst: Even with strong performance, the market will remain "nervous and uneasy"

On the eve of its earnings report, Nvidia is facing a dilemma: if its performance guidance is too strong, it may trigger concerns about over-investment; if it only raises guidance moderately, it could be seen as slowing growth. In either case, it may lead to market volatility.